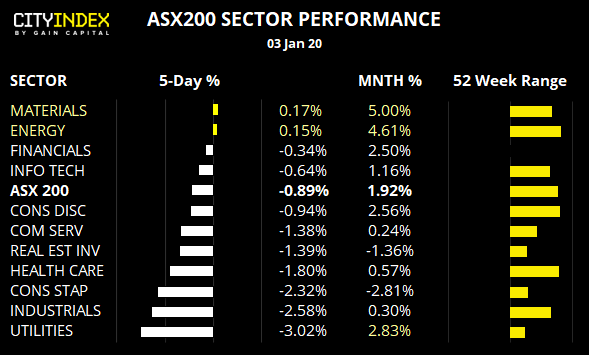

The energy sector trades the closest to its 52-week high, and we could expect oil stocks to remain supported and perhaps break to new highs following the US attack in the Middle East earlier today. Indeed, the sector itself has formed a prominent swing low and higher lows on Monday, and appears set to head back to 2019’s high.Consumer discretionary has also remained resilient and shows potential to form a symmetrical triangle, just below the December highs.Financials remain in the doldrums, and trades effectively around the same level it did one year ago. Only this time it remains in a downtrend and beneath its 200-day eMA.

Fortescue Metals Group CFD (FMG): Up over 210% since its 2018 low, Fortescue is forming a potential bull flag. It’s encouraging to see Monday’s bullish bar respect gap support and the 20-day eMA, although a slight shame today’s gap higher ended with a bearish close. Still, as long as support above 10.50 holds, we’re looking for it to break to new highs.

Bias remains bullish above 10.50. A break beneath here warns of a deeper correction against the dominant trend and will be placed onto the back burner until further notice.A break above 11 – 11.10 assumes bullish continuation. Bulls can use an open upside target.

Bapcor Ltd CFD (BAP): The trend reversed in November, and a lower high has formed around 6.60 and prices are now considering a break of 6.29 support. The 20-day eMA has recently crossed beneath the 200-day eMA and they are capping as resistance, adds extra weight to the argument a swing high has formed.

Bias remains bearish below 6.60, and for a break beneath 6.29.Initial target are the lows around 6.00 but, if it truly has topped, we could see it eventually head for the lows around 5.40 if the bearish trend remains intact.

Boral Ltd CFD (BLD): Not the prettiest of chart, but it shows potential for range expansion around 4.40 support. One way or another).

Prices trade in a tight range between 4.40 – 4.60 with the 20-day eMA capping as resistance. Given the longer-term trend is bearish, along with the preceding move into its consolidation, the bias is for a break lower. However, a clear break above 4.60 assumes a counter-trend move is on the way.

Bias is for a bearish break below 4.40A measured move from the 5.20 high projects an approximate target around 4.00A clear break above 4.60 assumes a correction is underway, which counter-trend traders could explore.Original Post