Talking Points- Large Triangle Pattern on Daily Chart

- Long Set-up on Shorter-Term Time Frames

- The Ideal Time Frame for Buying AUD/CAD

AUD/CAD is beginning a large triangle-type consolidation on the daily chart (see below). This comes after a downtrend, so the bigger picture is biased to the down side. However, given the unusually large size of the triangle, it is valid to take both longs and shorts within the context of this consolidation.

AUD/CAD " title="Large Triangle Pattern In AUD/CAD " align="bottom" border="0" height="242" width="474">

AUD/CAD " title="Large Triangle Pattern In AUD/CAD " align="bottom" border="0" height="242" width="474">

As price has recently made a high, it is reasonable to imagine that shorts are most favorable now, and in the bigger picture, they probably are. However, the recent move up has been quite abrupt, and thus, there is a possibility that there may be another spike to the upside. Although this is a lower-probability set-up, it is worth trying on the lower time frames in the event that an entry with tight risk is available.

On the four-hour chart below, price has just pulled back to the trend line, which may provide a long-entry opportunity.

AUD/CAD Testing Trend Line Support" title="AUD/CAD Testing Trend Line Support" align="bottom" border="0" height="242" width="474">

AUD/CAD Testing Trend Line Support" title="AUD/CAD Testing Trend Line Support" align="bottom" border="0" height="242" width="474">

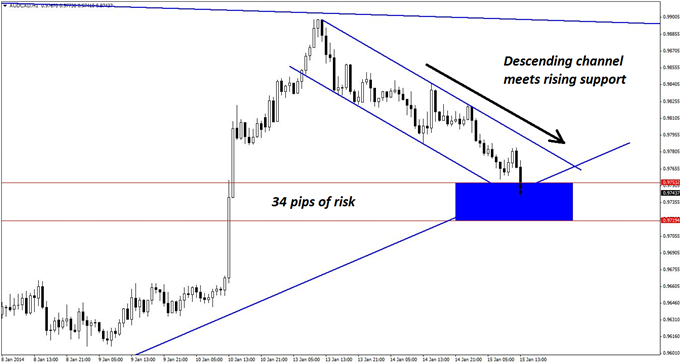

Since there is no other nearby support or resistance on which to build this trade, we must consult the hourly time frame for further clarification, and there (see below), we have further validation in the form a descending parallel channel that is currently meeting rising support. Together, these levels define a key zone of support that is just 34 pips wide: 0.9719-0.9753.

AUD/CAD Longs" title="Key Zone For Initiating AUD/CAD Longs" align="bottom" border="0" height="242" width="474">

AUD/CAD Longs" title="Key Zone For Initiating AUD/CAD Longs" align="bottom" border="0" height="242" width="474">

The recent shallowness of the channel helps make a case for initiating this trade on the 15-minute chart (not shown). On that time frame, traders would be advised to look for bullish pin bars, bullish engulfing patterns, and/or bullish reversal divergence.

As always, two or three tries may be needed to get in on the trade. If it works, however, this limited risk will meet with a potential reward of 130 pips or more, which, of course, is dependent upon trade management and stringent risk control.

By Kaye Lee, private fund trader and head trader consultant, StraightTalkTrading.com