One of my favourite dividends paying stock which also turns out to be undervalued at the moment is AT&T (NYSE:T).

AT&T is the world’s largest telecommunications company, the second largest provider of mobile telephone services and the largest provider of fixed telephone services in the U.S. The company evolved from the Bell Telephone Company which was founded by Alexander Graham Bell, the inventor of the first practical telephone.

In July the firm completed the acquisition of Time Warner thereby bringing together global media and entertainment leadership with AT&Ts strength in technology. Although the acquisition was approved by the court, government attorneys have appealed against this on the basis that such agreement would harm competition and consumers. The federal judge has already rejected the first appeal and I don’t think the decision can be reversed now.

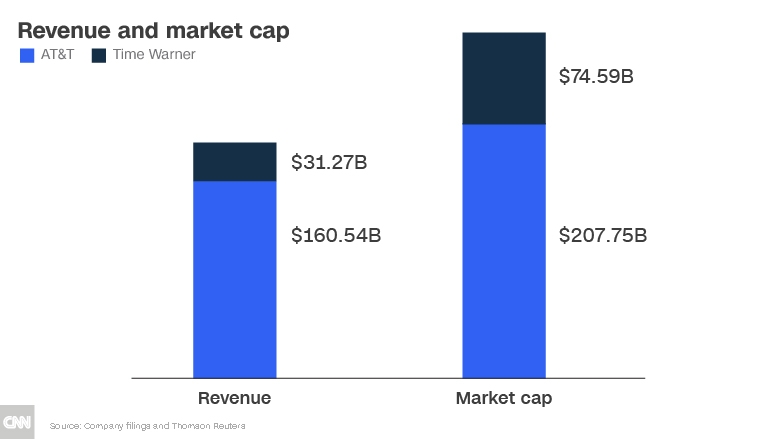

The combined firms posted nearly $192 billion in sales last year, and are worth roughly $282 billion on the stock market. That would have made it the seventh biggest American company by revenue last year, and it will have the thirteenth biggest market valuation. (see bar chart below).

Let’s have a look at some fundamental numbers now:

Dividend: 6%

PE ratio of 6x lower than industry peers of 15x

Positive free cash flow and on the rise

Revenues on the rise

Positive net income

If we look at the price, this has been hovering at the area of $31-$35 region for a number of years (with the exception being 2016 when it reached a high of $43 which retraced back over time).

What this tells us here is that the stock can be considered quite a ‘boring’ investment with prices finding a strong support for years now and thus we don’t expect a huge level of volatility.

Should the price remain in the same area, we expect a very good return with dividends level of 6%, which most probably would rise once cash injection from the TimeWarner deal start working out.

The stock is also in my opinion undervalued and hence it provides a further opportunity for a total return (growth + dividend) investment in a well-established firm that continues to generate good revenues and profits.