The market quickly pivoted from yesterday’s doomsday scenario to refocus on what President Elect Trump means for both the global and US economy. Of course, this will take some time to understand the implications, especially in the areas of trade, globalization and the Federal Reserve.

Clearly, yesterday’s doomsday scenario created a knee-jerk sell-off in equity markets, but a far more calculated investor view has emerged. Forex traders are busy ironing out the number of US dollar positive signals from this new epoch in US politics.

One reason the market was able to rebound so quickly was its position size, as outright USD risk was minimal. The leveraged equity community positioning was light, which can partially explain the elasticity and vigour behind last night’s market rebound. By all appearances this morning, investors were busy bargain shopping, but I must stress that I would be underselling the fact if I suggested we are entering very uncertain times.

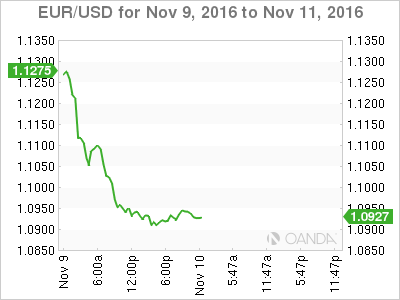

USD Rebound

The USD rebound occurred after President-Elect Trump calmed investors nerves during his post-election “unity address”. Forex traders quickly pivoted to the potential dollar impact of his policies. While both candidates suggested a significant fiscal infrastructure spend, the Republican sweep of the House and Senate, as well as the presidency, gives the GOP the extraordinary power to set these wheels in motion virtually unchallenged.

A “sweep” would also suggest that the HIA2 tax reform would be quickly tabled. The massive size of these repatriated offshore funds during the soon to be proposed “tax holiday” would, at minimum, support the USD on the margin, but would more likely provide a significant USD dollar boost in concert with supportive interest rate differential provided the Federal Reserve Board stays on track.

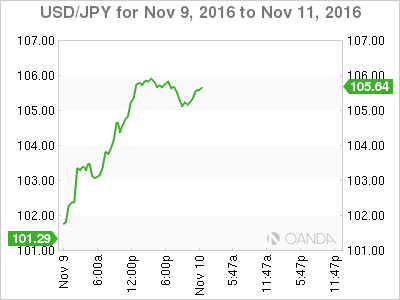

BOJ Governor Kuroda is likely breathing a sigh of relief with USD/JPY trading close to the 106 level this morning after plumbing the 101 depths during yesterday’s election inspired USD knee-jerk. Look for risk and US Bond Yield to remain the dominant drivers. The 106 level should provide some reasonable exporter resistance, but I believe fundamental interest rate differentials will be the ultimate decider on this trade.

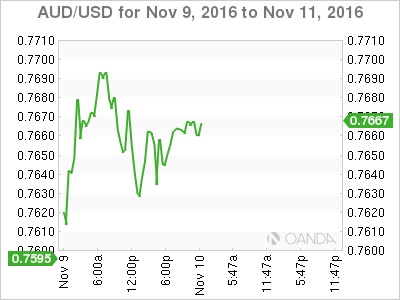

Australian dollar Aftermath

After an epic trading day on G-10 currencies, the AUD has found itself a temporary victim of broader US dollar strength and unhinged by the apparent global shift away from globalisation.

While a cloud of uncertainty is engulfing markets, the uncertainty over the univocal shift in US foreign policy, especially those matters dealing with trade are weighing on US global trade partners. The possibility that trade wars could accelerate in North America around a move to rewrite NAFTA, a major shift by the US for less globalisation would weigh negatively on China, and by default Australia, in the face of less trade and slow growth globally.

While commodity prices rode roller coaster yesterday, this morning’s firm copper and iron ore prices would suggest the hard commodity markets are not buying into the global growth slowdown argument, which should provide support for the Aussie. In my view, commodity markets are viewing the Trump effect in the rearview mirror.

I would also expect the AUD to benefit from resurgent risk appetite, yet traders will be extremely guarded on their positions, awaiting further clarity from both the Federal Reserve, and the RBA, on their post-US election policy stance. Particularly, the RBA view of what lies in store for global trade in this new era of US politics.

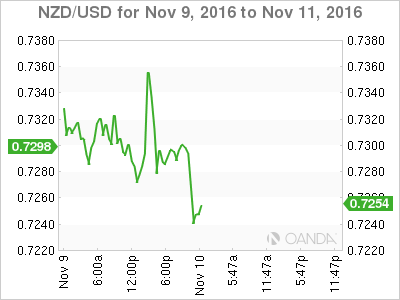

Not unexpectedly the RBNZ cut interest rates but definitively removed their easing bias, which saw the KiwI initial pop higher only to be overwhelmed by broader US dollar strength and heightened risk surrounding the lack of clarity on the New US administration trade policies.

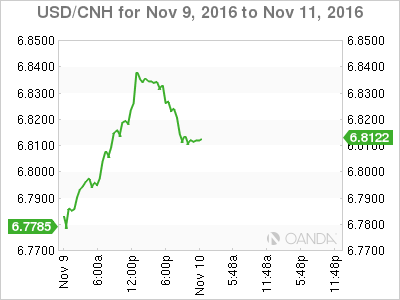

The move above 6.80 USD/CNH was a reflection of the broader US dollar rally, but to a degree, factored a level of uncertainty over global trade. A move to higher US bond yields, with US10Y trading above 2%, will bring reassessment of emerging market (EM) asset rotation, which is a primary driver for APAC risk sentiment in 2016. Expect further Yuan and regional currency weakness over the short term, especially for currencies tied closely to US trade, such as the yuan, won and Taiwan dollar.

Federal Reserve

It is hard to assume that the Fed will put a December rate hike on hold given the dramatic rebound in global risk overnight, but of more concern to markets will be an affirmation that Yellen may resign. Given the criticism levied on the Fed policies from the Trump camp during the election run up, the Fed remains a real wild card in this new market calculus.