If you’re a world watcher, and the majority of investors/traders are, then you would have noticed the recently announced Australian federal budget - the budget for which to fix the economy, if it can be fixed in a hurry.

So far the public backlash has been immense and many are saying that it's offensive, given that it takes from the most vulnerable in society. I’m not going to argue with that at all or open myself up for debate, but what is interesting is the forecast from the budget and what they expect relative to the current forecasts when it comes to the government debt on a global scale.

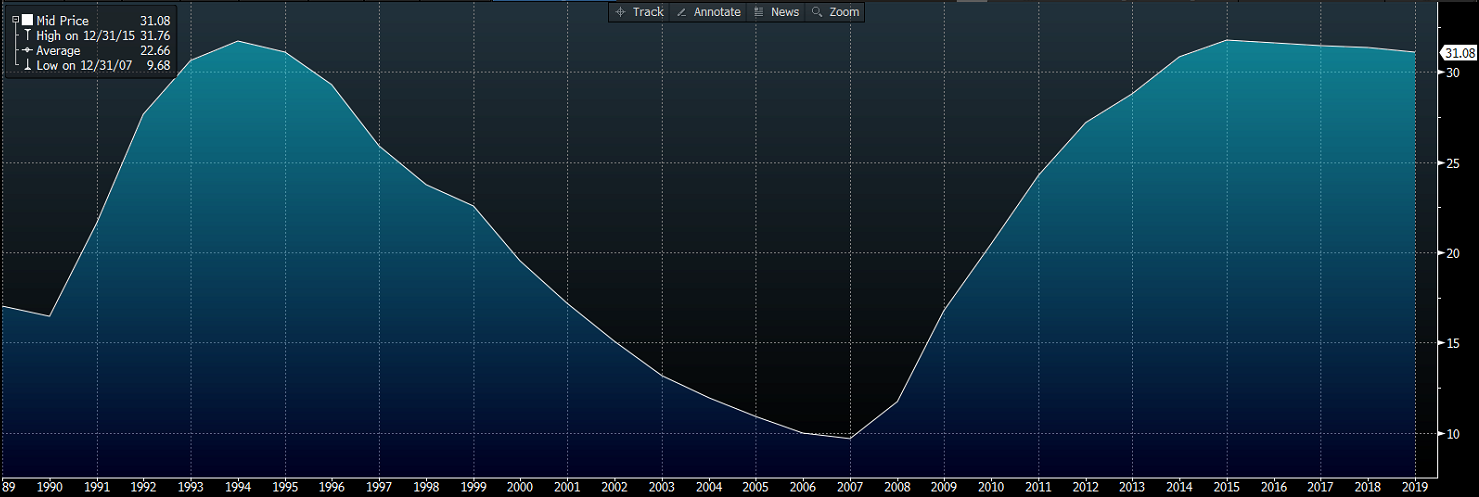

One of Australia’s strong points has been its strong position, economically speaking, when we talk about debt to GDP as a ratio. Australia ranks about 111th on the global ranking of debt to GDP ratios out of a total of 160 countries. It also takes second place when it comes to developing countries with low debt to GDP ratios, with only Luxemburg beating Australia at 22.90%. So where do the other developed countries come in. Well, the United States generally rates a lot higher than Australia with 71.8%, while Japan takes the number one spot at 226.1% .

