AT&T Inc. (NYSE:T) just released its second quarter fiscal 2017 financial results, posting adjusted earnings of 79 cents per share and revenues of $39.8 billion. Currently, T is a Zacks Rank #4 (Sell), and is up 3% to $37.30 per share in trading shortly after its earnings report was released.

AT&T:

Beat earnings estimates. The company posted adjusted earnings of 79 cents per share, beating the Zacks Consensus Estimate of 74 cents per share. This number excludes 16 cents from non-recurring items. Net income came in at $3.9 billion.

Matched revenue estimates. The company saw consolidated revenue figures of $39.8 billion, matching our consensus estimate of $39.8 billion but declining 1.8% year-over-year.

AT&T reported growing operating income margin of 30.4%, with record high EBITDA margins that included best-ever wireless service margin of 50.4%. Operating income was $7.3 billion for the quarter.

The company reported 2.8 million wireless net adds, 2.3 million of which came from the U.S., which was driven by connected devices (prepaid and postpaid). 476,000 net adds were logged from Mexico.

AT&T’s U.S. wireless segment also reported its best-ever postpaid phone churn of 0.79%. Total postpaid churn was 1.01%

AT&T maintains its full-year guidance.

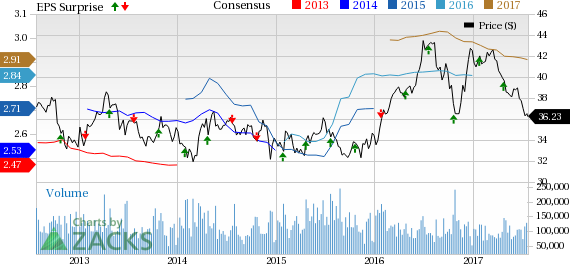

Here’s a graph that looks at AT&T’s price, consensus, and EPS surprise:

AT&T Inc. is a premier telecom company. Its subsidiaries and affiliates, AT&T operating companies, are the providers of AT&T services in the U.S. and around the world. Among their offerings are the world's most advanced IP-based business communications services, the nation's fastest 3G network and the best wireless coverage worldwide, and the nation's leading high speed Internet access and voice services. As part of their three-screen integration strategy, AT&T operating companies are expanding their TV entertainment offerings.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without.

Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future. Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

AT&T Inc. (T): Free Stock Analysis Report

Original post

Zacks Investment Research