Astec Industries, Inc. (NASDAQ:) posted earnings of 62 cents per share in second-quarter 2017, down 22% year over year and also short of the Zacks Consensus Estimate of 80 cents.

The maker of building, paving and mining equipment, posted total revenue of $302 million, rising 2.6% from the $294 million reported in the year-ago quarter. Revenues also missed the Zacks Consensus Estimate of $315 million.

Astec’s domestic sales dipped 2% year over year to $237 million. However, international sales increased 25% year over year to $65 million. Increase in sales in Russia, Europe and Canada were offset by decreases in South America and Africa.

Cost of sales was up 7% year over year to $236 million. Gross profit was at $65.5 million, an 11% decline from $73.4 million reported in the year-ago quarter. Gross margin contracted 330 basis points (bps) year over year to 21.7%. Gross margins were impacted by lower-than-expected margins due to the installation of pellet plant equipment as well as lower margins on several new products. New equipment traditionally carries a lower margin through the early part of its life cycle due to the refining and the manufacturing process.

Selling, general, administrative and engineering expenses went down 2% year over year to $44.2 million. Income from operations plunged 25% year over year to $21.3 million. Operating margin contracted 250 bps year over year to 7.1%.

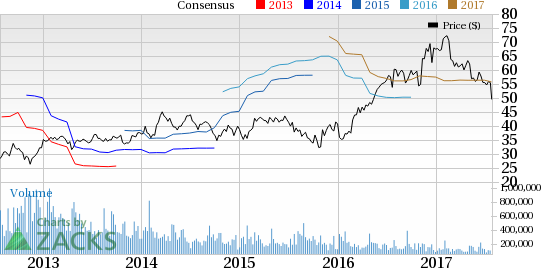

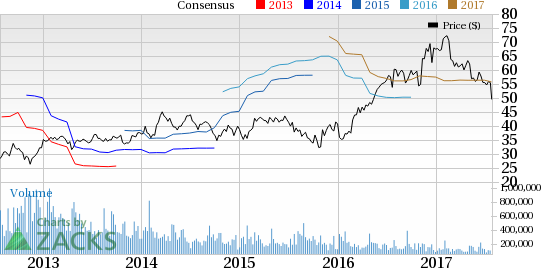

Astec Industries, Inc. Price, Consensus and EPS Surprise

Astec Industries, Inc. Price, Consensus and EPS Surprise | Astec Industries, Inc. Quote

Segment Performance

Revenues for the Infrastructure Group segment declined 6.1% to $143 million from $152 million in the year-ago quarter. Segment profit plunged 49.7% year over year to $9.9 million.

Total revenue for the Aggregate and Mining Group segment increased 8% year over year to $107 million. Profit improved 3.8% year over year to $11.4 million.

The Energy Group segment’s total revenue increased 20.7% to $51.7 million from $42.8 million in second-quarter 2016. The segment reported operating profit of $3.2 million, up from $2.6 million in the year-ago quarter.

Financial Position

Astec reported cash and cash equivalents of $52 million at the end of second-quarter 2017, down from $68 million as of Jun 30, 2016. Receivables increased to $149 million as of Jun 30, 201, from $127.5 million as of Jun 30, 2016. Inventories went up to $381 million as of Jun 30, 2017, from $379.5 million as of Jun 30, 2016.

Astec’s total backlog dipped 5% to $352 million at the end of the second quarter from $371 million at second-quarter 2016 end. Backlog improved in the Aggregate and Mining Group and Energy group a respective 55.2% and 9.5%. However, backlog in the Infrastructure Group declined 20.4%. Domestic backlog declined 13% year over year to $376 million as of Jun 30, 2017 while international backlog improved 39% year over year to $76.2 million at the end of the second quarter.

Outlook

For third-quarter 2017, the company expects revenues to be higher on a year-over-year basis, backed by backlog, domestic infrastructure product sales activity, continued oil, gas and water product sales activity as well as momentum in international sales despite a strong U.S. dollar. The company expects gross and net margins to be also higher in the quarter from the prior-year quarter levels.

For 2017, the company anticipates revenues to rise approximately 5% year over year, with a flat to slightly improved net income for the year.

Share Price Performance

In the last one year, Astec has underperformed the industry with respect to price performance. The stock declined 18.1%, while the industry rose 41%.

Zacks Rank & Key Picks

Astec currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks worth considering in the same sector are AGCO Corporation (NYSE:) , Terex Corporation (NYSE:) and Apogee Enterprise, Inc. (NASDAQ:) . All the three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has an average positive earnings surprise of 40.39% in the trailing four quarters. Terex generated an outstanding average positive earnings surprise of 122.61% in the past four quarters, while Apogee has an average positive earnings surprise of 3.41% in the last four quarters.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Apogee Enterprises, Inc. (APOG): Free Stock Analysis ReportTerex Corporation (TEX): Free Stock Analysis ReportAstec Industries, Inc. (ASTE): Free Stock Analysis ReportAGCO Corporation (AGCO): Free Stock Analysis ReportOriginal post