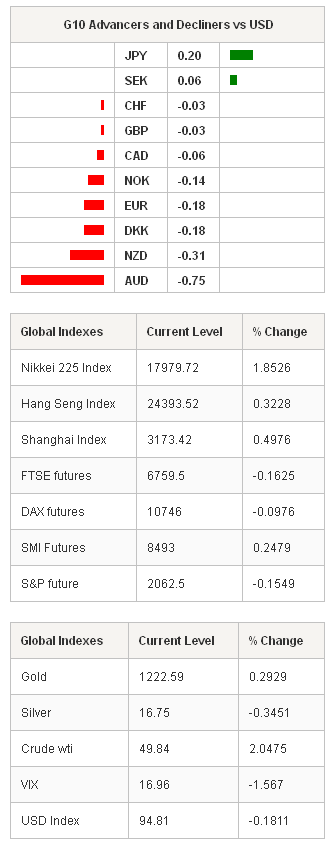

Market Brief

The Aussie took a hit overnight amid the labor data came in far worse-than-expected. Australian economy lost a total of 12’200 jobs in January; the loss of 28’100 full-time jobs have been only partially countered by 15’900 increase in part-time jobs and the unemployment rate deteriorated from 6.1% to 6.4% (vs. 6.2% exp.) The alarming situation in labor market revived dovish RBA speculations and pushed AUD/USD down to 0.7644. Recent bullish efforts have therefore failed, the MACD is back in negative territories, pointing the way is now open to 75 cents. AUD/NZD extends losses to 1.0413. The key support stands at 1.0355 (Jan 7th low).

No clarity came out of yesterday’s Eurogroup meeting on Greek situation. According to a Greek official, the possibility of a “bridge agreement” has been discussed. The negotiations will continue on Monday. The EUR/USD rally to 1.1352 on mixed news that EU/Greece may have reached an agreement in late New York, rapidly faded following the crowded news wire. Asia started the session by pulling EUR/USD back to 1.1300/20 range. The sentiment remains comfortably bearish with resistance seen at 1.1396/1.1445 (21-dma / Fibonacci 23.6% on Dec’14-Jan’15 drop). The 3-year Greek sovereign yields remain above 20%.

GBP/USD tests Sep’14-Feb’15 downtrend channel top (1.5280) as broad risk-off sentiment directs the short-term flows into low-cost safe-havens. The sterling pound outperforms all its G10 and EM counterparts before the Quarterly Inflation Report (QIR) due in London today. The dovish BoE stance being already priced in, the BoE is expected to dissipate deflationary fears by new forecasts. If this is the case, the QIR should help the Cable step into fresh bullish consolidation zone. Option bets are supportive above 1.5280/1.5300 for today expiry. EUR/GBP remains bid above 0.74 after having recovered from yesterday’s 0.73853 low. Option barriers are touted below 0.74 (MACD pivot).

Failure to break above the 200-dma keep downside pressures tight on XAU/USD. The sell-off accelerated amid the pair break 50-dma (previous support). A break of 100-dma ($1,216.33) suggests the extension of weakness toward $1,200 (Fibonacci 38.2% on Nov’14-Jan’15 recovery).

Riksbank is expected to maintain its policy rate unchanged at 0% given the situation in the Euro-zone has not changed significantly since the latest Riksbank cut. The Greek drama is certainly a heavy weighting tail risk on the EUR-complex, yet the impact of a potential Grexit is quite difficult to price in. Therefore we see no immediate need to step in negative-rate territory nor to announce unconventional intervention measures as asset purchases at today’s meeting. The 1-month 25-delta risk reversals spike to highest since mid-2010 on expectations that Riksbank will need to further intervene sooner or later to keep up with sustainable EUR-debasing and push EUR/SEK higher.

Besides the Riksbank verdict and BoE QIR, traders watch German January Final CPI m/m & y/y, Swedish January Unemployment Rate, Euro-zone December Industrial Production m/m & y/y, Canadian January Teranet/National Bank HPI m/m & y/y, US January Retail Sales, US February 7th Initial Jobless and Jan 31st Continuing Claims and US December Business Inventories.

Swissquote Sqore Trade Ideas: http://en.swissquote.com/fx/news/sqore

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| GE Jan F CPI MoM | -1.00% | -1.00% | EUR / 07:00 |

| GE Jan F CPI YoY | -0.30% | -0.30% | EUR / 07:00 |

| GE Jan F CPI EU Harmonized MoM | -1.30% | -1.30% | EUR / 07:00 |

| GE Jan F CPI EU Harmonized YoY | -0.50% | -0.50% | EUR / 07:00 |

| Riksbank Interest Rate | 0.00% | 0.00% | SEK / 08:30 |

| SW Jan Unemployment Rate | 8.10% | 7.00% | SEK / 08:30 |

| SW Jan Unemployment Rate Trend | - | 7.80% | SEK / 08:30 |

| SW Jan Unemployment Rate SA | 7.70% | 7.60% | SEK / 08:30 |

| EC Dec Industrial Production SA MoM | 0.20% | 0.20% | EUR / 10:00 |

| EC Dec Industrial Production WDA YoY | 0.30% | -0.40% | EUR / 10:00 |

| Bank of England Inflation Report | - | - | GBP / 10:30 |

| CA Jan Teranet/National Bank HPI MoM | - | -0.20% | CAD / 13:30 |

| CA Jan Teranet/National Bank HP Index | - | 167.17 | CAD / 13:30 |

| CA Jan Teranet/National Bank HPI YoY | - | 4.90% | CAD / 13:30 |

| CA Dec New Housing Price Index MoM | 0.10% | 0.10% | CAD / 13:30 |

| US Jan Retail Sales Advance MoM | -0.40% | -0.90% | USD / 13:30 |

| CA Dec New Housing Price Index YoY | 1.70% | 1.70% | CAD / 13:30 |

| US Jan Retail Sales Ex Auto MoM | -0.50% | -1.00% | USD / 13:30 |

| US Jan Retail Sales Ex Auto and Gas | 0.40% | -0.30% | USD / 13:30 |

| US Jan Retail Sales Control Group | 0.40% | -0.40% | USD / 13:30 |

| US Feb 7th Initial Jobless Claims | 287K | 278K | USD / 13:30 |

| US Jan 31st Continuing Claims | 2400K | 2400K | USD / 13:30 |

| US Dec Business Inventories | 0.20% | 0.20% | USD / 15:00 |

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1423

CURRENT: 1.1324

S 1: 1.1262

S 2: 1.1098

GBP/USD

R 2: 1.5486

R 1: 1.5352

CURRENT: 1.5234

S 1: 1.5197

S 2: 1.5140

USD/JPY

R 2: 121.85

R 1: 120.83

CURRENT: 120.24

S 1: 119.20

S 2: 118.34

USD/CHF

R 2: 0.9500

R 1: 0.9347

CURRENT: 0.9279

S 1: 0.9170

S 2: 0.8936