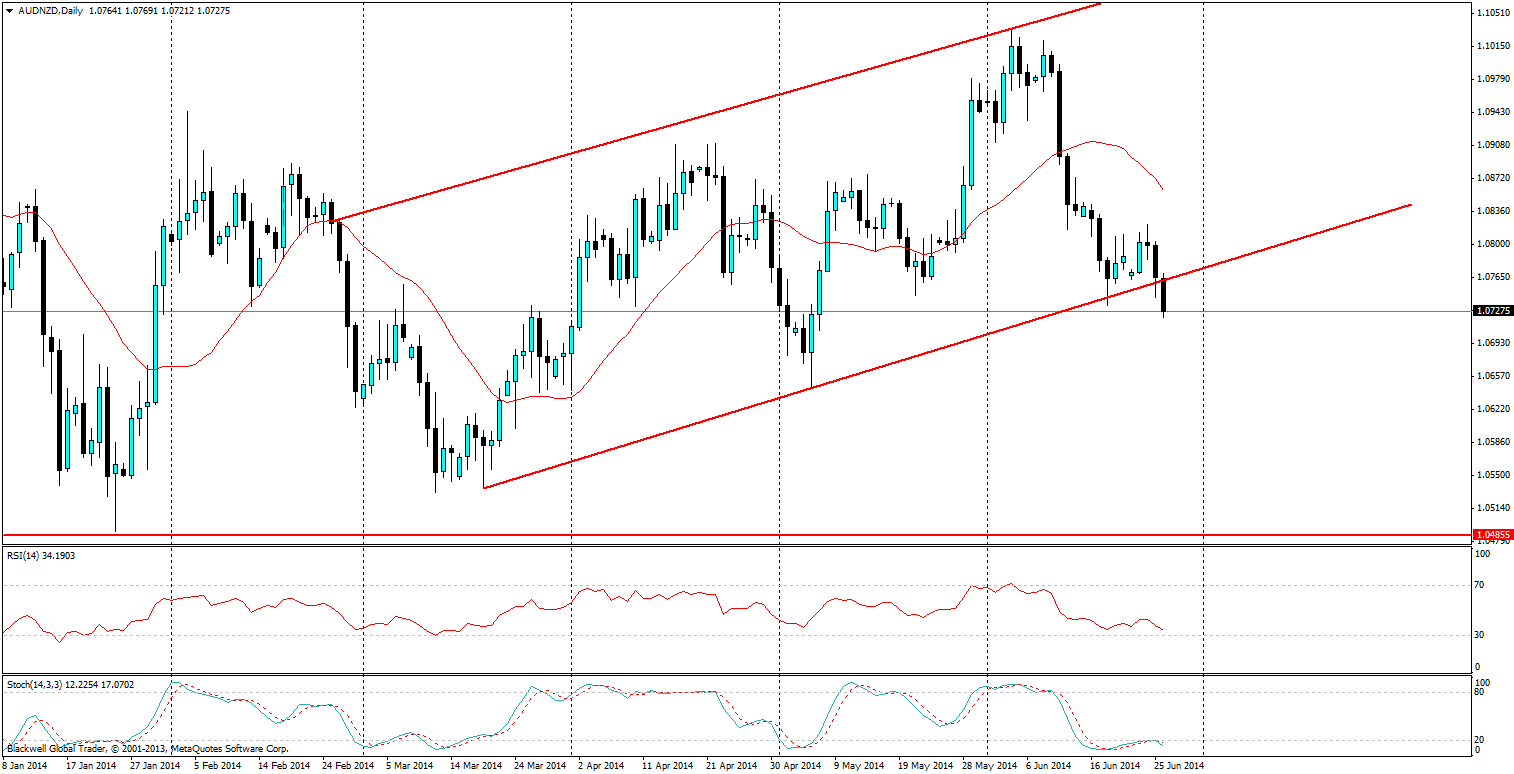

The AUD/NZD channel has broken down as of today.

The AUD/NZD dollar channel has looked strong over the past few weeks, as markets looked to push higher. However, in anticipation of tomorrows NZ trade balance data, we have seen a fall. Many could argue that recent Job Vacancy data from Australia was a catalyst for a fall, but a reduction to 2.5% from 2.6% over a quarter is not a dramatic drop at all.

