- Asia exporting nations have started to weaken currencies to sell more exports.

- Japan commits to an ultra-loose monetary policy to weaken the yen.

- China responds by weakening the RMB through liquidity injections.

- It could help global markets as money printing flows from Asia to the rest of the world.

As media attention focuses on western nations’ competition to hike rates, another war is heating up in Asia quietly as exporter countries embark on competitive devaluation of their respective currencies, more commonly known as a currency war, which may have implications beyond the shores of Asia but is not yet widely reported.

A currency war is the intentional weakening of a country’s currency so that the price of its exports becomes relatively cheaper in the foreign markets due to the falling exchange rate. This works for countries that derive more income from exports than they spend on imports such that the benefit derived from exports can improve their current account balance.

At the same time, the currency devaluation makes imports more expensive to the country's consumers, forcing them to choose home-grown substitutes, thereby inducing an increase in demand for domestic goods. This combination of export-led growth and increased domestic demand contributes to higher employment and faster economic growth. The stimulative monetary policies that usually result in a weaker currency also positively impact the nation's capital and housing markets, which in turn boosts domestic consumption through the wealth effect.

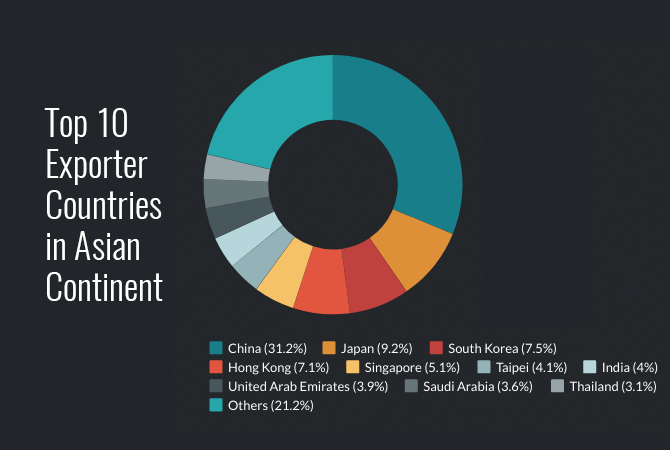

As net exporting nations, Asian economies could benefit from such a policy, as many Asian nations derive most of their income from the manufacturing sectors. Think China, the factory of the world, Japan, and South Korea, which together account for half of the total Asian exports.

With inflation in these economies not as high as that in their western counterparts, these three Asian exporters have leeway to devalue their currencies more to take advantage of the rate hiking cycle in the West to increase their share of exports to boost their economies as the prices of their goods and services would become relatively cheaper than those produced in Western countries.

While inflation in the West tops 9%, inflation in Japan is merely around 1.5%, and that in China is only around 2.1% as it recovers from demand destruction due to COVID lockdowns. Hence, these two countries have the conditions to continue a path of accommodative policies that they race to sell more exports.

These three countries would benefit disproportionately via currency devaluation and are the largest competitor of one another in world trade. Hence, whenever one country starts to devalue its currency, the others would follow suit. As China was busy battling COVID lockdowns earlier this year, Japan started on the aggressive by leading the currency devaluation, pounding the yen 17% lower against the USD year-to-date, trading at a 24-year low.

Not to let Japan get all the advantage, Korea has weakened the won in tandem last week, causing the won to break 14-year lows and on pace to fall more than 9% against the USD. This follows an 8.6% drop in 2021 that was the fastest annual fall since 2008, leading the won to trade at an even lower level than it did when the country was mired in economic crisis due to COVID shutdowns. This shows the level of aggression by the Korean authorities to weaken the won.

In comparison, while being the largest exporter, China has been a lot less aggressive in weakening its currency thus far. The RMB has only fallen by around 4.5% against the USD this year, while it even gained against the USD over the past two years. With annual inflation only at 2.1% in May, the RMB has room to fall further without many negative implications for the Chinese economy as it has survived a far lower rate in 2020.

China will need to weaken the RMB as soon as possible to avoid losing export competitiveness against its major competitors, particularly Japan, the second-biggest exporter, and has aggressively weakened the yen. China has just started to do so.

As China attempts to regain its momentum after coming out of COVID lockdowns, attention is turning back to its export sector as China races to recover its economy. According to figures published by the World Bank, exports accounted for around 18.5% of China’s GDP in 2020.

Hence, getting a competitive advantage in selling exports is a quick way to get China's economy back on track, and weakening its currency is one sure way of doing this. China weakens its currency to inject additional liquidity into its financial markets, similar to QE.

Already, the PBOC is pumping liquidity into the markets even as the Fed is withdrawing liquidity. Since last Friday, the PBOC has started pumping more cash into its financial markets in anticipation of higher demand for cash at the end of the year's first half.

On Monday again, China made its biggest daily cash injection in three months into the banking system via open market operations, injecting 100-billion-yuan ($14.95 billion) worth of seven-day reverse repos, the biggest daily injection via the liquidity tool since Mar. 31.

All these actions speak of a nation that is eager to compete, setting the tone for more competitive devaluation in Asia and responding to Japan’s commitment to an ultra-accommodative monetary policy.

The move is starting to work, as the USD/CNY has currently weakened from last Friday’s 6.680 yuan to 6.697 yuan. However, Japan will not sit back and watch and allow their efforts thus far to go into the drain with the RMB weakening. The BOJ will likely weaken the yen further and create a vicious cycle.

This, in turn, could be positive for world economies as cheap money continues to flow, albeit from a different part of the world. Bear in mind China and Japan are the second and fourth-largest economies of the world, and adopting an easy monetary policy would pump much-needed liquidity into their financial markets, which will, in turn, filter their way into the global financial system due to interest rates differentials.

Hence, while stocks and risky assets continue to get battered on the narrative of stagflation in the West, aid in the form of more cheap money is coming from Asia to buy up assets on the dip and rescue the global markets.