- ASX 200 SPI futures break key support, eyeing further downside if 7796 gives way.

- AUD/JPY tests March 4 low, with a break below 91.86 opening room for 90.27.

- RSI signals oversold conditions, raising the risk of a countertrend squeeze.

Australia’s S&P/ASX 200 and AUD/JPY are both regarded as economically sensitive markets, heavily exposed to shifts in investor risk appetite. So, it’s hardly a shocker that both are under the pump in the current macro minefield. U.S. recession fears have slammed into stretched asset valuations, triggering a sharp unwind from levels seen just weeks ago.

While price and momentum signals continue to favour downside in S&P/ASX 200 Futures and AUD/JPY, traders need to be alert to the risk of sharp countertrend rallies with both sitting in oversold territory. Short-covering and opportunistic dip-buying could see abrupt squeezes, especially if sentiment stabilises. Watch for obvious reversal signals to guide your decisions.

ASX 200 Bears Eye Larger Unwind

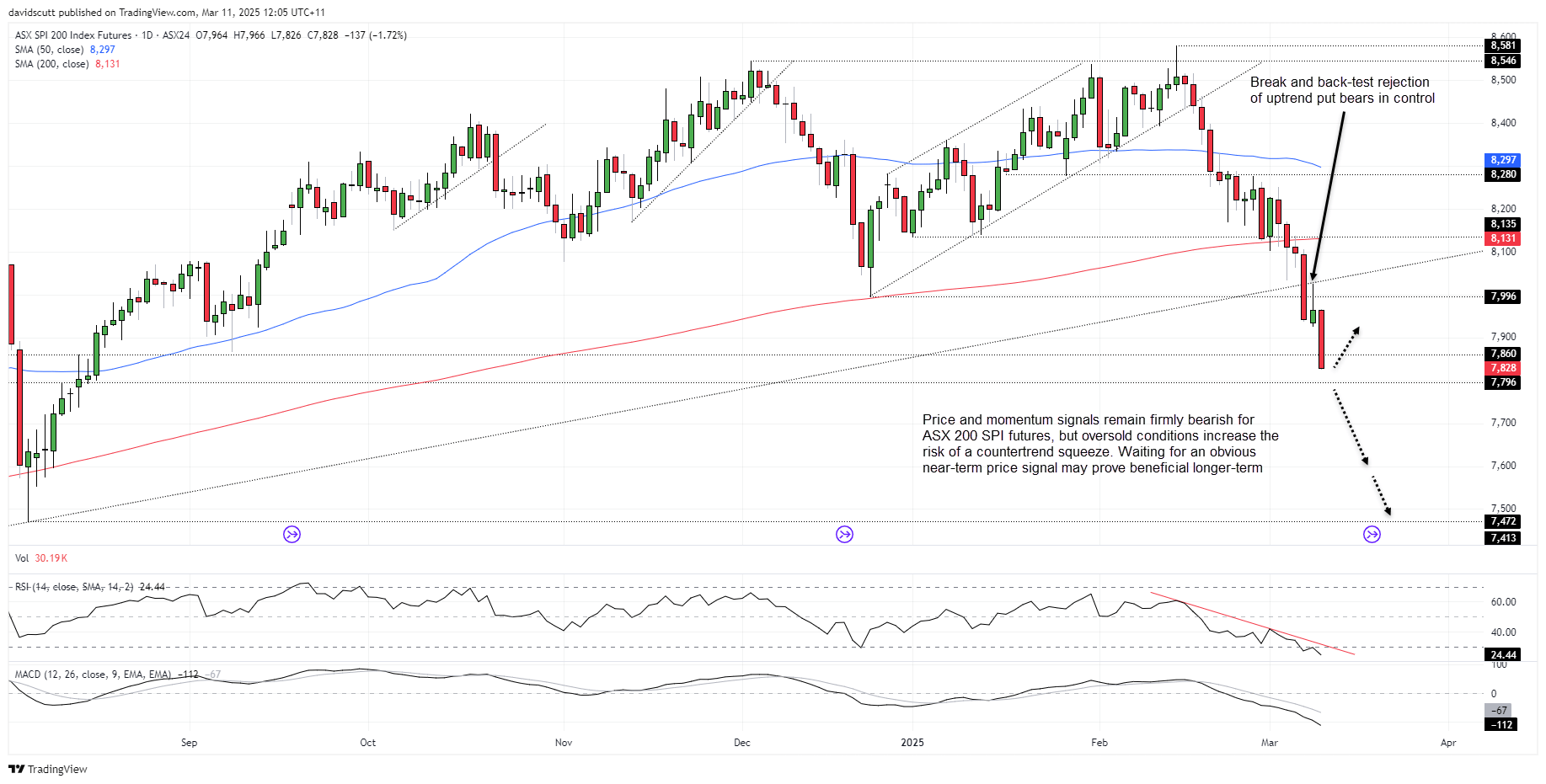

Bears tore through the October 2022 uptrend in ASX 200 SPI futures like a hot knife through butter, slicing through with ease after disposing of the 200DMA days earlier. A half-hearted attempt to reclaim the uptrend on Monday was swiftly rejected, paving the way for another exaggerated decline that kicked off in the overnight session and has spilled into Tuesday.