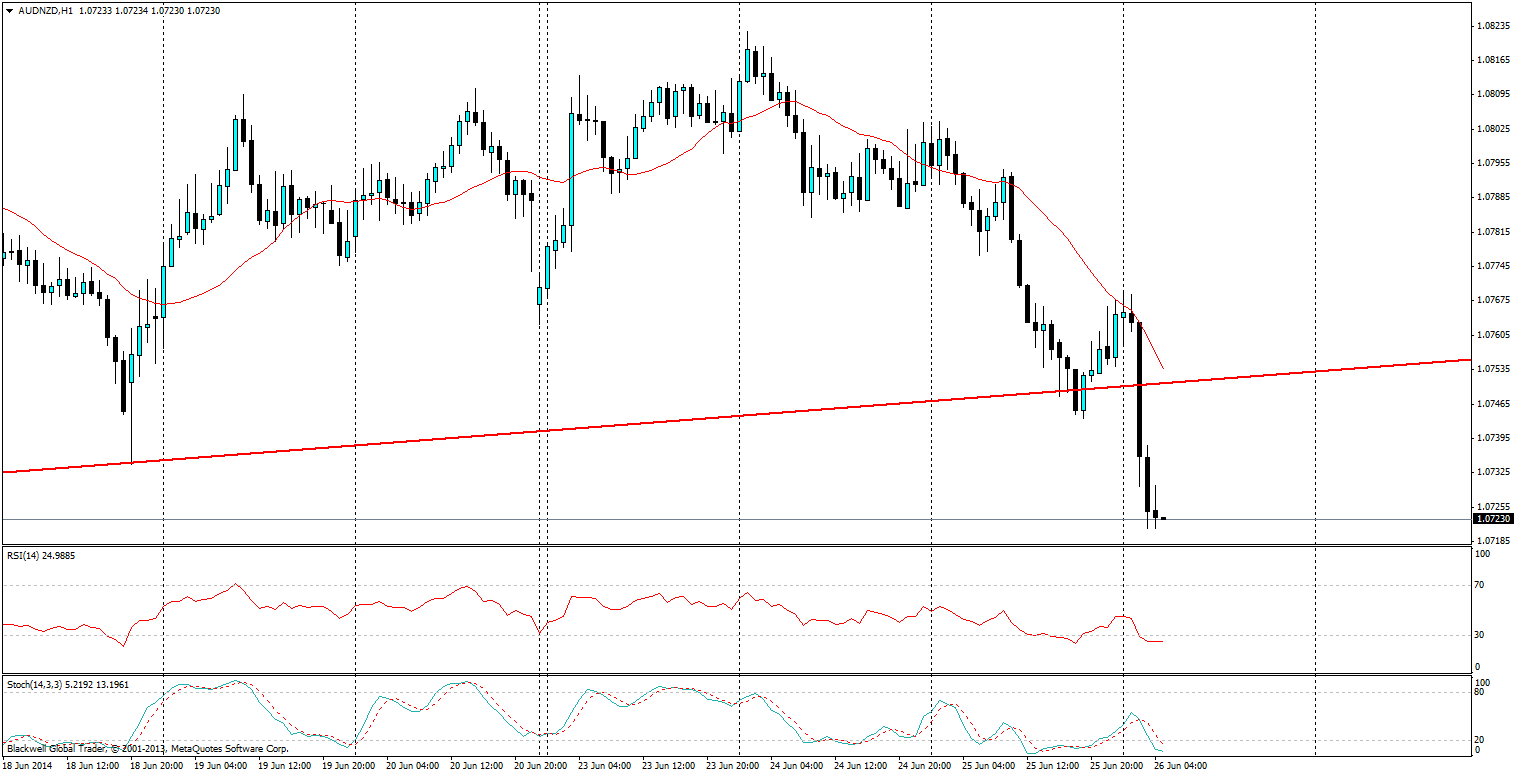

On the hourly chart, it looks certain that the drops will likely continue, as the markets have looked to push lower. A slight pullback is certainly on the cards, though after such a heavy drop and it should come as no surprise. But I’m setting my sights loweron the current support levels that are in play.

