Market Brief

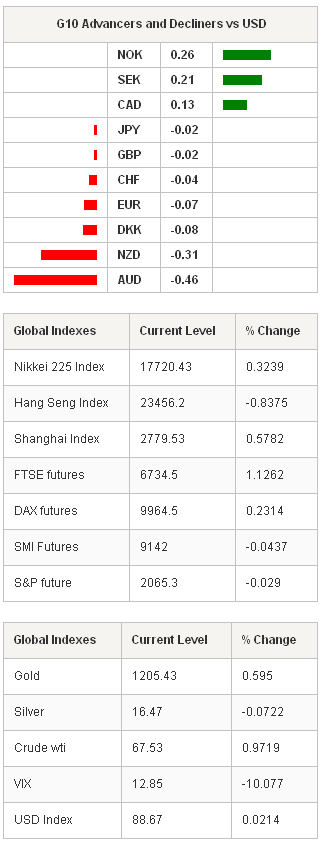

The Aussie took another dive overnight amid the Australian GDP unexpectedly slowed to 0.3% q/q (vs. 0.7% exp. & 0.5% last). The GDP y/y has been revised down to 2.7% for the last quarter, and remained stable at this level in Q3 (vs. 3.1% exp. & last release). AUD/USD legged down to fresh four year low of 0.8389. Stronger bearish momentum suggests further downside. In the mid-run, we anticipate a steady slide toward 80 cents.

In New Zealand, the NZD/USD sold-off to 0.7767 amid the whole milk powder price fell another 7.1% at most recent Fonterra auction. The 0.7% contraction in residential building approvals and slower than expected increase in value of buildings in 3Q added to heavy sentiment. A close below 0.7820 should keep the bias on the downside.

USD/JPY and JPY crosses traded mixed in Tokyo. According to Markit, the Japanese services and composite PMI stepped in the expansion zone in November (above 50). USD/JPY advanced to 119.44, fresh seven year high. Solid offers are presumed at pre-120 (psychological level) before the December 14th snap elections. Yet the option bids are supportive of gains, large 120-strike call will come to maturity tomorrow. Given the political uncertainties, attempts above 120 should face correction. We believe a confirmation of support to Abenomics is needed for sustainable gains above 120. The sentiment in EUR/JPY turns mild. The daily Ichimoku conversion line heads downward (147.01). The broad EUR sell-off should further weigh on the cross.

EUR/USD tests 1.2358/60 territories as the dovish bets dominate before Thursday’s ECB. Large option barriers trail below 1.2375/1.2400 for this week expiry. The US ADP read is due today, any positive surprise should place the 1.2358 low at risk. Stops are eyed below.

USD/CAD tests the year high levels (1.1467) walking into the BoC meeting today. The BoC is expected to maintain the bank rate unchanged at 1%. Yet given the surprise overheating in inflation, combined to stress in energy prices, we expect the BoC to tighten the tone. The impact on the markets will most probably depend on how different the accompanying statement is, but also how convinced the markets are. The trend and momentum indicators turn positive, anticipating an advance toward fresh highs; option bids trail above 1.14 to 1.15+. The sentiment is mixed below 1.1375. The first line of support is seen at 1.1265/67 (50-dma / Fib 76.4% on Jul-Oct uplift).

Today, the Bank of Canada announces decision and the US Fed releases Beige Book. Traders are also focused on Swiss 3Q GDP q/q & y/y, November Final Composite and Services PMI from Sweden, Spain, Italy, France, Germany, Euro-zone, UK and US, UK November Official Reserve Changes, Euro-zone October Retail Sales m/m & y/y, US November 28th MBA Mortgage Applications, US November ADP Employment Change, US 3Q (Final) Nonfarm Productivity and Unit Labor Costs and US November ISM Non-Manufacturing Composite.

Swissquote SQORE Trade Idea: G10 Currency Trend Model: Buy USD/NOK at 7.0330

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| SZ 3Q GDP QoQ | 0.30% | 0.20% | CHF / 06:45 |

| SZ 3Q GDP YoY | 1.40% | 1.40% | CHF / 06:45 |

| SW Nov PMI Services | - | 57.7 | SEK / 07:30 |

| SP Nov Markit Spain Services PMI | 55.2 | 55.9 | EUR / 08:15 |

| SP Nov Markit Spain Composite PMI | - | 55.5 | EUR / 08:15 |

| IT Nov Markit/ADACI Italy Composite PMI | 49.6 | 50.4 | EUR / 08:45 |

| IT Nov Markit/ADACI Italy Services PMI | 50.2 | 50.8 | EUR / 08:45 |

| FR Nov F Markit France Services PMI | 48.8 | 48.8 | EUR / 08:50 |

| FR Nov F Markit France Composite PMI | 48.4 | 48.4 | EUR / 08:50 |

| GE Nov F Markit Germany Services PMI | 52.1 | 52.1 | EUR / 08:55 |

| GE Nov F Markit/BME Germany Composite PMI | 52.1 | 52.1 | EUR / 08:55 |

| EC Nov F Markit Eurozone Services PMI | 51.3 | 51.3 | EUR / 09:00 |

| EC Nov F Markit Eurozone Composite PMI | 51.4 | 51.4 | EUR / 09:00 |

| UK Nov Official Reserves Changes | - | -$652M | GBP / 09:30 |

| UK Nov Markit/CIPS UK Services PMI | 56.5 | 56.2 | GBP / 09:30 |

| UK Nov Markit/CIPS UK Composite PMI | 56.2 | 55.8 | GBP / 09:30 |

| EC Oct Retail Sales MoM | 0.50% | -1.30% | EUR / 10:00 |

| EC Oct Retail Sales YoY | 1.60% | 0.60% | EUR / 10:00 |

| US Nov 28th MBA Mortgage Applications | - | -4.30% | USD / 12:00 |

| US Nov ADP Employment Change | 222K | 230K | USD / 13:15 |

| US 3Q F Nonfarm Productivity | 2.40% | 2.00% | USD / 13:30 |

| US 3Q F Unit Labor Costs | -0.20% | 0.30% | USD / 13:30 |

| US Nov F Markit US Services PMI | 56.5 | 56.3 | USD / 14:45 |

| US Nov F Markit US Composite PMI | - | 56.1 | USD / 14:45 |

| Bank of Canada Rate Decision | 1.00% | 1.00% | CAD / 15:00 |

| US Nov ISM Non-Manf. Composite | 57.5 | 57.1 | USD / 15:00 |

| US U.S. Federal Reserve Releases Beige Book | - | - | USD / 19:00 |

Currency Tech

EUR/USD

R 2: 1.2532

R 1: 1.2461

CURRENT: 1.2371

S 1: 1.2358

S 2: 1.2288

GBP/USD

R 2: 1.5826

R 1: 1.5763

CURRENT: 1.5625

S 1: 1.5586

S 2: 1.5423

USD/JPY

R 2: 120.00

R 1: 119.50

CURRENT: 119.24

S 1: 117.89

S 2: 117.04

USD/CHF

R 2: 0.9839

R 1: 0.9742

CURRENT: 0.9731

S 1: 0.9595

S 2: 0.9531