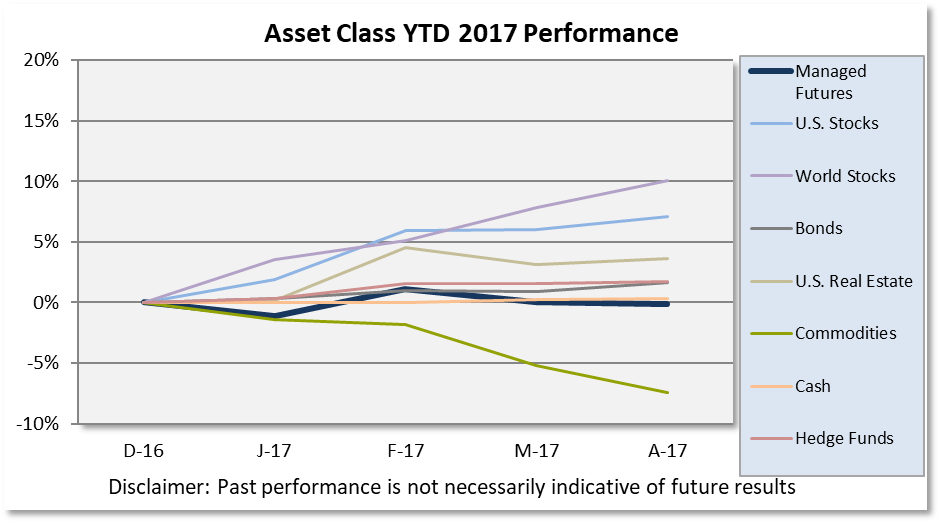

World Stocks have established themselves as the 2017 front runner in the asset class scoreboard. The asset class is up double digits in the first four months of the year, up 14.42% over the past 16 months, but unlike U.S. Stocks, it remains in a drawdown.

Despite recent gains, World Stocks are 8% off of its 2014 highs. This just goes to show looking month-to-month, quarter-to-quarter, and even year-to-year only gives someone a short glimpse of the investment sentiment. Meanwhile, U.S. Stocks continue to hit new all-time highs in 2017, with the possibility of catching up to World Stocks for 2017 numbers.

Managed Futures dipped into the negative for the second time this year, just 10 basis point in the red, while long-only commodities continue to look like a horrible term investment.

We are entering the “Sell in May and go away” part of 2017; only time will tell if the markets sell off in the coming months. We will say this market doesn’t feel like the normal market behavior, but that just makes us question if this is the new normal of market behavior? We guess that’s why we in this space say past performance is not necessarily indicative of future results. No market behavior is ever like the one before it, but there might be ripples of similarities.

Sources:

- Managed Futures = SocGen CTA Index

- Cash = 13 week T-Bill rate

- Bonds = Vanguard Total Bond Market ETF (NYSE:BND)

- Hedge Funds= IQ Hedge Multi-Strategy Tracker (NYSE:QAI)

- Commodities = iShares S&P GSCI Commodity-Indexed ETF (NYSE:GSG)

- Real Estate =iShares US Real Estate ETF (NYSE:IYR) (IYR)

- World Stocks = iShares MSCI ACWI ex US ETF (NASDAQ:ACWX)

- US Stocks = SPDR S&P 500 ETF (NYSE:SPY)