Assurant, Inc. (NYSE:AIZ) acquired American Title, Inc. for a cash consideration of $45 million. With this, the company strengthens its capabilities in the housing market.

American Title, Inc., founded in 1994, is an ace provider in title and valuation services for home equity lenders and generates fee income of about $48 million annually. The primary business lines include title services, settlement services and valuation for home equity loans. The company also offers conventional mortgages and refinancing.

The acquired company will operate as part of Assurant’s Mortgage Solutions business, which includes property preservation, appraisal and valuation services. Hence, the acquisition will complement Assurant’s strategy to focus on risk management in the housing market as well as on expansion of fee-based business. Assurant projects the transaction to be moderately accretive to earnings next year.

Assurant is directing capabilities to targeted markets and enhancing operating efficiency. The insurer remains focused on diversifying its product and service portfolio, adding client partnerships and growing market share. The buyout not only adds capabilities in housing markets to Assurant’s portfolio, it also bears testimony to its financial strength.

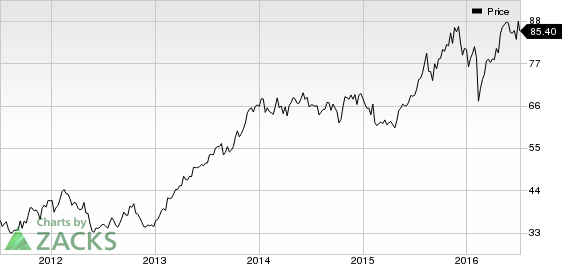

Assurant is on track to restructure its business for long-term growth. The Zacks Rank #2 (Buy) multiline insurer divested its Employee Benefits business to Sun Life Financial Inc. (TO:SLF) and divested its health insurance business to National General Holdings Corp. It also intensifies focus on Specialty Property and Casualty and Lifestyle Protection.

Assurant has been witnessing downward estimate revisions over the past few weeks. With optimism surrounding the company’s compelling inorganic growth story, we expect analysts to pull up their estimates. Assurant is scheduled to release its second-quarter earnings results on Jul 26. The Zacks Consensus Estimate is currently pegged at $1.48 per share. Though the company’s favorable Zacks Rank #2 the predictive power of an earnings beat, an Earnings ESP of 0.00% makes prediction difficult.

Acquisitions are a well-accepted growth strategy among insurers. Recently, Arthur J. Gallagher & Co. (NYSE:AJG) acquired an 85% interest in Brim AB to expand its Scandinavian presence. Last month, AmTrust Financial Services, Inc. (NASDAQ:AFSI) acquired Total Program Management LLC to expand its esteemed fee-based businesses.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GALLAGHER ARTHU (AJG): Free Stock Analysis Report

SUN LIFE FINL (SLF): Free Stock Analysis Report

ASSURANT INC (AIZ): Free Stock Analysis Report

AMTRUST FIN SVC (AFSI): Free Stock Analysis Report

Original post

Zacks Investment Research