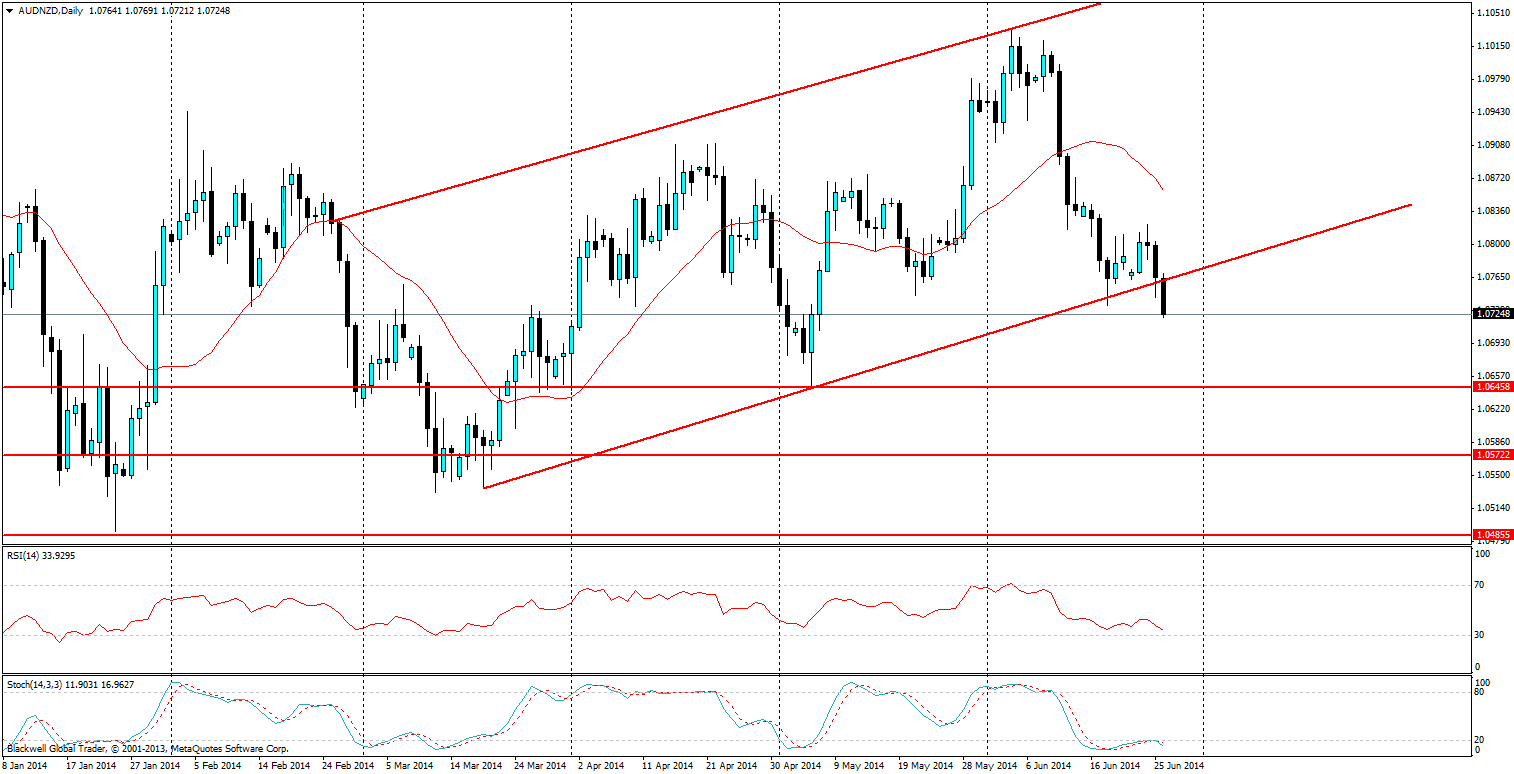

Current support levels can be found at 1.0645, 1.0572 and 1.0485, expect these to be tested if things get worse in Australia, and if the NZD continues to find strength on the way down in the markets. Most of all, expect the unexpected. A tight stop loss should be used when dealing with an initial breakout as fake breakouts do occur and getting caught can be a painful experience on an open position.

Be aware of the channel and pay attention to the hourly charts when watching the AUD/NZD, tight stop losses can protect against big swings, there is plenty of opportunity when it comes to the AUD/NZD but expect a drop in the trade balance tomorrow, as it is seasonal for the NZ economy and we are heading lower.