Source: TradingView

The price is now wedged between minor supports at 7860 and 7796—the latter being the last notable level before 7600, where buyers stepped in throughout much of 2024. RSI (14) and MACD are flashing bearish signals, but with RSI now oversold on the daily timeframe, the odds of a squeeze are creeping higher. A bit of patience may go a long way here.

If we were to see a sustained push beneath 7796, traders could look to sell the bread, targeting a move to 7600. A stop could be placed above 7796 for protection against reversal.

Alternatively, if 7796 were to hold, look for a bottoming signal on timeframes of one day or less. If one were to present itself, it could allow for longs to be established, looking for a countertrend squeeze. Monday’s low of 7925 screens is one possible target. A stop below 7796 would protect against a continuation of the bearish trend.

AUD/JPY Tests March Swing Low

Source: TradingView

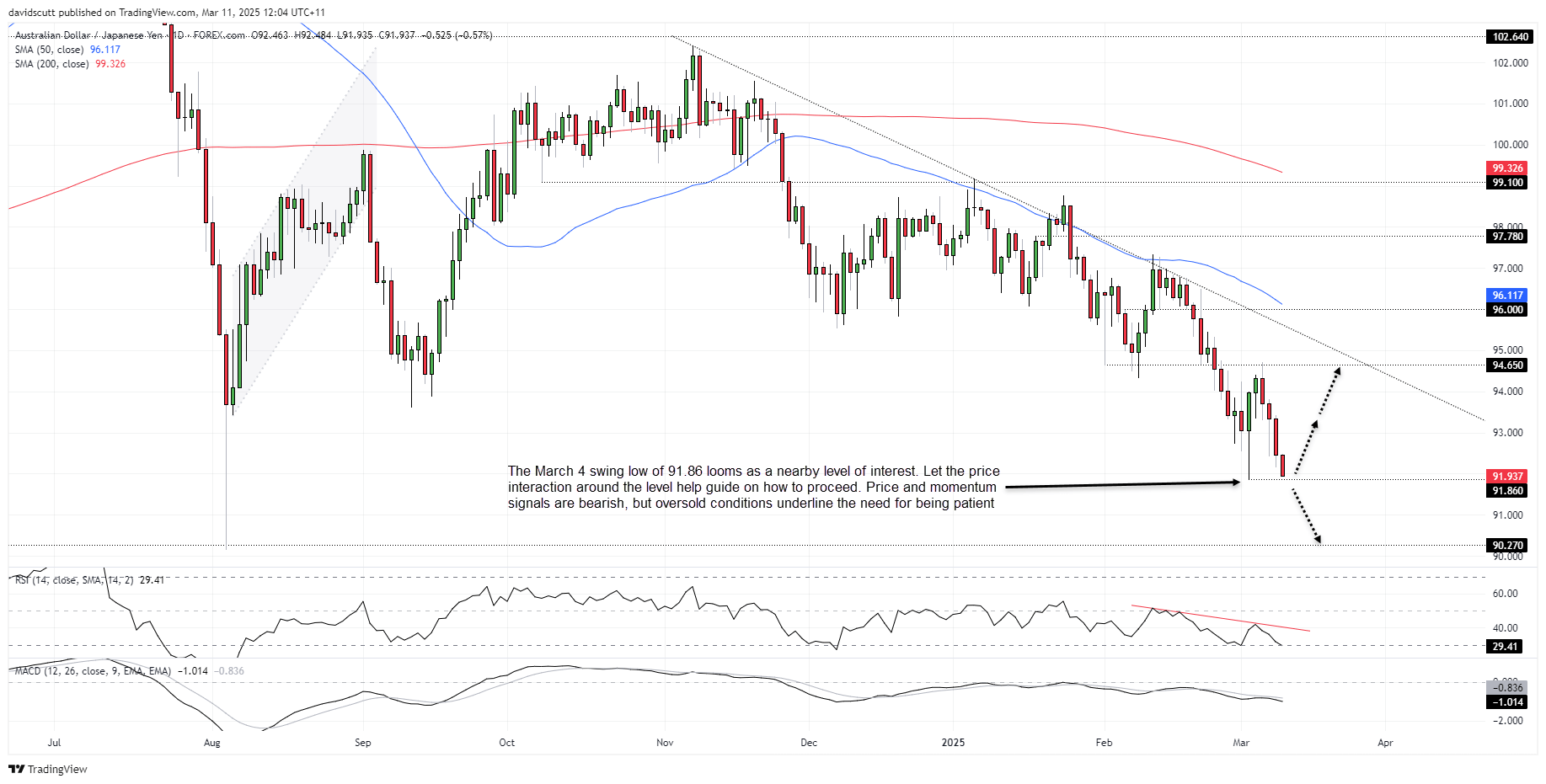

AUD/JPY is testing the March 4 low of 91.86 midway through the Asian session, continuing the rapid unwind that began after sellers shut the door at 94.65, leaving behind a key bearish reversal candle. The latest drawdown has shoved RSI (14) into oversold territory on the daily, though both it and MACD remain firmly bearish. While a squeeze risk is building, that alone isn’t a good enough reason to jump ship without an obvious bottoming signal.

A sustained break of 91.86 would create a bearish setup, allowing for shorts to be established below with a stop above for protection. 90.27 screens as one potential target.

If 91.86 were to continue to hold, traders could flip the setup, establishing longs above with a stop beneath for protection. Some resistance may be encountered around 93.40, although 94.65 comes across as a more appropriate target.