U.S. Consumer Staple stocks offer a compelling relative risk/reward opportunity. Understandably, the sector displayed softer performance over the past few months as broader equity markets advanced. The defensive nature of consumer staple stocks could attract buying interest this month, especially with volatility measures near extreme lows.

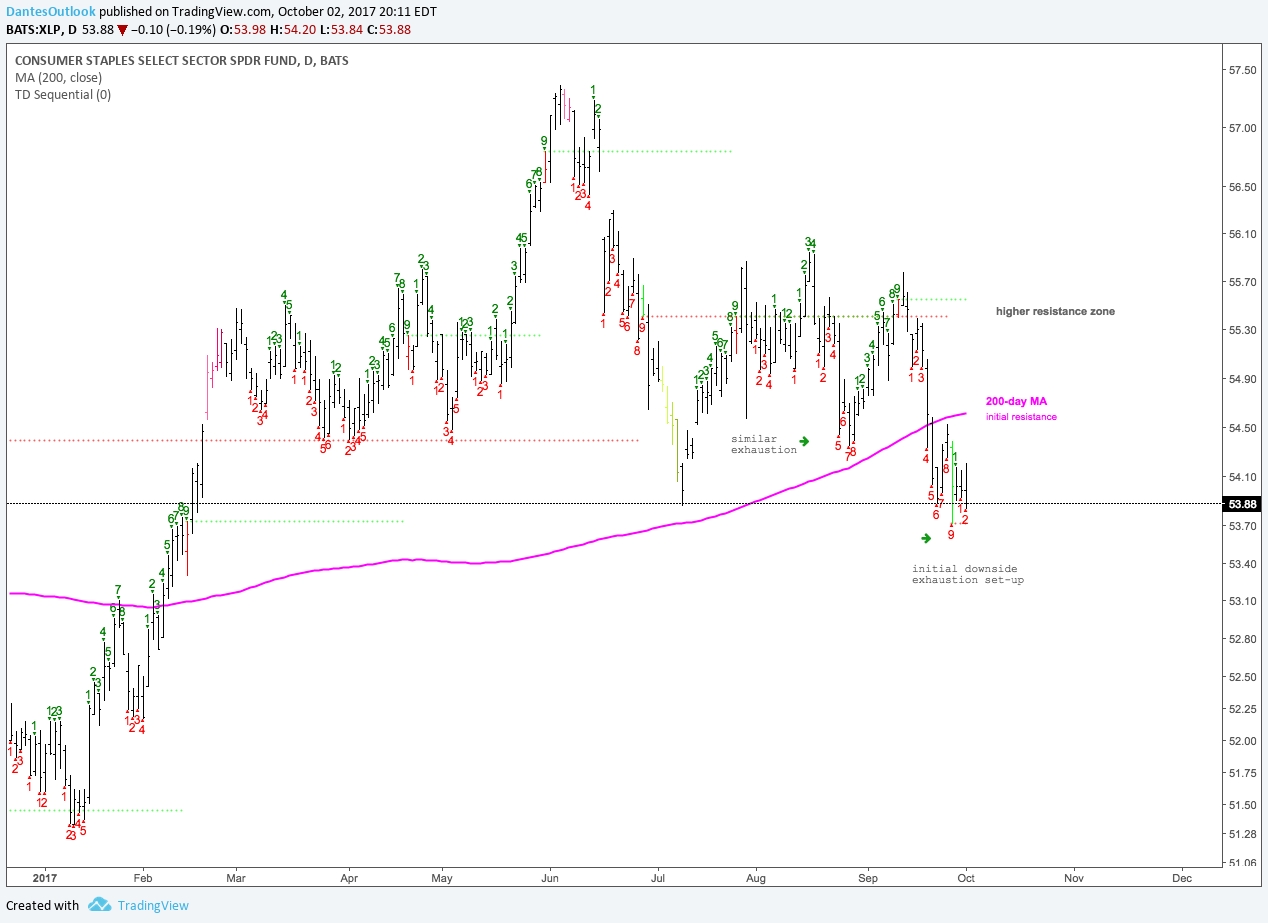

The Consumer Staples Select Sector SPDR (NYSE:XLP) broke below the 200-day moving average in September, which typically provides a bearish signal. However, an initial downside exhaustion set-up could create value opportunities into October. Initial resistance is around $54.50, with a stronger resistance zone near $55.30.

