Investing.com’s stocks of the week

A surprise cut in Australian interest rates led the aussie to fresh lows against the US dollar as well as weakness versus other majors. The RBA reduced rates to 2.25% from 2.50%, as it said the economy was growing below trend. In addition, even following its recent drop, the Reserve Bank still saw the Australian dollar as overvalued on a fundamental basis.

The move came as a surprise to the majority of analysts and this led to aggressive sales of the aussie down to 0.7650; the lowest since May of 2009. Analysts were expecting at least one more rate cut out of Australia to bring the Overnight Cash Rate (OCR) to 2%.

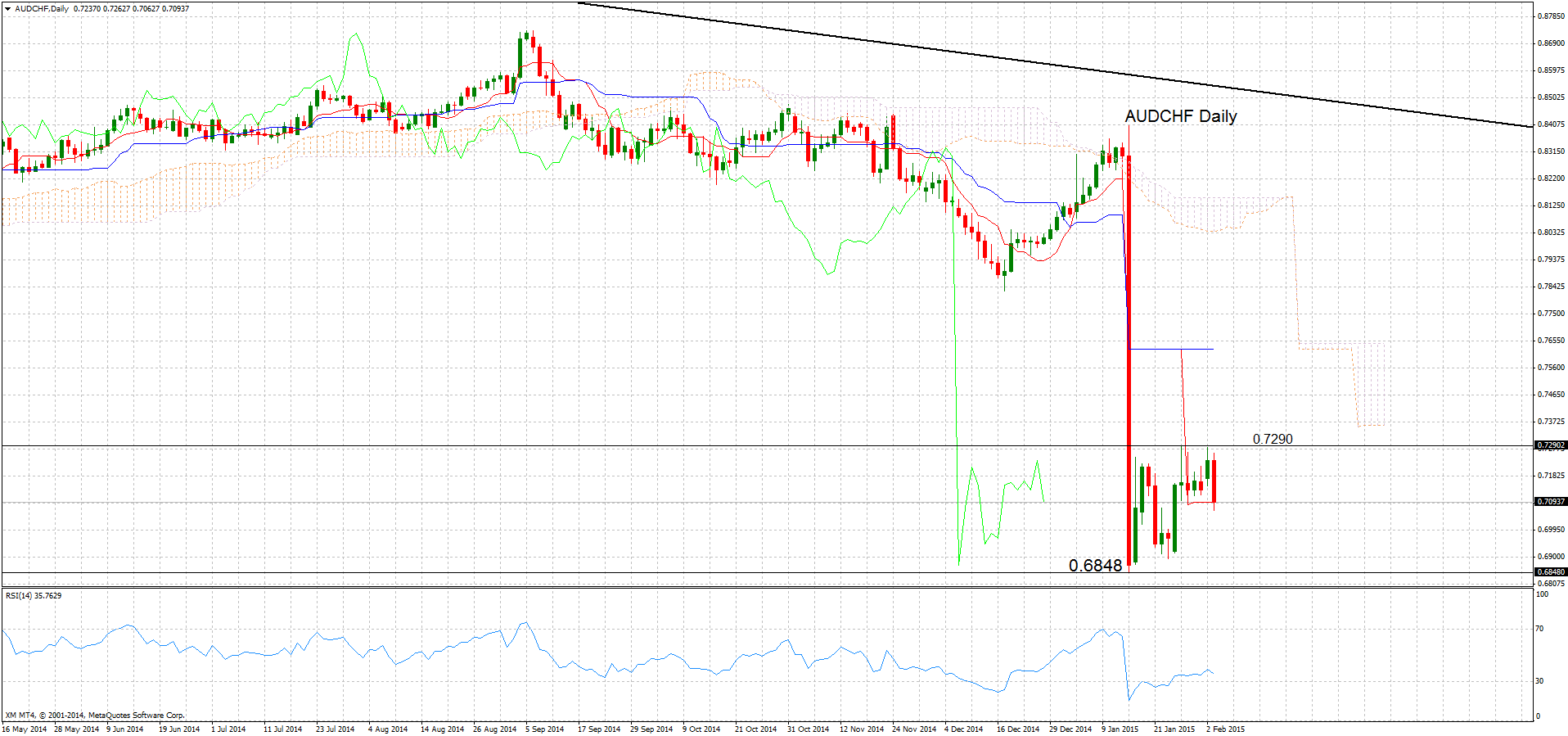

AUD/CHF resumed its fall today after the RBA rate cut and touched a low of 0.7062 by early European session trading. Resistance at 0.7290 proved difficult to break and the intraday bias is back on the downside. There is scope to target the all-time low of 0.6848.

To the upside, a break of the recent resistance at 0.7290 would indicate a short-time bottoming. However, the long term outlook remains bearish as long as the market remains under the Ichimoku cloud and the RSI is in bearish territory.