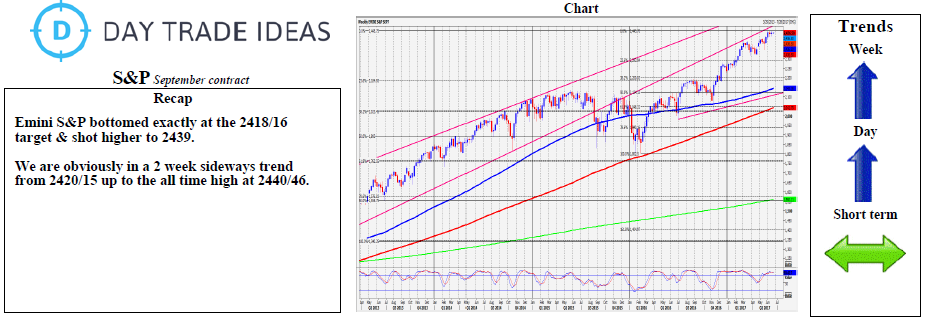

Emini S&P bounced well from 2418 back to 2431/29 and overran as far as 2439. Looks like we are in a sideways trend now for a while to ease overbought conditions...as is normal. Back below 2435 targets first support at 2430/29 and minor support at 2424 before the May high and good short term Fibonacci support at 2418/16 (which has held perfectly so far of course). Next downside target and Fibonacci support at 2408/06. A break below 2400 targets 2395 and perhaps as far as a buying opportunity at 2385/83.

Above 2436/39 sees prices head towards the double top at the new all time high at 2444/2445.75. If we do break higher unexpectedly, look for very strong resistance at 2457/59.