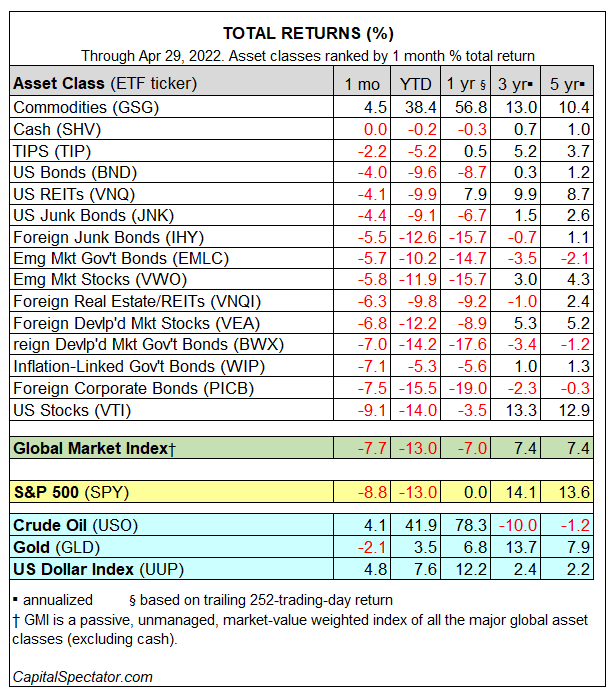

Red ink spilled across nearly every slice of the major asset classes in April. Commodities were the exception, posting a solid gain. Otherwise, losses prevailed, based on a set of ETF proxies.

Notably, it’s the same story for year-to-date results in the wake of last month’s losses. Everything except commodities is down so far in 2022, with double-digit slides representing half of the declines.

The upside outlier: iShares S&P GSCI Commodity-Indexed Trust (GSG), which rallied 4.5% last month and is ahead more than 38% in 2022. For globally diversified portfolios, commodities are the main (and in some cases the only) source of ballast for an increasingly bearish year. A distant second-place source of stability: cash (SHV), which was flat in April and off fractionally for the year to date.

Last month’s steepest loss: US stocks VTI, which fell 9.1% in April and are in the hole by 14% year to date.

The Global Market Index (GMI) resumed its decline in April. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, fell a hefty 7.7% last month and is off 14% so far for the year.

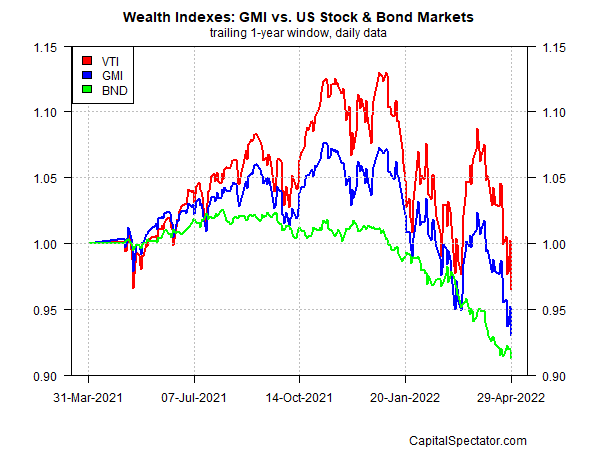

Reviewing GMI’s performance relative to US stocks and bonds over the past year continues to reflect a middling performance for this multi-asset-class benchmark (blue line in chart below). US stocks (VTI) shed 3.5% for the trailing one-year window. A broad measure of US bonds — Vanguard Total US Bond Market (BND) – lost even more, falling 8.7%. GMI declined 7.0% for the year through April’s close.