EU and US indices gained yesterday, perhaps on reports of progress with regards to a coronavirus vaccine. However, new tensions between the US and China weighed on market sentiment during the Asian session today. Yesterday, we also had a BoC monetary policy decision, with the Bank standing pat. As for today, the central bank torch will be passed to the ECB.

RISK APPETITE EASES IN ASIA, BOC KEEPS POLICY UNCHANGED

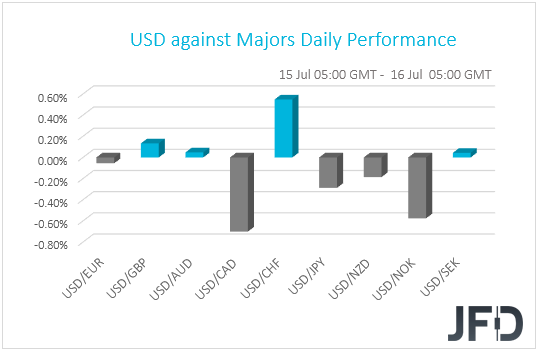

The US dollar traded mixed against the other G10 currencies on Wednesday and during the Asian morning Thursday. It lost the most ground versus CAD, NOK, and JPY in that order, while it underperformed against CHF and GBP. The greenback was found virtually unchanged against EUR, AUD and SEK.

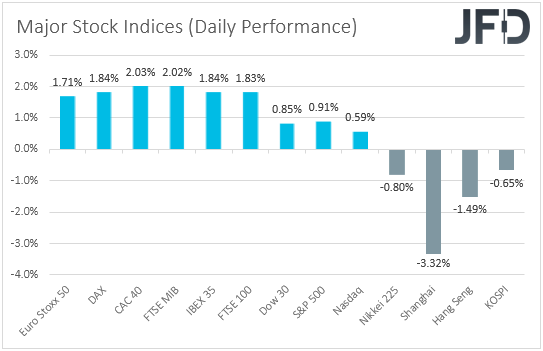

The strengthening of the oil-related CAD and NOK, combined with the weakness in the safe-haven CHF, suggests that markets traded in a risk-on fashion yesterday. However, the fact that JPY was among the main gainers, points otherwise. Thus, with the performance in the FX world painting a blurry picture with regards to the broader market sentiment, we prefer to turn our gaze to the equity sphere in order to clear things up. There, major EU and US indices closed in positive territory, perhaps on reports of progress with regards to a coronavirus vaccine. Market participants may have been encouraged by a study which showed that Moderna (NASDAQ:MRNA) Inc’s experimental drug provoked immune responses, as well as by reports that data on a vaccine developed by AstraZeneca (NYSE:AZN) and Oxford University could be announced as soon as today.

Having said all that though, Asian bourses did not follow the recovery, and instead slid, even after data showed that the Chinese economy rebounded more than anticipated in Q2. Yesterday, we noted that this data may not prove a major market mover, as investors may have already been waiting for a decent print. In any case, the switch to risk off during the Asian session may have been the result of fresh headlines raising concerns over the relationship between the US and China. Yesterday, US Secretary of State Mike Pompeo said that the US will impose visa restrictions on Chinese firms which facilitate human-rights violations, while according to a White House official, the Trump administration is expected to take action in the next few weeks to address security risks posed by Chinese mobile apps, the likes of TikTok and WeChat.

On the one hand, we have news pointing to a positive vaccine trials, which are very positive for the markets, as with a vaccine ready, governments may not need to proceed with new full-scale lockdowns, and thereby, allow their economies to continue recovering. On the other hand though, infected cases by the virus are still on acceleration mode, while tensions between the world’s two largest economies remain elevated, something that could jeopardize any progress made so far with regards to a trade accord. As we have been noting the last few days, we will stand pat until we get clearer signs with regards to the market’s forthcoming direction.

Yesterday, apart from headlines surrounding the coronavirus and the US-China saga, we also had a BoC monetary policy decision. The Bank decided to keep interest rates unchanged at +0.25%, and noted that they will stay there until the 2% inflation target is sustainably achieved. Officials also added that they will continue to buy CAD 5bn per week in QE until the economic recovery is well underway, and that they stand ready to adjust their programs if market conditions change. “Overall, the risks appear to be tilted to the downside, largely because of the potential for a second wave of the virus,” policymakers also said.

