The Australian dollar fell to its lowest levels in over two months on Thursday, as a variety of fundamental data pressured the currency.

Fed Minutes

The minutes the Federal Reserve’s latest meeting released yesterday suggested that a tapering of $85 billion in monthly bond purchases could begin in the “coming months”, bolstering the US dollar and triggering weakness in the Australian dollar. The news comes in contrast to the dovish remarks made by Janet Yellen, President Obama's nominee to lead the Federal Reserve, in her testimony before the Senate Banking Committee last week.

China PMI

On Thursday the Aussie saw continued selling after the release of disappointing Chinese manufacturing data. The Purchasing Managers’ Index (PMI) released yesterday by HSBC Holdings PLC and Markit Economics showed that China’s manufacturing expanded at a slower pace, adding pressure to Australia's commodity exports. China is Australia's biggest trading partner and largest export market.

RBA Intervention Risk

Reserve Bank of Australia Governor Glenn Stevens, speaking to the Australian Business Economists annual dinner in Sydney on Thursday, said he was "open minded" on intervening to weaken the Australian dollar. "Overall, in this episode so far, the Bank has not been convinced that large-scale intervention clearly passed the test of effectiveness versus cost. But that doesn't mean we will always eschew intervention." He added, "Our position has long been, and remains that foreign exchange intervention can, judiciously used in the right circumstances, be effective and useful."

IMF Comments

In a preliminary statement on Wednesday the IMF recommended accommodative monetary policy, stating "With growth currently on the soft side, the real exchange rate still overvalued and weighing on the non-mining sector, and inflation within the target range, monetary policy should remain accommodative."

In an interview on Thursday, Min Zhu, deputy managing director of the IMF said "The Australian dollar is overvalued by around 10 per cent from a medium-term point of view."

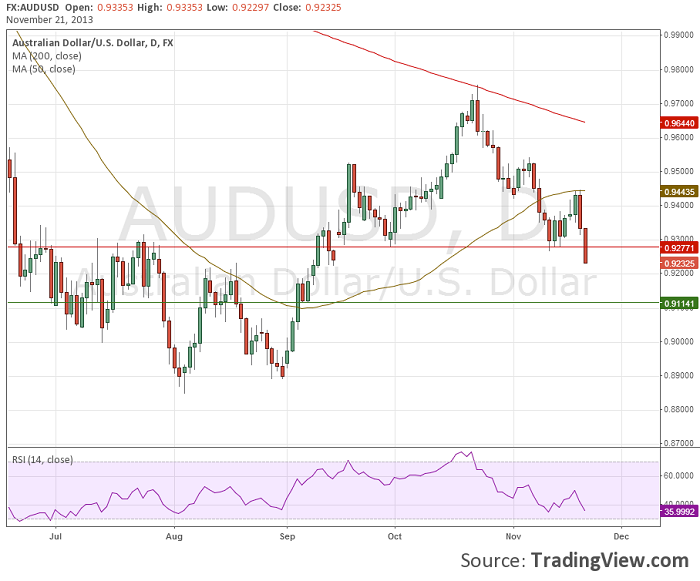

AUD/USD Daily Chart Looking at the AUD/USD daily chart we can see that price has fallen through major support at 0.9277. Potential support lies below at 0.9114.

AUD/USD" width="700" height="581" />

AUD/USD" width="700" height="581" />

Fed Minutes

The minutes the Federal Reserve’s latest meeting released yesterday suggested that a tapering of $85 billion in monthly bond purchases could begin in the “coming months”, bolstering the US dollar and triggering weakness in the Australian dollar. The news comes in contrast to the dovish remarks made by Janet Yellen, President Obama's nominee to lead the Federal Reserve, in her testimony before the Senate Banking Committee last week.

China PMI

On Thursday the Aussie saw continued selling after the release of disappointing Chinese manufacturing data. The Purchasing Managers’ Index (PMI) released yesterday by HSBC Holdings PLC and Markit Economics showed that China’s manufacturing expanded at a slower pace, adding pressure to Australia's commodity exports. China is Australia's biggest trading partner and largest export market.

RBA Intervention Risk

Reserve Bank of Australia Governor Glenn Stevens, speaking to the Australian Business Economists annual dinner in Sydney on Thursday, said he was "open minded" on intervening to weaken the Australian dollar. "Overall, in this episode so far, the Bank has not been convinced that large-scale intervention clearly passed the test of effectiveness versus cost. But that doesn't mean we will always eschew intervention." He added, "Our position has long been, and remains that foreign exchange intervention can, judiciously used in the right circumstances, be effective and useful."

IMF Comments

In a preliminary statement on Wednesday the IMF recommended accommodative monetary policy, stating "With growth currently on the soft side, the real exchange rate still overvalued and weighing on the non-mining sector, and inflation within the target range, monetary policy should remain accommodative."

In an interview on Thursday, Min Zhu, deputy managing director of the IMF said "The Australian dollar is overvalued by around 10 per cent from a medium-term point of view."

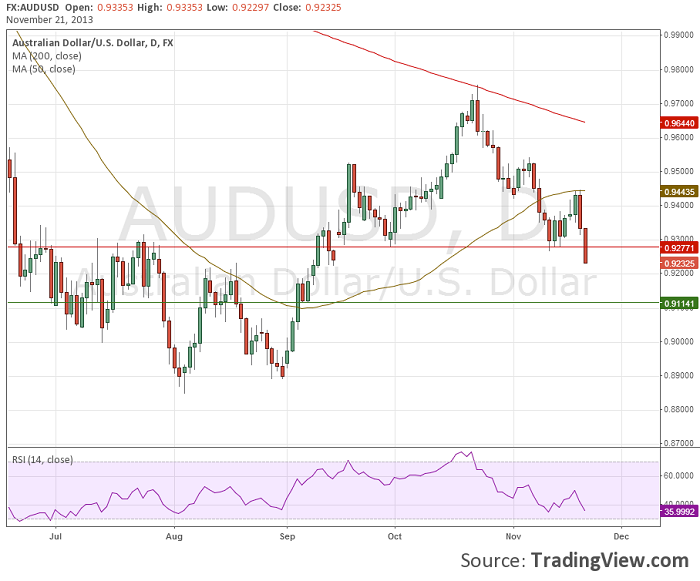

AUD/USD Daily Chart Looking at the AUD/USD daily chart we can see that price has fallen through major support at 0.9277. Potential support lies below at 0.9114.

AUD/USD" width="700" height="581" />

AUD/USD" width="700" height="581" />