FX Brief:

Equity Brief:

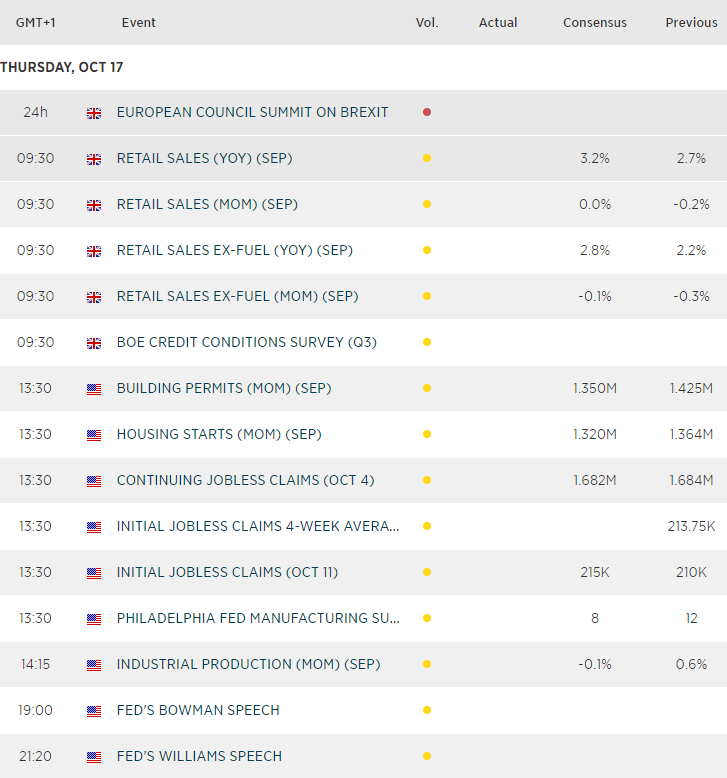

Up Next

- (MS) US building have surged since the Fed cut rates (up 15.5% YoY) and is considered a leading indicator to the broader economy, given it feeds into construction, mortgages and therefor consumer sentiment. It may not be a huge market mover, but something to consider as markets are heavily expecting further cuts from a Fed who don’t sound overly dovish. (KW) U.S Housing data for Sep. After a dismal U.S. Retail Sales print yesterday that has indicated a negative growth m/m, housing data will be monitor closely to gauge the health of another significant component of the U.S. economy. The consensus for Building Permits and Housing Starts are expected to come in at 1.35 million and 1.32 million respectively where the trend has been rising steadily over the past 2-months since Jul 2019.

- U.S. Industrial Production for Sep where consensus is expecting a decline of -0.1% m/m from 0.6% m/m/ recorded in Aug. A worst that expected print reinforces the view that manufacturing activities have continued to face downside pressure from trade tension, and the U.S. administration may see an urgency to get the partial trade deal with China signed off.