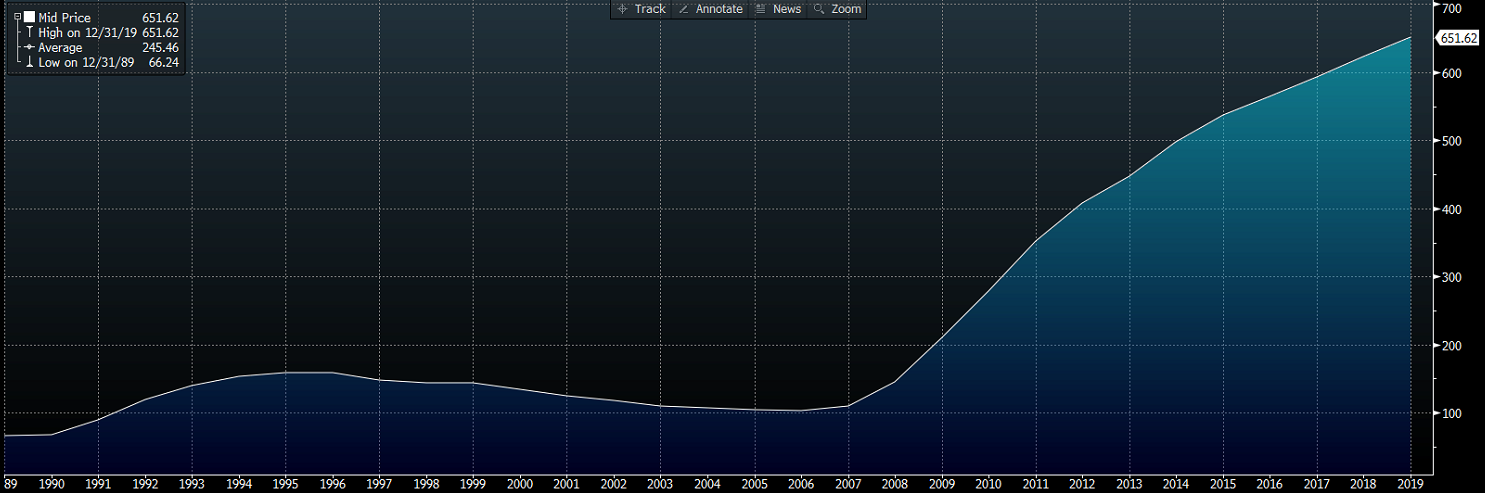

While those debt to GDP ratios are impressive, when you look at Australia’s actual accumulated debt, it’s a slightly different story, with debt certainly increasing heavily since the global financial crisis as fiscal policy was used to help fight the global financial crisis by cutting taxes and upping spending heavily in order to help Australia.

All in all, Australia’s position is fairly impressive and its credit rating is still very strong; rated AAA according to the latest global rating agencies. It should come as no surprise as to why there has been an influx of capital into Australia chasing returns, when you look at the debt to GDP ratio coupled with Australia’s higher fixed interest rates. Global fund managers were certainly bullish on Australia when other developed nations were struggling to stay above water.

So the Australian government's predicted deficit is a little bit scary, and that’s no surprise really, but they are looking to tackle it, and this will rub off well on global markets. Current forecasts show that for 2013-2014, the cash deficit will be -49.9 billion AUD, the largest deficit in the Abbot government, and the 2014-2015 financial year will see a significant reduction with an estimated -29.8 Billion AUD with a projected surplus finally coming about in 2019.