On a relative basis, consumer staples appear stretched compared to consumer discretionary stocks. A defensive rotation is likely given improving momentum, evidenced by higher highs in the MACD indicator despite lower highs in the relative price chart. The bullish divergence indicates a weaker bid for discretionary stocks vs. defensive staple stocks.

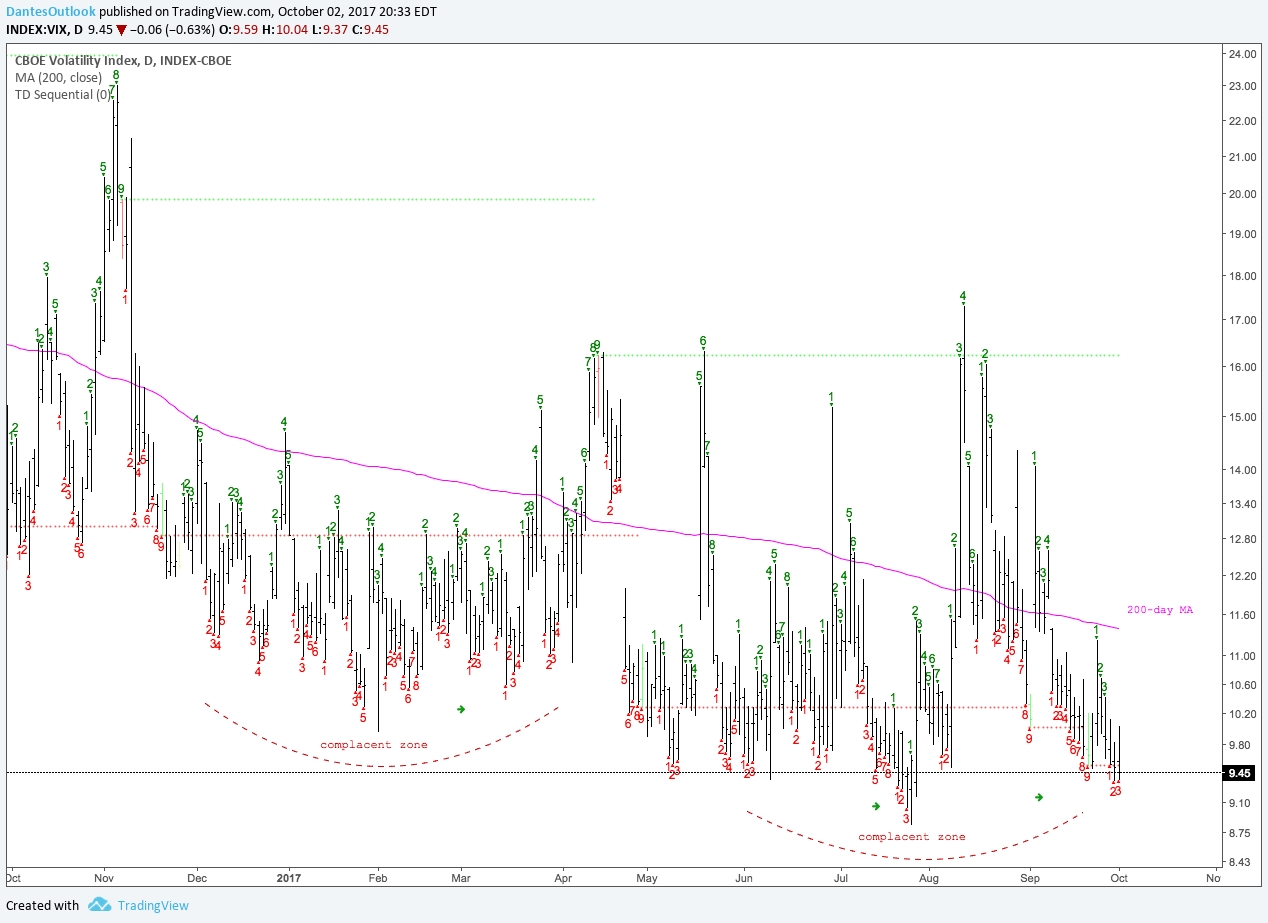

Volatility returned to a complacent zone below the 200-day moving average. While exhaustion set-up counts are less reliable on the CBOE Volatility Index (VIX), the pattern of support at current levels since May signals short-term caution.