The FX markets consolidate levels amid strong US jobs data printed on Friday. EM currencies and high-yielders see limited upside, while the US yields remain subdued. The 10-year US sovereign yields persist below 2% as Euro-zone peripheral yields rally (lead by Greek bonds) on Grexit fears. Decent inversion in Turkish sovereign curve (also due to political pressures on rates) push USD/TRY toward fresh 2.4954 record high. ZAR write-off gains, as Aussie holds ground despite 19.9% slump in Chinese imports.

19.9% drop in China imports hurts AUD

The Chinese imports slumped by a significant 19.9% on year to January, exports eased 3.3%. The Chinese trade surplus expanded to 60.03 billion dollars from 49.61 billion a month ago. The weakening Chinese demand despite lower commodity prices has clearly been bad news for the Aussie complex as China represents roughly 40% of Australia’s exports. AUD/USD gap-opened at 0.7768 (Friday close at 0.7796) with upside attempts tempered by lower carry appetite post-NFPs.

Technically, January’s AUD/USD sell-off eases with MACD turning neutral from negative. Despite limited appetite in high-beta currencies, AUD short-covering before Friday’s job report should keep the downside limited at 0.7700/23 (optionality / Oct’14-Feb’15 downtrend channel base). Resistance is solid walking into 80 cents on clear divergence between RBA and Fed policy outlooks.

ZAR rebounds from short-term downtrend base

As the strong US jobs data reversed the carry appetite in the high yielding EMs, the USD/ZAR had no difficulties holding the ground above January down-trending base. In addition to global carry unwind, the fading South African gross and net reserves, partially due to the strong USD but also to FX swaps and foreign payments, have not been good news for ZAR-bulls. South Africa’s December gold, platinum and mining production are due on February 12th. Lingering weakness in commodities are expected to have pushed the production lower and should limit appetite in long-ZAR positions. The break above the 50-dma (11.5349) today adds momentum on the upside, option bets turn supportive of further USD/ZAR gains. Key support stands at 11.00/11.20 era (200-dma / uptrend base building since mid-2011).

Heavy sell-off Turkish bonds

USD/TRY tests 2.50 offers as government refuses to ease pressures on the Central Bank. President Erdogan blames the central bank as responsible for “wrong” rate decisions. In a Fed-hawk-driven trading environment, it is just a matter of time before the USD/TRY pulls off resistance at 2.50. Stops are eyed above. The inverted Turkish sovereign curve confirms: any rate cut would be heavily rejected by the market. The descending short-end of Turkish sovereign curve steepens with 3-month - 2-year bonds yielding above 8%, the belly of the curve (2, 5, 10 years) shift above 7.50%. Fears that the Central Bank may be obliged to cut rates on February 24th meeting, giving up to the political pressures, is the biggest issue in Turkish bonds markets and should keep the short and long term inflows meager through weeks ahead. December trade data is due on February 11th and the deficit is expected to have deepened to -6.79 billion dollars from -5.64 billion print a month ago.

AUD/USD holds ground

The Risk Today

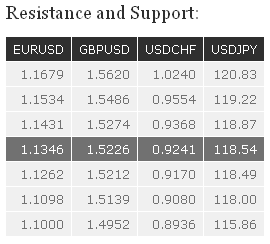

EUR/USD EUR/USD weakened on Friday. Although the support at 1.1262 is intact thus far, we suspect a limited upside potential in the short-term. Hourly resistances can be found at 1.1431 (intraday low) and 1.1534. Another support lies at 1.1098. In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, the recent strength is likely to be temporary. A resistance lies at 1.1679 (21/01/2015 high), while a key resistance stands at 1.1871 (12/01/2015 high). Key supports can be found at 1.1000 (psychological support) and 1.0765 (03/09/2003 low).

GBP/USD GBP/USD has broken the key resistance at 1.5274 (06/01/2015 high). Even if the declining trendline remains thus far intact, further strength towards the resistance at 1.5486 is favoured. Hourly supports now stand at 1.5212 (06/02/2015 low) and 1.5139 (04/02/2015 low). An hourly resistance can be found at 1.5352 (06/02/2015 high). In the longer term, the break of the key resistance at 1.5274 (06/01/2015 high) suggests renewed buying interest. Upside potential are likely given by the resistances at 1.5620 (31/12/2014 high) and 1.5826 (27/11/2014 high). The strong support at 1.4814 should cap the medium-term downside risks.

USD/JPY USD/JPY has broken the key resistance at 118.87 and is now challenging the resistance implied by its declining channel (around 119.22). A break to the upside would suggest abating medium-term selling pressures. Hourly supports can be found at 118.49 (29/01/2015 high) and 118.00 (04/02/2015 low). A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Even if a medium-term consolidation is likely underway, there is no sign to suggest the end of the long-term bullish trend. A major resistance stands at 124.14 (22/06/2007 high). A key support can be found at 115.46 (17/11/2014 low). We are raising our stop-loss at 117.86.

USD/CHF USD/CHF is consolidating below the resistance at 0.9368 (15/10/2014 low, see also the 200-day moving average). Hourly supports stand at 0.9170 (30/01/2015 low) and 0.8936 (27/01/2015 low). Another resistance lies at 0.9554 (16/12/2014 low). Following the removal of the EUR/CHF floor, a major top has been formed at 1.0240. The break of the resistance implied by the 61.8% retracement of the sell-off suggests a strong buying interest. Another key resistance stands at 0.9554 (16/12/2014 low), whereas a strong support can be found at 0.8353 (intraday low).