- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AUD/NZD Confirms A Channel

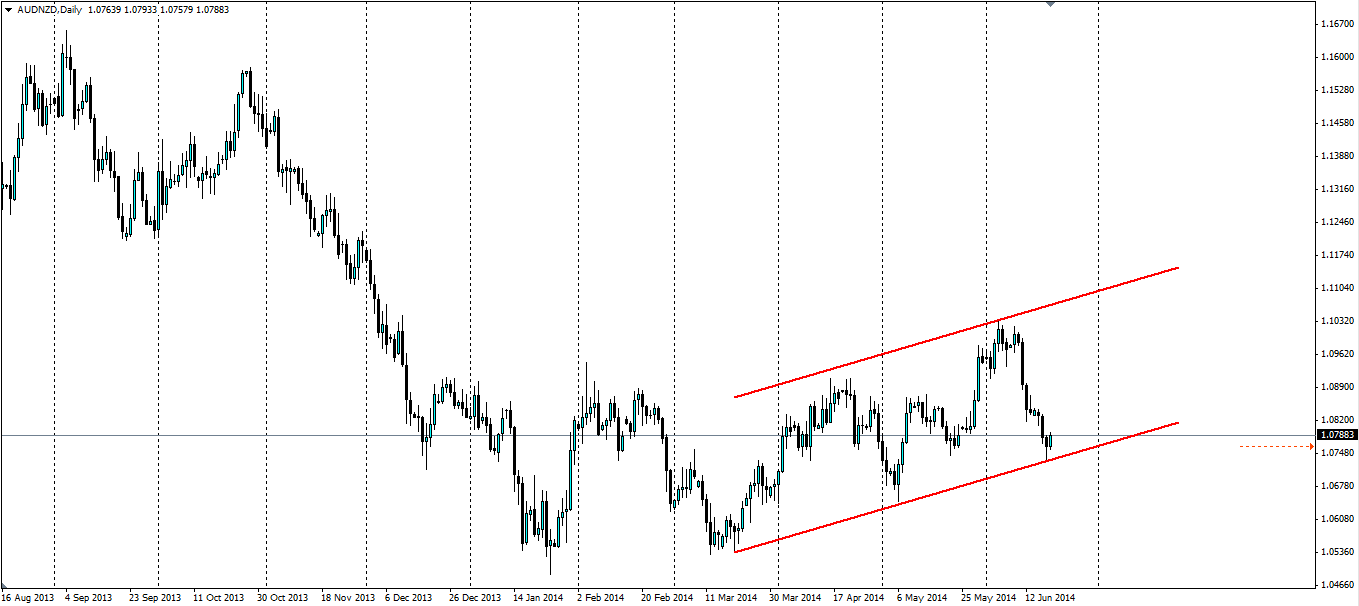

The Aussie/Kiwi pair likes to range and the latest pattern on the AUD/NZD D1 chart is a bullish channel. A pull back could provide an entry point for a bounce off the lower line.

The ranging pattern the AUD/NZD pair formed at the beginning of the year was a sideways channel between 1.0520-1.0910, and was in play for 6 months before being broken at the end of May. This breakout led to the confirmation of a new channel, this time bullish in nature. The price touched the support line of the new channel yesterday before pulling back.

The Kiwi dollar is beginning to run out of support as positive news fails to impress the market. The recent hike in the Official Cash Rate (OCR) to 3.25% by the Reserve Bank of New Zealand (RBNZ) pushed the kiwi higher, only because the RBNZ Governor Graeme Wheeler said that the economy was looking robust and would stick to its initial plan or rate hikes. The market had predicted rates may not go as high as originally forecast due to the fall in dairy prices, a drop in business confidence and a drop in house prices.But the RBNZ remained firm, citing the strength of the housing market, immigration and GDP. At these levels, future interest rate rises are priced in so it is difficult to see the AUDNZD pushing further down.

The Aussie Dollar has been mixed, but overall is well below its long term levels. The RBA sounds very reluctant to increase interest rates any time soon. They are acutely aware of falling commodity prices and the impact a depressed mining sector will have on the Australian economy as a whole. Australia is intimately tied to China through the resources Australia exports, so any news out of China affects the AUD. The Aussie dollar has been oversold on fears of a slowdown in China, but this may have been overhyped.

