Key Points:

- Bears likely to remain in control of AUD in the short term.

- AUD impacted by poor employment change result.

- Fed likely to hike FFR 25bps in December.

The Australian dollar has declined decisively over the past week as the pair has been beset by a range of negative fundamental events. Initially, the pair dived on the post-election volatility and stronger U.S. economic data.

However, this bearish move was subsequently followed up by a relatively negative AU Employment Change figure of 9.8k which has again seen the embattled Aussie plunge. Subsequently, we consider a few valid scenarios for the venerable Aussie dollar in the days ahead.

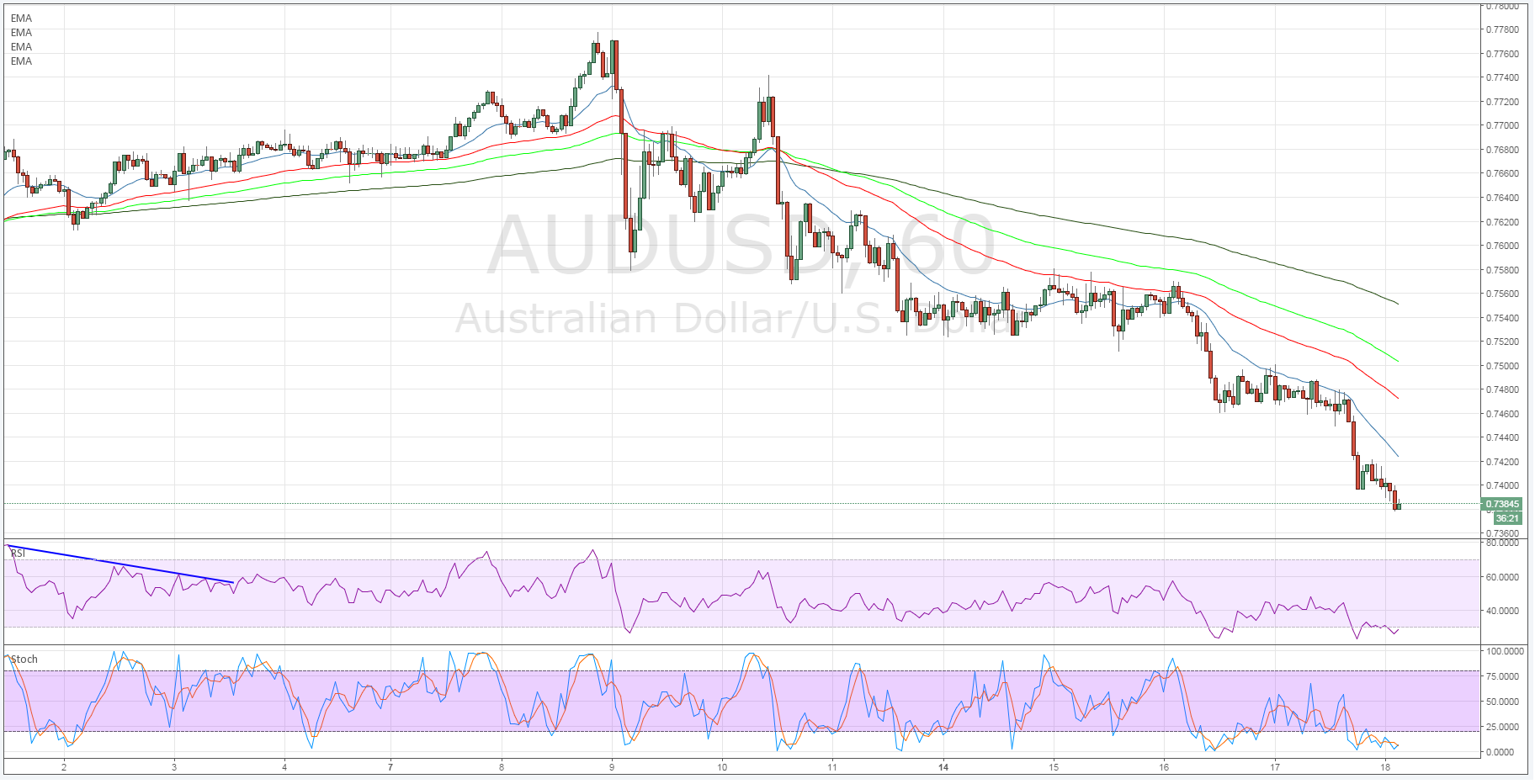

A cursory review of the technical indicators seems to suggest that the pair has reached a critical inflexion point just below the 0.7400 handle. At this stage, the RSI and Stochastic Oscillators are showing signs of being oversold, as well as some sideways moderation.

However, any upside bounce is relatively unlikely given that price action has broken through the Quasimodo line at 0.7451. In fact, the recent plunge has taken price action well below the September opening level. Subsequently, there is little evidence to suggest that the bearish decline has completed.

Fundamentally, the U.S. economic outlook is likely to improve in the final part of the 4th quarter as we move towards a critical FOMC decision on interest rates. At this point, a 25bps hike to the Federal Funds Rate is almost assured and this would have a devastating impact upon AUD valuations.

Subsequently, as we move ever closer to that fateful decision the market is keenly pricing in the risk of a hike which will only pressure the Aussie dollar lower. The divide in monetary policies between the two economies is likely to be keenly felt in the weeks ahead especially if the Federal Reserve confirms their embarkation on a cycle of tightening.

Ultimately, there are plenty of reasons to remain bearish about the pair despite the building pressure for a correction within the various oscillators. In fact, the most likely scenario is some sideways price action, which would allow the RSI Oscillator to climb back into neutral territory, before the pair recommences its plunge to challenge support at 0.7334, and 0.7300 in extension.