World markets are declining in fear of a coronavirus pandemic as more and more cases of a disease spread outside of China. As we recently noted, there is a growing demand for safe havens against this backdrop.

Traditionally investors use the yen and the franc as funding to buy higher-yielding bonds in other currencies. The euro has been among them recently due to extremely low yields over the debt market. The reassessment of the growth rate of the world economy forces investors to revise their growth forecasts for commodity and emerging economies, and to a lesser extent for European countries and Japan.

Against this background, not the dollar, but the currencies of emerging and commodity economies are becoming the most volatile, that is, experiencing the sharpest movements. They can grow for years as if climbing up the stairs, but in a matter of weeks and months, they collapse as if falling into an elevator shaft.

Fear of the coronavirus is an essential driver of the markets in recent weeks. However, it is also worth noting that many currencies have been declining against the dollar since the very beginning of the year. So the events of recent weeks should be considered a catalyst but hardly the main reason.

The Australian dollar lost about 6% so far this year, and more than half of this decline occurred in the first weeks of January. The drop of AUD/USD to levels near 0.650 takes us back to the end of 2008, during the time of extreme debt cut in the markets. The reversal point was then in the area around 0.6000, when China announced massive growth stimulus programs, pulling the demand for Australian commodities.

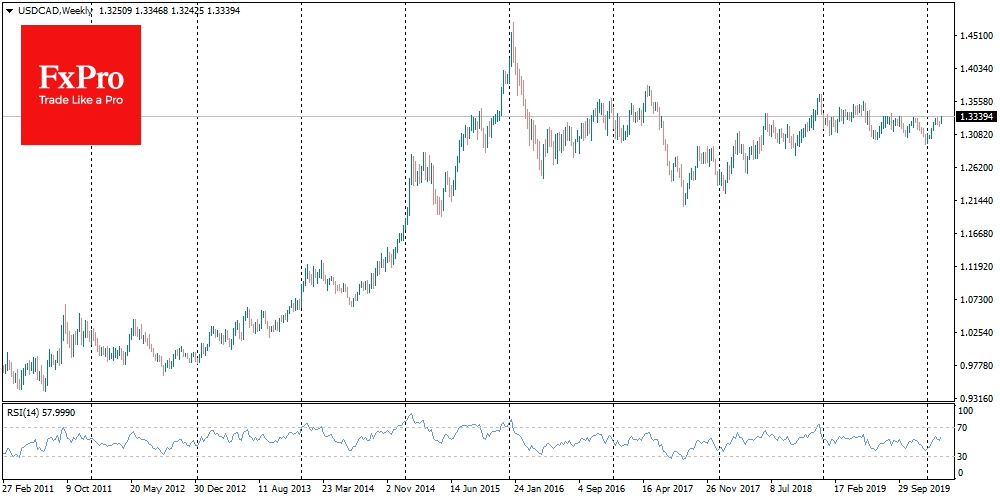

The Canadian dollar lost 2.2% in less than two months but reversed against its American counterpart. The situation in USD/CAD is interesting because now the pair is testing 8-month highs near 1.3350, the breakthrough of which can open the way to grow to 1.3500 and further to 1.3700.

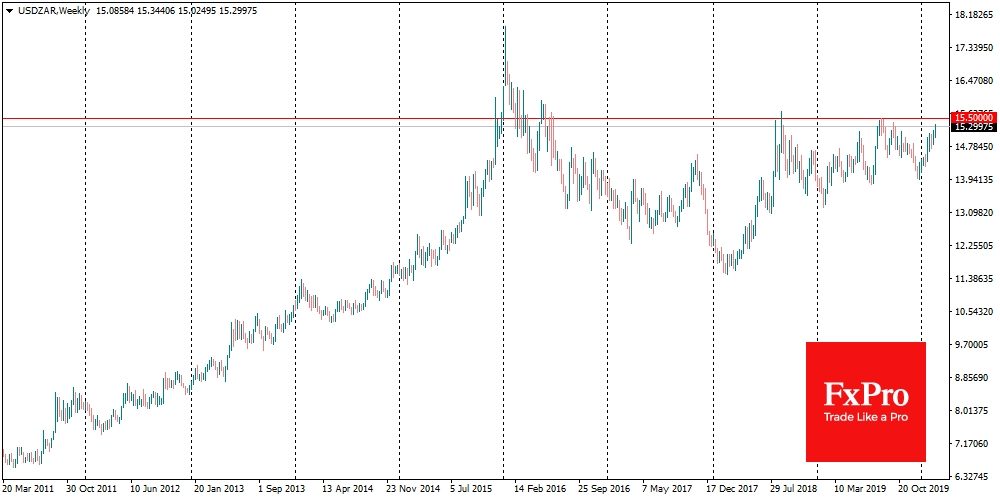

Another “commodity” victim of this year is the South African rand. It has been losing 8%, being the second-worst currency against USD after Brazilian real. The USD/ZAR, adding emphatically since the beginning of the year, was close to the vital mark at 15.50. The outcome of the struggle for this level may determine the future fate of the pair for the next weeks. In case of a breakthrough, the ZAR might decline quite quickly into the area above 17.00, as it did in early 2016, when there was almost uncontrolled selloff.

The FxPro Analyst Team