Data out of China recently showed the trade balance rose from US$18.5b to US$35.9b and CPI was also up from 1.8% to 2.5%. Australia’s own GDP rose 1.1% last quarter and 3.5% from a year ago. The market had forecast 3.2%. Unemployment looks to have plateaued with 6.0% being the peak back in March, with the latest figure was down to 5.8%. So it’s not all doom and gloom for the Aussie and the bulls are starting to rejoice.

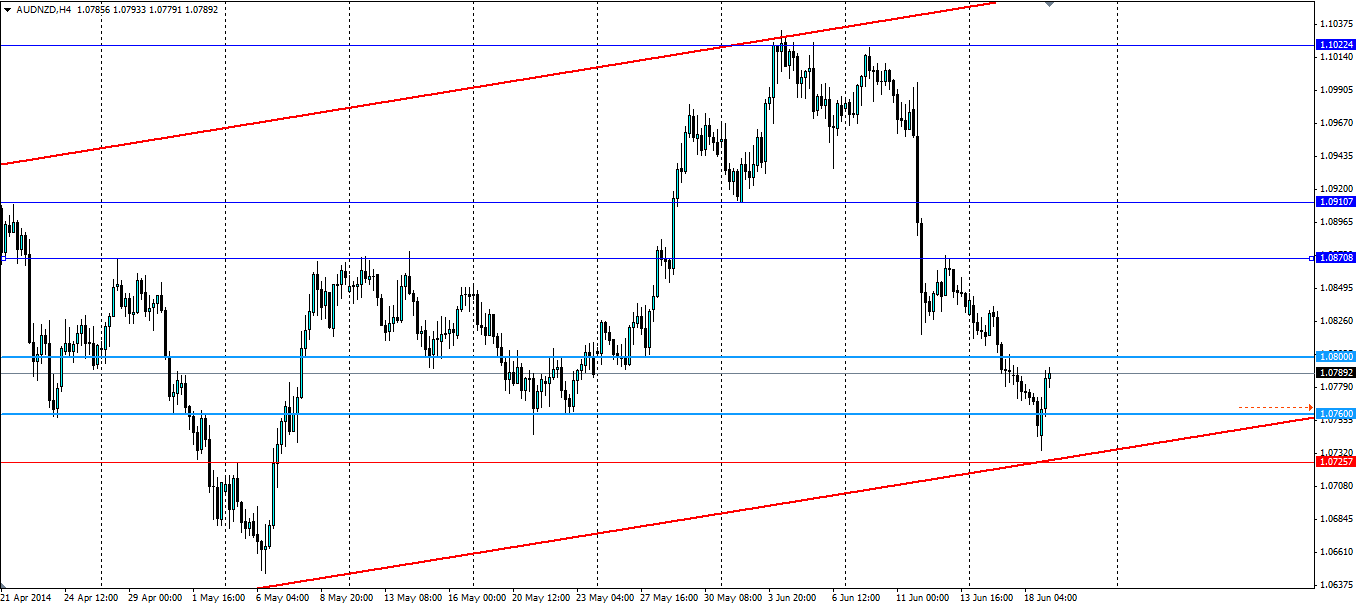

This all leads us to the current position in the bullish channel. Anyone bullish on the AUD will be licking their chops at the prospect of a bounce off the support line. The beauty is that a stop loss can be set quite tight below the trend line for a low risk to reward ratio. There is a possibility that we will see a pull back from the current level close to the trend line before it heads back up towards the upper line. A limit entry order can be set to take advantage of this and it looks like 1.0760 will act as the support level for a pull back. Otherwise a stop entry can be set above the resistance at 1.0800 to catch the movement. As previously stated, a stop loss should be set just below the trend line to minimise losses in case of a break out. Look for previous levels of support and resistance when targeting an exit point.

The AUD/NZD pair is forming an interesting bullish channel and the current price level provides an interesting entry point for traders looking to capitalise on a movement back to the top.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.