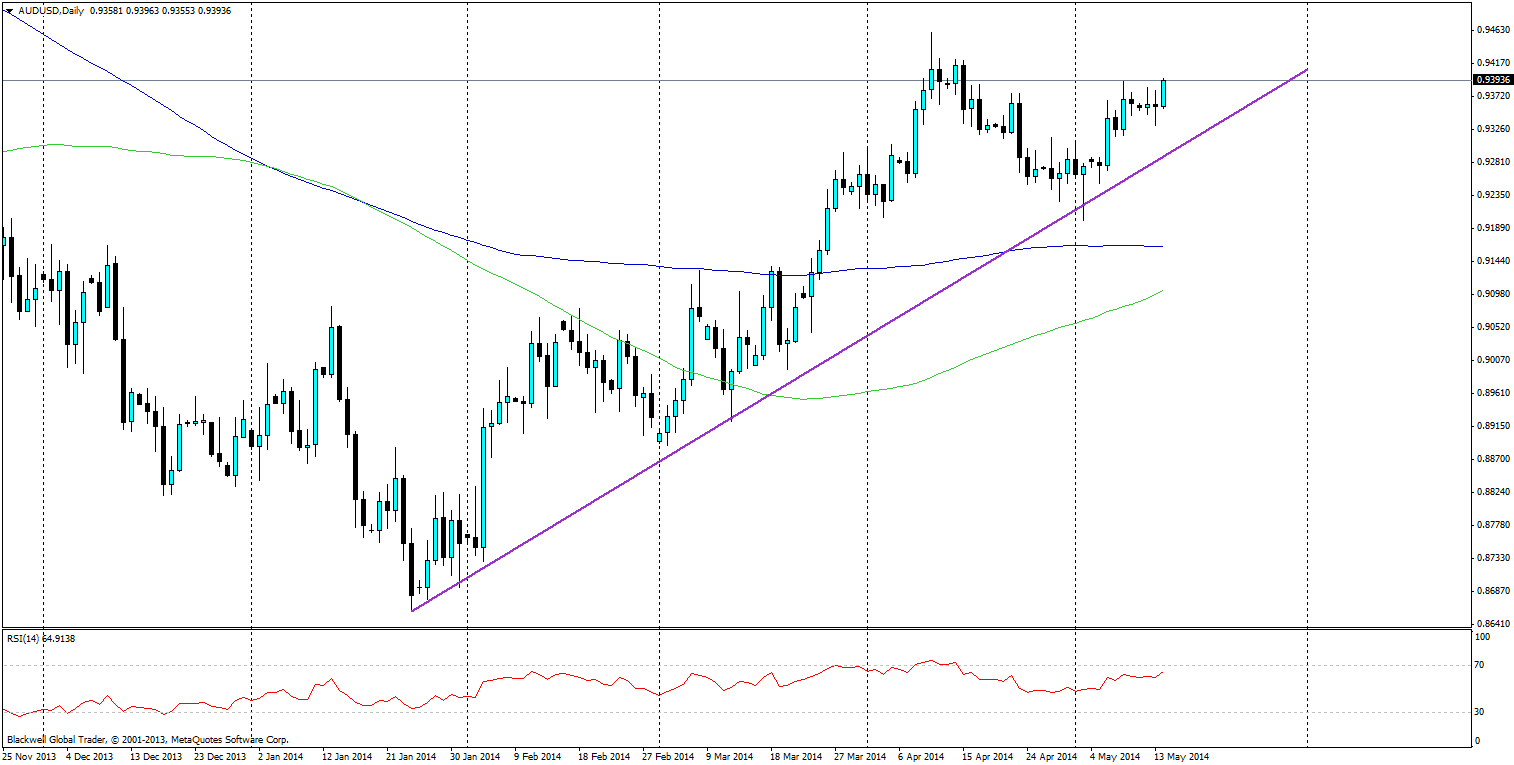

While the Abbot government is clearly concerned about debt and it has so far been driven to tackle markets, it's likely that the global community will look favourably upon the drive for deficit reduction and a return to surplus, and the AUD will likely benefit from it in the long run. After all, if you’re producing a good surplus, it’s a positive sign for the economy generally.

Already, the day after the budget, the AUD has looked to rise higher. My only fear is that the tax increases and recent hits to the economy may hamper the already decimated retail sector and consumer confidence in Australia, both of which could use a boost for a change. These may have some negative movements in the coming months, but if the economy does improve like the current government predicts, then this should off-set it hopefully.

In adding it all up, Australia does not have a massive debt crisis when you look at the numbers. In fact, their economy is not stagnating or drying up like many have been yelling, but the current aggressive government will certainly help to improve the books. The next question though will be if the senate will allow such changes and if the current government can survive a re-election – which is always the hard part with a tough budget. These are questions that can only be answered in the future. For now, the future outlook for the Australian economy still looks bullish.