Investment In Growth

The FY12 results were strong, as expected, with EBITDA up 80%, broadly in line with expectations. FY13 is a demanding one: events will be much enlarged by the Beacon deal, but early benefits will be modest due to start up costs. Heavy new product investment will squeeze events and online margins; our EPS (normalised) estimate is cut by 58%. But the investment and the Beacon deal should produce a strong profit rebound in FY14. Short term we estimate the shares have c 20% upside, with potential for further rerating when investment pays off.

Strong Revenue Growth In 2012, But Costs Rise

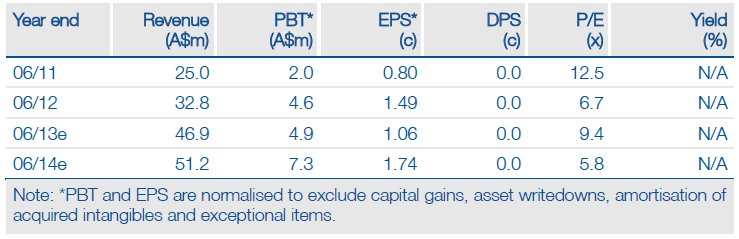

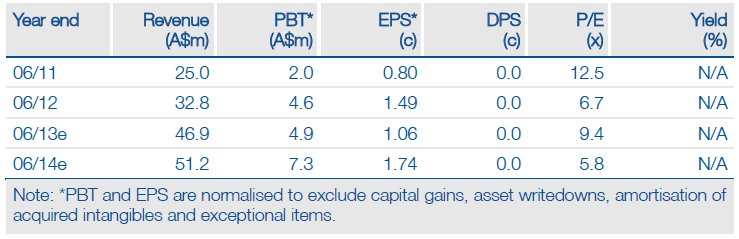

Reported FY12 revenue grew 31% (25% excluding acquisitions) to A$32.8m, due mainly to events (up 47%). Total segment profits grew 34% to A$10.0m, below our estimate of $10.4m, due to higher organic investment costs. After lower central costs, EBITDA grew 80% to A$6.2m, just below our estimate of A$6.4m, but within the company’s target range. PBT (normalised) reached A$4.6m (estimate: $5.3m) with EPS (adjusted) at 1.49c, compared to our estimate of 1.69c.

FY13: Rising Investment Costs, Benefits From Beacon

Higher investment costs in FY13 in events and online (about A$2m) plus an incentive scheme (potentially worth A$1m) for the events division lead to our PBT (adjusted) estimate being cut by 32% from $7.2m to A$4.9m, with EPS down by 46% from 1.97c to 1.06c. Offsetting this to a degree will be benefits (initially modest, due to start-up costs) from a deal (effective1 July) to combine the events business with that of Beacon Events; Aspermont has 60% of the enlarged business.

Valuation: Upgrades And Rerating Needed For Further Share Price Rises

We look for a 64% rise in EPS (adjusted) in FY14, based on investment benefits and more from Beacon. Benchmarked against Centaur, which has been rerated after restructuring and investment benefits, the shares would stand on a price of 12.8c, including 0.6c from the investment portfolio. Compared to other B2B shares and the FTSE UK Small-cap sector, there is potential for rerating when the investment strategy is seen to be successful.

To Read the Entire Report Please Click on the pdf File Below.

The FY12 results were strong, as expected, with EBITDA up 80%, broadly in line with expectations. FY13 is a demanding one: events will be much enlarged by the Beacon deal, but early benefits will be modest due to start up costs. Heavy new product investment will squeeze events and online margins; our EPS (normalised) estimate is cut by 58%. But the investment and the Beacon deal should produce a strong profit rebound in FY14. Short term we estimate the shares have c 20% upside, with potential for further rerating when investment pays off.

Strong Revenue Growth In 2012, But Costs Rise

Reported FY12 revenue grew 31% (25% excluding acquisitions) to A$32.8m, due mainly to events (up 47%). Total segment profits grew 34% to A$10.0m, below our estimate of $10.4m, due to higher organic investment costs. After lower central costs, EBITDA grew 80% to A$6.2m, just below our estimate of A$6.4m, but within the company’s target range. PBT (normalised) reached A$4.6m (estimate: $5.3m) with EPS (adjusted) at 1.49c, compared to our estimate of 1.69c.

FY13: Rising Investment Costs, Benefits From Beacon

Higher investment costs in FY13 in events and online (about A$2m) plus an incentive scheme (potentially worth A$1m) for the events division lead to our PBT (adjusted) estimate being cut by 32% from $7.2m to A$4.9m, with EPS down by 46% from 1.97c to 1.06c. Offsetting this to a degree will be benefits (initially modest, due to start-up costs) from a deal (effective1 July) to combine the events business with that of Beacon Events; Aspermont has 60% of the enlarged business.

Valuation: Upgrades And Rerating Needed For Further Share Price Rises

We look for a 64% rise in EPS (adjusted) in FY14, based on investment benefits and more from Beacon. Benchmarked against Centaur, which has been rerated after restructuring and investment benefits, the shares would stand on a price of 12.8c, including 0.6c from the investment portfolio. Compared to other B2B shares and the FTSE UK Small-cap sector, there is potential for rerating when the investment strategy is seen to be successful.

To Read the Entire Report Please Click on the pdf File Below.