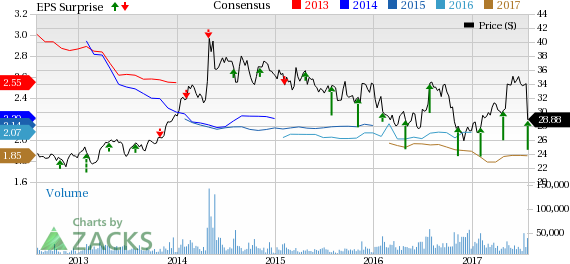

AstraZeneca PLC (NYSE:AZN) reported second-quarter 2017 core earnings of 87 cents per American Depositary Share, which comfortably beat the Zacks Consensus Estimate of 41 cents. Core earnings also increased 6% year over year at constant currency rates (CER).

Shares of AstraZeneca were down almost 15% on Thursday, reflecting disappointing results from a phase III study evaluating Imfinzi combination therapy for first-line lung cancer. However, AstraZeneca’s shares have gained 5.7% so far this year, which compares unfavorably with the industry’s increase of 9.9%.

Concurrent with its earnings release, the company announced initial results from phase III MYSTIC study. The study showed that Imfinzi in combination with tremelimumab did not improve progression-free survival (PFS) in first-line non-small cell lung cancer (NSCLC) when compared to platinum-based chemotherapy.

Core earnings increased due to continued focus on cost control and higher other income and expense.

Total revenue declined 8% at CER to $5.05 billion in the reported quarter. Revenues were in line with the Zacks Consensus Estimate.

Among the key growth platforms (representing 70% of total revenue), Emerging Markets and New Cardiovascular & Metabolic Diseases (CVMD), New Oncology and Japan performed well in the quarter. However, Respiratory sales declined in the reported quarter.

Revenue in Detail

Product sales declined 8% in the quarter to $4.94 billion and externalization revenues fell 15% to $111 million. Loss of exclusivity for Crestor and Seroquel XR and lower Symbicort sales hurt product sales in the quarter.

U.S. product sales plummeted 22% to $1.53 billion, primarily due to the entry of generic versions of Crestor and Seroquel XR and pricing pressure for Symbicort in the U.S. European markets witnessed a 6% decline in sales to $1.14 billion. Revenues from Emerging Markets were, however, up 2% to $1.44 billion in the reported quarter primarily on the back of strong growth in China.

Performance of Key Drugs

Symbicort sales were down 11% to $706 million in the quarter due to pricing headwinds in the U.S. and competitive dynamics in Europe.

Nexium recorded sales of $595 million (up 7%), with the U.S. contributing $203 million (up 25%) and Europe accounting for $59 million (down 9%). However, Crestor sales declined 38% to $560 million, with the U.S. accounting for $41 million (down 89%) and Europe contributing $167 million (down 24%). U.S. and Europe sales declined sharply in the quarter as multiple generic versions of the drug entered the market.

Products that recorded growth in the quarter include Farxiga/Forxiga (up 20% to $250 million), Daliresp/Daxas (up 20% to $48 million), Faslodex (up 18% to $248 million), Iressa (up 2% to $137 million) and Lynparza (up 11% to $59 million).

Concurrent with its earnings release, the company announced an agreement with Merck & Co., Inc. (NYSE:MRK) in Jul 2017 to develop Lynparza along with Keytruda. Tagrisso, launched in 2015, recorded sales of $232 million, up 35.7% sequentially. The upside was driven by strong U.S. and Japan sales due to strong patient demand trends and successful commercial launches across multiple markets. The company also announced on the same day data from phase III FLAURA study evaluating Tagrisso, which demonstrated statistically-significant improvement inPFS in NSCLC patients. Another new medicine, Movantik/Moventig, recorded 39% higher sales in the quarter to reach $32 million.

Brilinta/Brilique sales were $272 million in the reported quarter, up 29% year over year. Brilinta maintained its leadership position in the U.S. branded oral anti-platelet market. In Europe and China, Brilinta continued to display an impressive performance.

Recently launched drugs in the U.S., Imfinzi (bladder cancer) and Bevespi (COPD) recorded sales of $1 million and $4 million, respectively in the reported quarter.

Other Details

AstraZeneca’s core gross margin increased 100 basis points (bps) to 82.3%. Core selling, general and administrative (SG&A) expenses decreased 7% to $1.9 billion due to integration of all shared services and outsourcing activities.

During the quarter, core research and development (R&D) expenses decreased 4% to $1.28 billion.

2017 Outlook Reiterated

AstraZeneca continues to expect total revenue to decline in the low-to-mid single-digit percentage range in 2017. The company also maintained its guidance for core earnings in 2017, which are expected to decline in the low-to-mid teen percentage. Based on the average exchange rates during the year, currency movements are expected to adversely impact the top line in low single-digit percentage but minimally impact core earnings per share.

While adjusted R&D costs are expected to be broadly in line with the 2016 levels, the company anticipates a further reduction in SG&A costs owing to the evolving structure of its business.

Zacks Rank & Key Picks

AstraZeneca currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the health care sector are Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) and Aduro Biotech, Inc. (NASDAQ:ADRO) . Each of these stock carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arena Pharma’ loss per share estimates narrowed from $2.94 to $2.86 for 2017 over the last 60 days. The company delivered positive surprises in three of the four trailing quarters with an average beat of 73.46%. The company is expected to report on Aug 14.

Aduro’s loss per share estimates narrowed from $1.63 to $1.46 for 2017, over the last 60 days. The company delivered positive earnings surprises in two of the four trailing quarters with an average beat of 36.28%. The company is expected to report on Aug 2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Astrazeneca PLC (AZN): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Arena Pharmaceuticals, Inc. (ARNA): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research