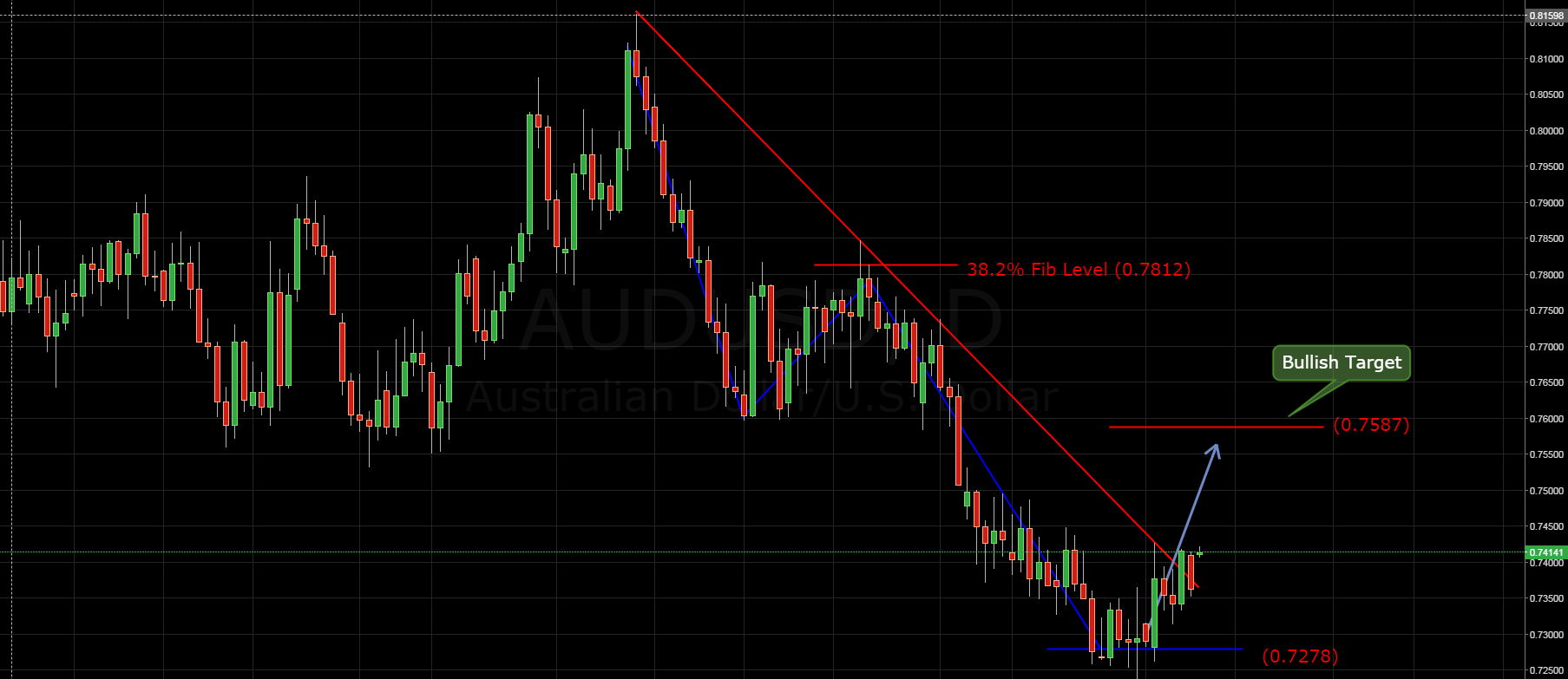

The Australian dollar has been under considerable selling pressure lately, however the pair might have finally discovered some bullish support as it busts through the long running bearish trend line.

After approximately 3 months of an almost linear decline, the Aussie dollar looks to be finally turning the corner, albeit temporarily. Late July saw the pair forming a base of support around the 0.7259 level as it looked to challenge the long running bearish trend line.

The opportunity finally came in the latter part of last week as the US Non-Farm Payroll figures, came in weaker than expected, and the bulls capitalised and rushed for the in-zone. Price action subsequently started to turn decidedly north and strongly pushed through the long running trend line. The short term focus for the pair has now shifted towards the upside and the bulls are finally ready to have their day in the sun.

From a technical analysis viewpoint, the pair has managed to breach an extremely valid trend line that had been constraining its price action since May, 2015. The Aussie has also managed to close above the 30 day exponential moving average cementing the view that a short term push to the long side is the preferred bias. RSI has also ticked higher, out of oversold territory, and now resides firmly in the neutral zone meaning that there is plenty of room to move on the upside.

The intermediate bullish target for the pair falls around the 0.7587 level, however, the AUD will need to break through some difficult resistance at 0.7468 to cement a move higher. Any break above that will likely put our target level at play.

However, the current bullish leg is short term at best and the pair is still likely to face the bears again come the end of August. Considering the markets focus upon the US Federal Reserve’s timing on a rate rise, along with a faltering Australian economy, the AUD will continue to suffer from persistent selling. Subsequently, the current bullish push is likely to be simply a temporary correction.

So enjoy the short term bullish romp in the park but know that the bears are gathering and will, once again, turn up to ruin the party.