Asian Market Roundup:

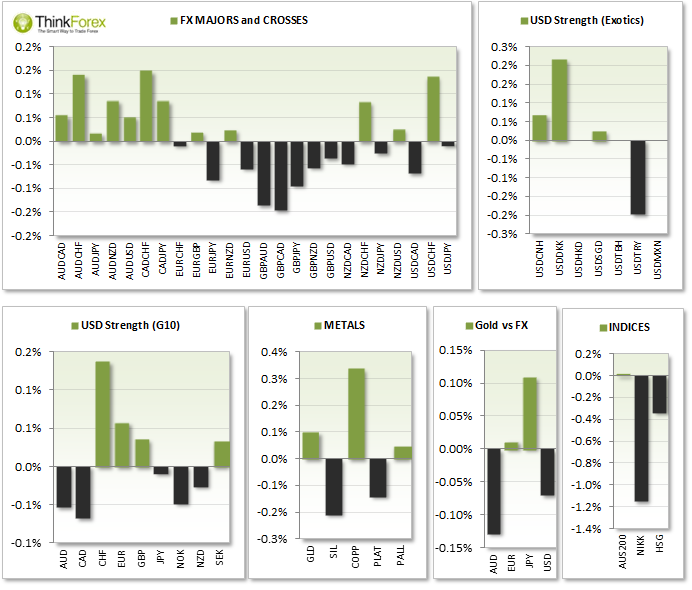

- Japan Retail sales beat expectations and are up 11% y/y and +16.1% ytd; AUDJPY rallied 21 pips; The Yen continued to be one of the stronger currencies of the session as money flowed into safe havens whilst awaiting further news of the Ukraine situation.

- AUS200 held onto multi-year highs after an intraday low tested 5510 support

- Hang Seng was relatively subdued following Friday's abrupt sell-off, ranging near the weekly lows

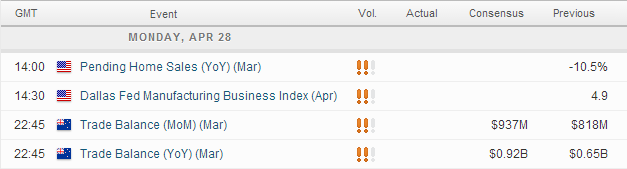

Upcoming Events:

Quiet on 'red news tonight' so albeit any shock news announcements we may find moves fairly limited. Conditions may be better suited for EOD (End of Day Traders) and day-traders, particularly scalpers.

Technical Analysis:

Finding trade setups today has been particularly difficult. Whilst I am sure there are always opportunities, it was tricky finding price action setups that had momentum, supported the price action and ticked my boxes for a trade. For this reason I have selected a very near-term intraday setup and an EOD (End of Day) price action setup to monitor.

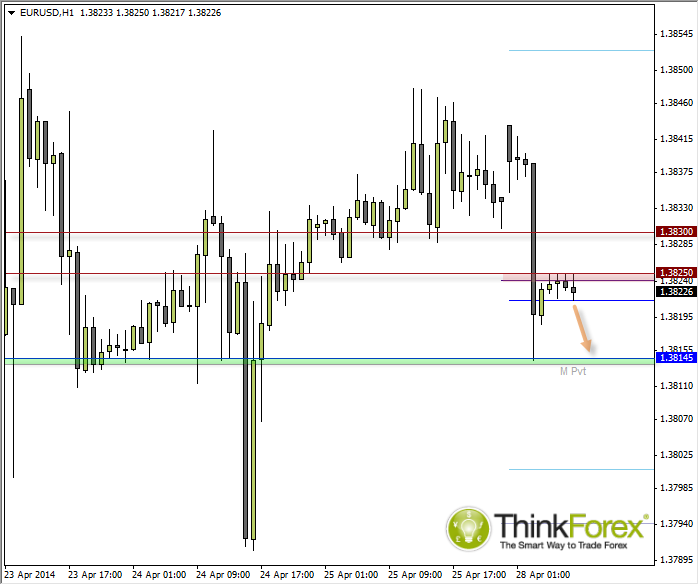

EUR/USD: Dead Cat bounce below 1.3825

Whilst we have seen narrow-range trading following the sell-off at open the past 4 candles have tested 1.3825 to the pip. As long as this area caps as resistance and we see a break below the daily pivot then the immediate target is the monthly pivot (and current daily low).

A break above 1.3825 targets 1.383.

You can use these levels to trade towards on lower timeframes such as M5, M15 etc. seeking trends on route to target.

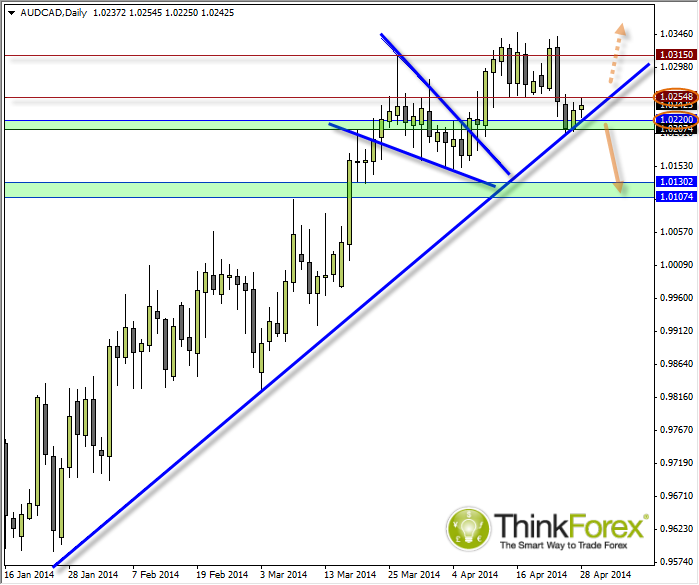

AUD/CAD: Sits at a crossroad between bullish and bearish

For the bearish bias to work out I would like to see 1.0255 cap as resistance and see a clear break below 1.0200 horizontal support and bullish trendline. The 1st target would be 1.010-13, however you could wait for a retracement towards 1.020-22 before seeking bearish trade signals.

However, a break above 1.0255 would favour a swing low to be in place and for a resumption of the bullish trend. Lower timeframes can be traded to target 1.0315 and 1.3045 highs.