Astec Industries Inc. (NASDAQ:ASTE) has been performing well so far this year with the stock gaining on the back of upbeat results and favorable markets. The stock had suffered a setback in 2018 primarily owing to the incremental input costs as a result of the imposition of tariffs on steel imports.

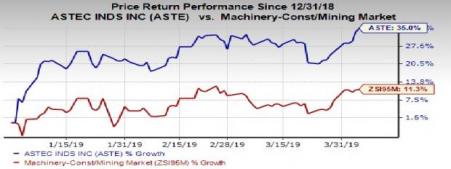

Shares of the company had tanked 48% in 2018, compared with the industry’s decline of 21%. However, the stock staged a comeback this year, having rallied 35% year to date, outperforming the industry’s growth of 11%.

What Weighed on the Stock in 2018?

The announcement of tariffs on steel imports into the United States last year was a big blow to the manufacturing sector. Given that steel is one of the primary raw materials, every manufacturing company bore the brunt of rising steel prices owing to the tariffs, and Astec was no exception. Further, a stronger dollar impacted Astec’s international sales.

Factors Favoring the Stock in 2019

The stock has recovered so far this year driven by Astec’s upbeat guidance for 2019 and solid order activity. The company’s focus on generating savings from strategic sourcing improvement is also working in its favor.

Astec reported adjusted earnings per share of $2.92 in 2018, up 17% from the prior year. Adjusted sales grew 6% year over year to $1.25 billion. For 2019, sales are expected to grow between 4% and 7% from 2018. Earnings per share for the year are anticipated to range in between $3.00 and $3.50. The mid-point of the guidance represents an annual growth of 11%. The Zacks Consensus Estimate for earnings per share is currently pegged at $3.22, reflecting year-over-year growth of 10.3%. While the consensus estimates for revenues is pegged at $1.29 billion, a projected growth of 10.5% from 2017.

Favorable end markets bode well for Astec. The company is witnessing strong order intake in the Aggregate and Mining Group as well as in the Energy Group. Higher infrastructure spending and favorable commodity prices are likely drive demand in mining industry. The current long-term Highway Bill, steady state in local government infrastructure spending and improving construction markets is likely to bolster revenues. Astec remains well poised in the long term backed by the global population growth, increased urbanization and the need to repair the ageing infrastructure.

The company is analyzing all areas of its business for opportunities of operational improvement. Astec anticipates savings from strategic sourcing improvement to add approximately 2% to gross margin in 2019 and free up $25 million in cash as a result of better inventory management.

Astec is pursuing a potential sale of the Georgia pellet plant. The company had forayed into the wood pellet industry in 2012 in order to diversify into new areas at a time when road building and aggregate industries were at a low. However, it was a prudent move to exit from pellet industry owing to size, complexity and time frames associated with the fabrication, installation and commissioning of wood pellet plants.

Astec decided to discontinue operations at its subsidiary in Germany, Astec Mobile Machinery, as it did not generate expected results. The company reported a restructuring charge of $1.8 million in the fourth quarter and expects the wind down of this business to be completed in 2019. Going forward, this will lead to an annual saving of $1 million. Astec has also consolidated its Dillman operation into Astec Incorporated. Driven by these initiatives, the infrastructure group is likely to bolster growth, moving forward.

Astec already has a dominant share of the asphalt plant market in North America and plans to introduce two new entry-level asphalt plants in 2019 that are designed to better meet the needs of the international market and improve competitiveness. Additionally, it will be introducing new paving equipment for both the domestic and international markets. The launch of new products from this group in 2019 will drive the segment’s revenues.

Zacks Rank and Stocks to Consider

Astec currently carries a Zacks Rank #3 (Hold).

Meanwhile, investors interested in the Industrial Products sector can consider better-ranked players like Mueller Industries, Inc. (NYSE:MLI) , Sun Hydraulics Corporation (NASDAQ:SNHY) and Zebra Technologies Corporation (NASDAQ:ZBRA) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Mueller Industries has expected earnings growth rate of 2.2% for 2019. The company’s shares have rallied 38% year to date.

Sun Hydraulics Corporation has projected earnings growth rate of 13% for the current year. The stock has appreciated 51% year to date.

Zebra Technologieshas estimated earnings growth rate of 13.4% for the ongoing year. The company’s shares have gained 37% year to date.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Astec Industries, Inc. (ASTE): Free Stock Analysis Report

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

Zebra Technologies Corporation (ZBRA): Free Stock Analysis Report

Mueller Industries, Inc. (MLI): Free Stock Analysis Report

Original post