Market Brief

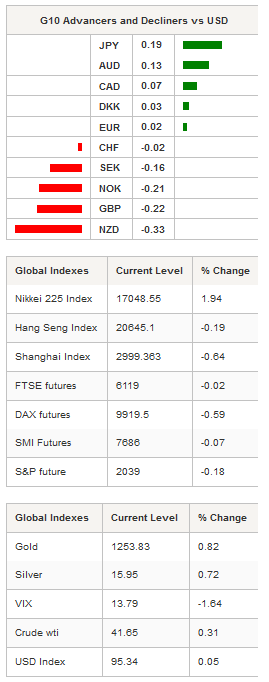

The Australian dollar was buoyed in overnight trading amid optimistic remarks from RBA Governor Stevens delivered during the ASIC annual forum. He reiterated his confidence in the Aussie economy, underlining the strength of the country’s macroeconomic framework, “which could, if needed, respond as appropriate to significant negative events”. He also added that the Aussie economy “is adjusting quite well in the circumstances”, even though it is “still a work in progress.” AUD/USD erased yesterday’s losses and returned above 0.76. However, we believe that the rally has limited legs given the absence of significant news from both sides of the Pacific. Australian equities were off 0.32% as Asian regional markets exhibited mixed returns.

USD/JPY traded sideways during most of the session in response to the release of mixed data. Japan’s March manufacturing PMI came in on the soft side, printing at 49.1 versus 50.5 expected and compared to 50.1 in February. Separately, the all industry index rose 2% m/m in January, beating median forecasts of 1.9% and previous reading of -0.9%. USD/JPY is currently testing the resistance lying at 112.16 (previous support from March 1st). However, given the dovish tone of the last FOMC statement, we believe that the odds of a dollar rally are pretty low.

The West Texas Intermediate rose sharply in Asia after PDVSA (Venezuela’s state-owned oil and natural gas company) said it had bought US crude from Petrochina (NYSE:PTR) for delivery in early April. The news came against the backdrop of rumours that the supply glut is overestimated. The WTI jumped sharply and traded above $41.60 a barrel, higher than the Brent crude. The US crude gauge has risen almost 60% since mid-February when it traded at around $26 a barrel. Should the rally continue, the WTI will face a first key resistance at $43.46 (high from November 24th).

The WTI’s bounce gave a fresh boost to the Canadian dollar, which surged 0.40% against the greenback, before partially erasing gains in the early European session. USD/CAD is currently trading at around 1.3080. We maintain our negative view on the pair as hopes for a Fed April rate hike fade away, while a further recovery in oil prices appears increasingly likely. The next key support can be found at 1.2832 (low from October 16th).

USD/CHF was treading water in Asia as traders had no real motivation to buy the US dollar. The pair moved between 0.9690 and 0.9710 throughout the entire Asian session. EUR/CHF also traded sideways and held ground above the 1.0895. On the downside, a support can be found at 1.0810 (low from February 29th), while on the upside a resistance lies at 1.1023.

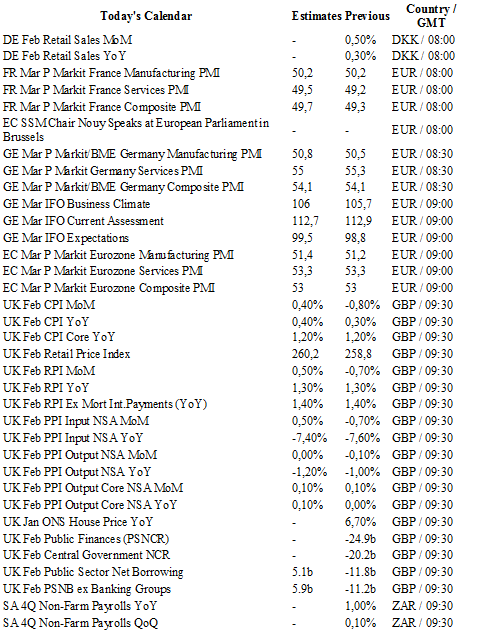

Today traders will be watching the trade balance from Switzerland; retail sales from Denmark; PMIs from France, Germany and the euro zone; IFO and ZEW surveys from Germany; CPI, retail price index, RPI and PPI from the UK; Markit manufacturing PMI and Richmond Fed manufacturing index from the US.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1376

CURRENT: 1.1223

S 1: 1.1058

S 2: 1.0810

GBP/USD

R 2: 1.4668

R 1: 1.4591

CURRENT: 1.4306

S 1: 1.4222

S 2: 1.4033

USD/JPY

R 2: 117.53

R 1: 114.91

CURRENT: 111.56

S 1: 110.67

S 2: 107.61

USD/CHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9713

S 1: 0.9651

S 2: 0.9476