Commodity currencies ended as the weakest major currencies in a holiday shortened week following the selloff in commodities. In particular, WTI crude oil slumped to 4 year low as OPEC decided to keep quota steady and closed at 65.99, comparing to last week's close of 73.88. Gold also seemed to finally give up on 1200 handle and dipped to close at 1167.0 even though it's held well above recent low at 1145.5. Aussie ended up as the weakest one, closely followed by Canadian. The Japanese yen was the next weakest currency as fresh selloff was seen after weak CPI data but is held above recent support so far. Selling momentum in yen was relatively weak. Dollar and Europeans were basically directionless as respect pairs were bounded in recent established range.

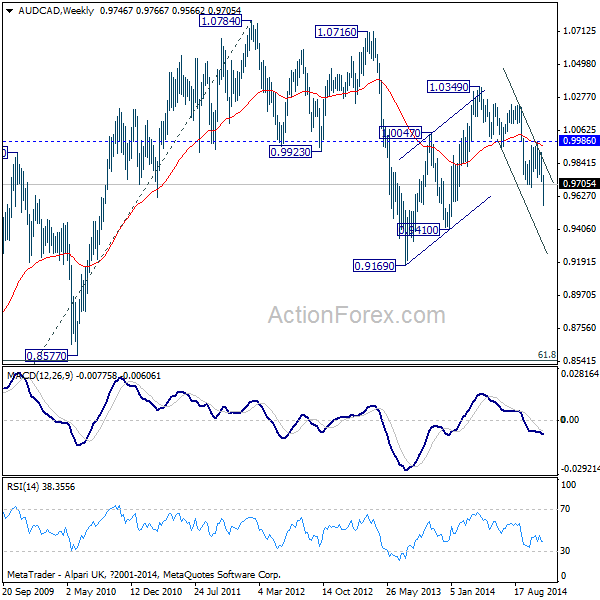

Comparing the commodity currencies, Aussie was clearly the weakest one recently. AUD/CAD dropped sharply to as low as 0.9566 last week before closing at 0.9705. The rejection from 55 weeks EMA is taken as a sign of weakness. The fall from 1.0349 should extend to 0.9410 next. Break will likely resume the whole decline from 1.0784 to 0.9169 support and below. In any case, outlook will stay bearish as long as 0.9986 resistance holds.

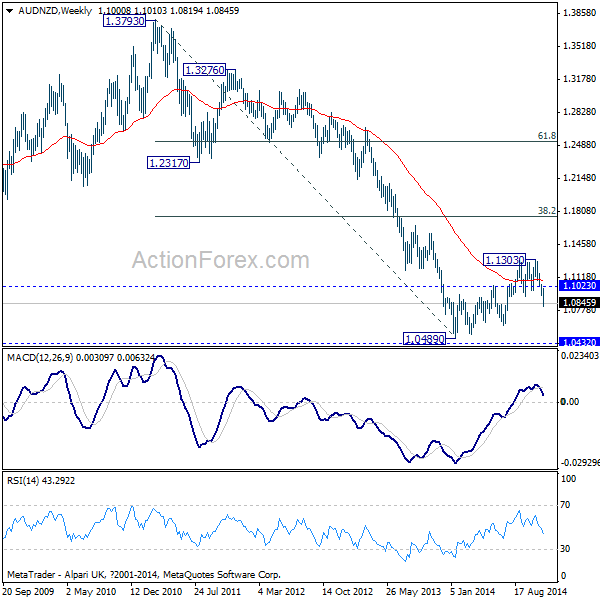

AUD/NZD's break of 1.0923 support last week suggested that corrective rebound from 1.0489 has completed at 1.1303 already, well below 38.2% retracement of 1.3793 to 1.0489. The down trend from 1.3793 might be resuming. Near term outlook stays bearish for a test on 1.0489 low and possibly further to 2005 low of 1.0432. We'd favor this bearish case as long as 1.1023 resistance holds.

Upside momentum in the dollar index remained unconvincing with bearish divergence condition in daily MACD. Despite edging higher to 88.44, there was no following buying in the greenback and the index was basically stuck in recently established range. While further rise could still be seen as long as 87.18 support holds, we'd point out again the dollar index would face important resistance zone of 88.70/89.62. Thus, risk of topping and reversal remains high. The lack of bullish momentum could also be seen as EUR/USD, GBP/USD, USD/CHF and even USD/JPY were bounded in recently established range last week.

Regarding trading strategy, while we're prefer to sell commodity currencies this week. The natural choice is selling them against dollar but we'd be cautious that that greenback might pull back further against European majors. Considering this, we'd buy USD/CAD on break of 1.1466 resistance, and buy EUR/AUD on break of 1.4704 resistance.