Key Points:

- Rising Wedge nearing completion.

- Long-term zone of resistance being approached.

- ABC wave also nearing completion.

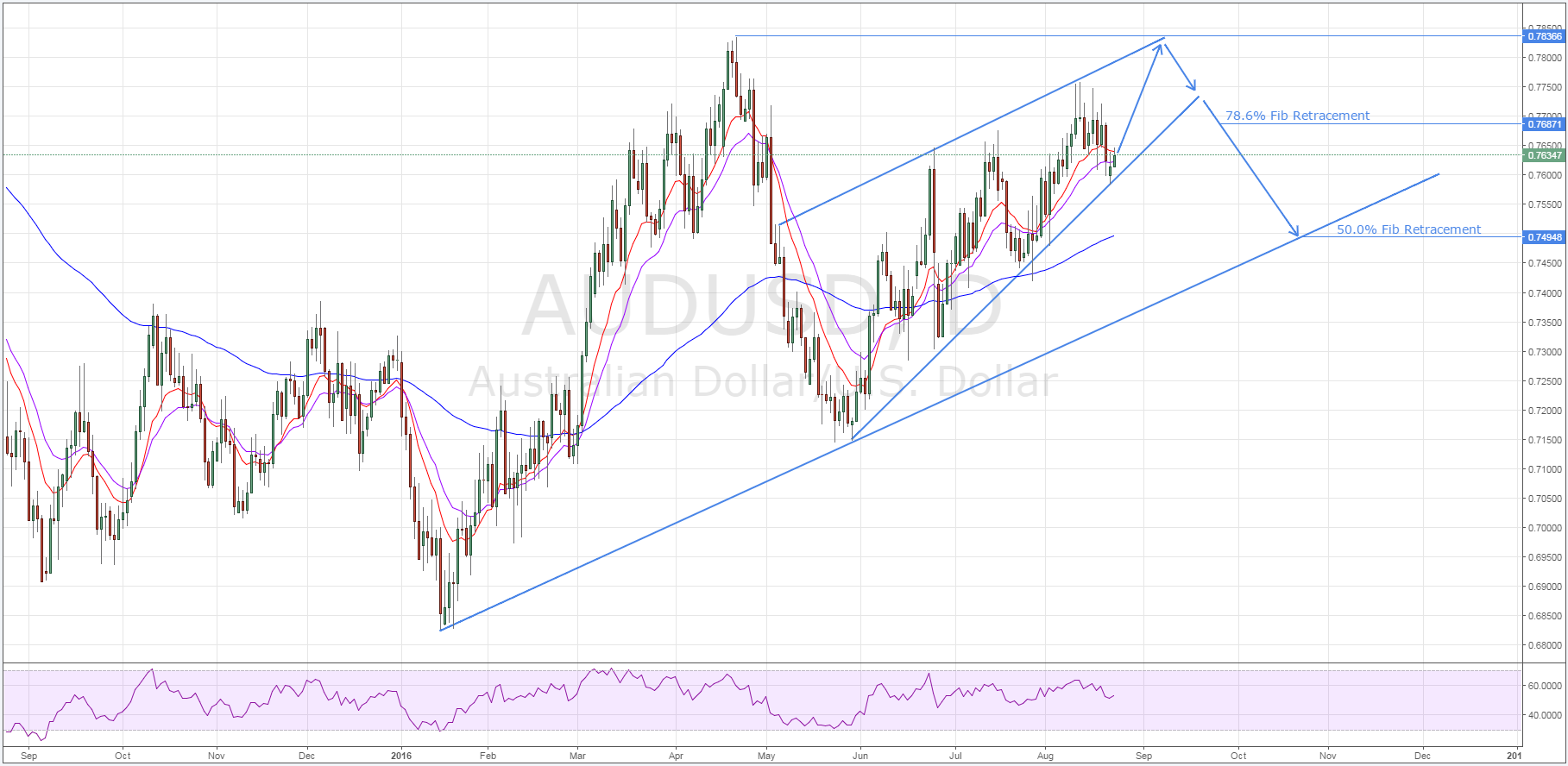

The Aussie dollar is setting up for a much needed tumble which might at first seem counterintuitive given its relentless bullish streak over the past few months. However, the end of a rising wedge pattern is fast approaching, as is a long term zone of resistance. Combined, these factors could easily send the pair reeling, but the presence of a rough corrective ABC wave is seeing pressure mount as the pair moves stridently higher.

Firstly, as is shown below, the AUD/USD has been making a strong recovery since the substantial and protracted decline which began late April. Notably, this recovery has taken the form of a rising wedge pattern and the pair has just recently tested the downside of said wedge.

As support here held, the AUD is now making a move higher and this should take it all the way back to the upside constraint. This is largely as result of the rather bullish daily EMA activity, however, an imminent reversal of the H4 Parabolic SAR reading is also adding fuel to the rally.

However, after reversing, the pair may find itself free of the confines of the wedge and move into another steep downtrend. This is predominantly due to the fact that, after moving to test the upside, the Aussie dollar will encounter a rather robust long-term zone of resistance.

This resistance is in place at the 0.7836 level and is the point at which we last saw a long-term trend reversal. This being said, there could be some scope for the AUD to move slightly beyond this level in order to complete the ABC wave prior to reversing.

Confirmation that the Aussie dollar has broken free of the wedge and a downtrend is in full swing will come when the 78.6% Fibonacci level has been broken. At this level, one can be relatively certain that a fake-out has not occurred and that the rising wedge has been completed.

Once the pair has begun its decline, it could move as low as the 0.7494 mark before recovering. Here, support should kick in strongly, especially given it is the 50.0% Fibonacci retracement. Moreover, this represents the lower boundary of the January uptrend which has proven to be a turning point once before.

Ultimately, even in the absence of some rather telling technicals, the medium to long term forecast for the AUD is biased towards another slip. This is, of course, a result of the RBA’s expressed commitment to depreciating the currency. Consequently, it is almost a certainty that we will see further rate cuts moving forward and, as result of the technicals, this time they will hopefully have the desired outcome.