The Australian dollar started the week strongly as a general sentiment swing against the USD occurred. However, the latter part of the week turned torrid for the pair as an uptick in the US Preliminary GDP to 1.0% caught markets by surprise and saw the AUD falling sharply to close the week lower at 0.7122. In addition, the AU Hourly Earnings figures, a measure of wage inflation, also slipped lower to 0.5% q/q, adding to the pain.

The week ahead is likely to be a busy one for the Australian dollar as the Reserve Bank considers its options in regards to interest rates and monetary policy. The market is largely expecting the RBA to leave rates unchanged at 2.00% but any dovish hint to their statements could see the pair challenge the key 70 cent handle.

In addition, the AU GDP results are due Wednesday and a negative result is a real prospect given the slide in China’s commodity demands. Although the domestic economy has held up reasonably well, following the end of the commodity super cycle, unemployment is now starting to rise which is indicative of the general time lag. Subsequently, expect the AUD to be under pressure in the coming week as a range of data points are due out which could highlight some holes in the Australian economic story.

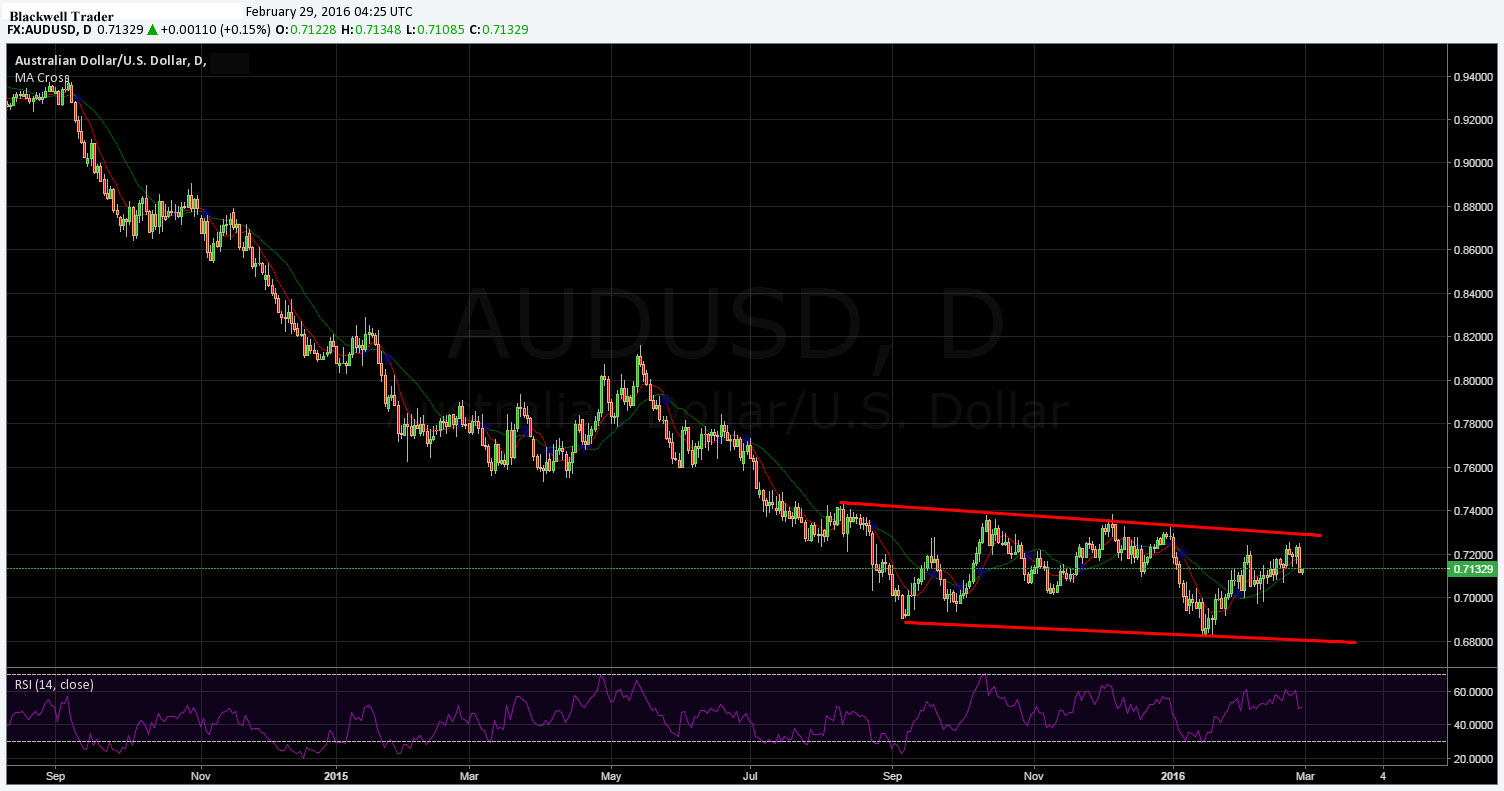

From a technical perspective, Friday’s sharp depreciation formed a relatively large bearish candle as well as a shooting star on the weekly chart. In addition, RSI has started to trend lower within neutral territory, whilst price action has finally penetrated the 100-Day MA on the downside. Any further upside rallies are likely to be exhausted and we subsequently view the probability of a move towards the 70 cent handle as likely. Support is found at 0.7096, 0.7014, and 0.6936 whilst resistance is found at 0.7257, 0.7324, and 0.7380.

Ultimately, the economic fundamentals of the pair still supports further falls considering the divide between Australia and the USA. Subsequently, expect to see the Aussie dollar remain under significant selling pressure until a more appropriate valuation level is reached.