Highlighting new opportunities

A proposed new Japanese regulatory framework to accelerate the development of regenerative medicines could be significant for companies such as Athersys. This could substantially reduce the time and cost of developing stem cell therapies, with as little as one clinical study required to demonstrate safety and meaningful therapeutic benefit, in order to gain provisional approval and reimbursement in Japan. Athersys is assessing how best to exploit this potential opportunity for its allogeneic stem cell product, MultiStem, which is core to its investment case.

Accelerated pathway proposed

With Japan historically lagging the US and Europe in the development and approval of new medicines, the government is targeting stem cell therapies as a sector in which to reverse this trend. The proposed pathway, or Regenerative Medicine Law, which has been approved by the Japanese legislature (Diet), would require just one well conducted study (in a relatively small number of patients to determine a ‘probable’ efficacy benefit) to gain provisional approval. Further studies and post-market surveillance would be required for final approval, but a stem cell product could reach the market in three years, rather than six to 10 years currently.

Implications for Athersys

MultiStem is undergoing two Phase II studies, in ulcerative colitis (conducted by Pfizer) and ischaemic stroke. The outcomes of these trials in 2014 are key to determining the near-term prospects of MultiStem, but extensive Phase III studies would typically be required for approval in the US and Europe. The prospect of conducting a modest single trial in Japan with MultiStem, ideally in a major unmet need such as stroke (assuming positive Phase II data from the current study) to gain approval is attractive. The regulatory pathway in Japan still needs to be enacted, possibly in 2014, and development partners would likely be required, but it certainly presents an attractive opportunity for stem cell companies like Athersys.

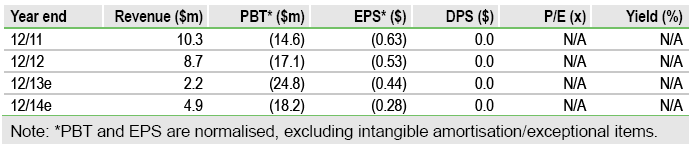

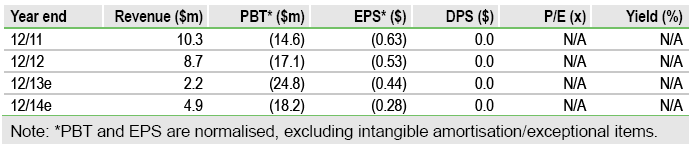

Valuation: Maintained at $205m, or $3.40 per share

Q313 results were in line with our model. The ulcerative colitis study is on track to report headline results by the end of Q114, although the outcome of the stroke trial is now slated for ‘mid-2014’ (previously Q214). Recruitment into the stroke study is accelerating, with the recent addition of UK sites (currently four, increasing to 12) helping to boost numbers. The outcomes of these studies are key catalysts that could re-rate the stock, which we currently value at $205m, or $3.40 per share, based on a sum-of-the-parts DCF valuation. This includes end-Q313 net cash of $18m, which can be supplemented by drawing-down on a two-year, $25m equity facility with Aspire Capital (full draw-down could result in 20% dilution).

To Read the Entire Report Please Click on the pdf File Below.

A proposed new Japanese regulatory framework to accelerate the development of regenerative medicines could be significant for companies such as Athersys. This could substantially reduce the time and cost of developing stem cell therapies, with as little as one clinical study required to demonstrate safety and meaningful therapeutic benefit, in order to gain provisional approval and reimbursement in Japan. Athersys is assessing how best to exploit this potential opportunity for its allogeneic stem cell product, MultiStem, which is core to its investment case.

Accelerated pathway proposed

With Japan historically lagging the US and Europe in the development and approval of new medicines, the government is targeting stem cell therapies as a sector in which to reverse this trend. The proposed pathway, or Regenerative Medicine Law, which has been approved by the Japanese legislature (Diet), would require just one well conducted study (in a relatively small number of patients to determine a ‘probable’ efficacy benefit) to gain provisional approval. Further studies and post-market surveillance would be required for final approval, but a stem cell product could reach the market in three years, rather than six to 10 years currently.

Implications for Athersys

MultiStem is undergoing two Phase II studies, in ulcerative colitis (conducted by Pfizer) and ischaemic stroke. The outcomes of these trials in 2014 are key to determining the near-term prospects of MultiStem, but extensive Phase III studies would typically be required for approval in the US and Europe. The prospect of conducting a modest single trial in Japan with MultiStem, ideally in a major unmet need such as stroke (assuming positive Phase II data from the current study) to gain approval is attractive. The regulatory pathway in Japan still needs to be enacted, possibly in 2014, and development partners would likely be required, but it certainly presents an attractive opportunity for stem cell companies like Athersys.

Valuation: Maintained at $205m, or $3.40 per share

Q313 results were in line with our model. The ulcerative colitis study is on track to report headline results by the end of Q114, although the outcome of the stroke trial is now slated for ‘mid-2014’ (previously Q214). Recruitment into the stroke study is accelerating, with the recent addition of UK sites (currently four, increasing to 12) helping to boost numbers. The outcomes of these studies are key catalysts that could re-rate the stock, which we currently value at $205m, or $3.40 per share, based on a sum-of-the-parts DCF valuation. This includes end-Q313 net cash of $18m, which can be supplemented by drawing-down on a two-year, $25m equity facility with Aspire Capital (full draw-down could result in 20% dilution).

To Read the Entire Report Please Click on the pdf File Below.