Despite the dovish message, the Canadian dollar was found as the main gainer among the G10 currencies this morning. This means that, apart from the risk on trading during the EU and US sessions, the Loonie may have also benefited as heading into the meeting, there may have been expectations over a QE expansion. Anyhow, with oil prices staying in uptrend mode despite the OPEC+ group agreeing to taper record supply curbs from August, the Loonie may stay relatively strong if market sentiment improves again. If this is the case, we would expect it to perform better against the safe havens, like the US dollar, the Japanese yen, and the Swiss franc.

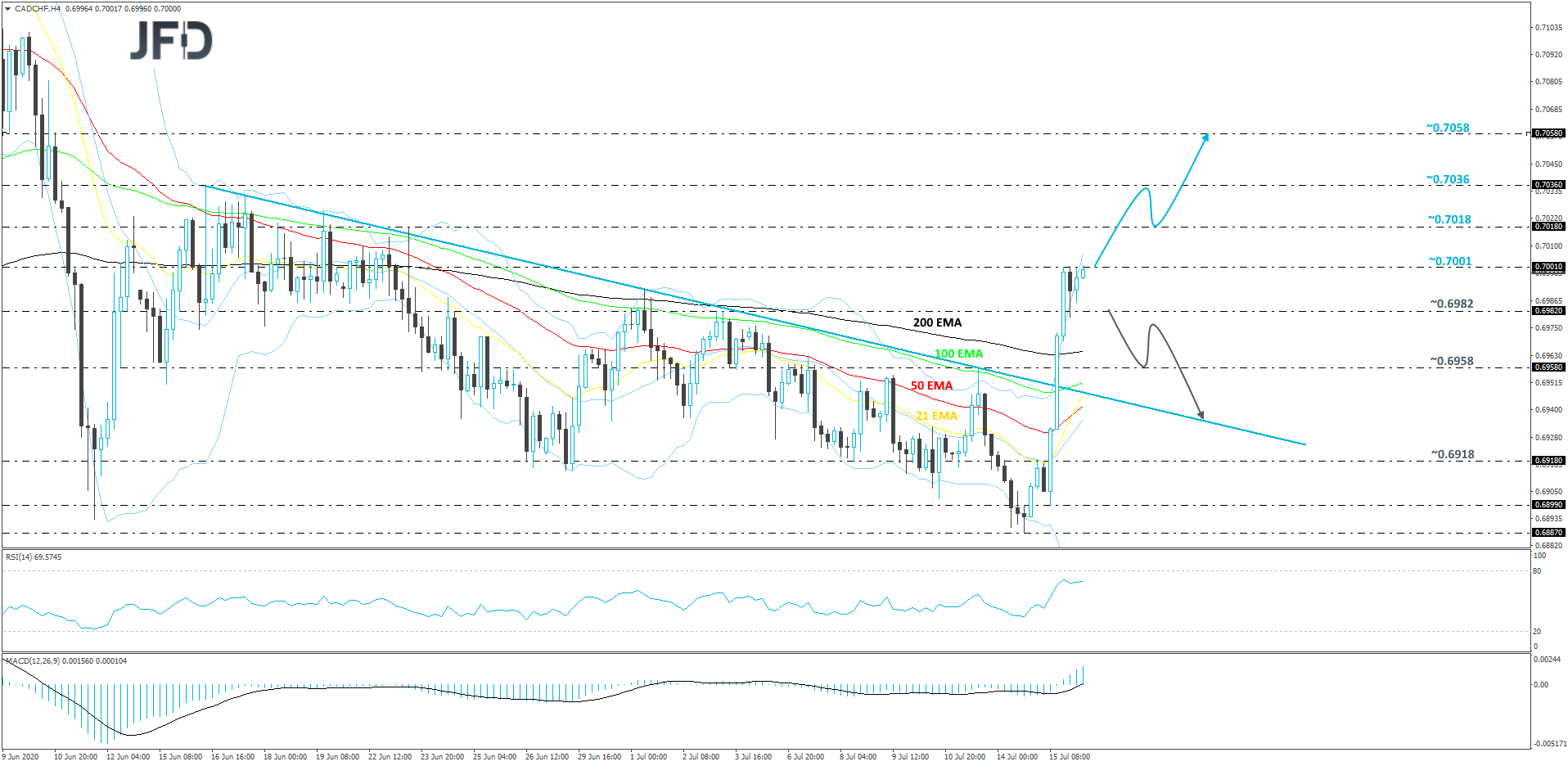

CAD/CHF – TECHNICAL OUTLOOK

CAD/CHF had a strong push to the upside yesterday, breaking its short-term downside resistance line drawn from the high of June 16th. The pair continued to rally, but found resistance near the psychological 0.7000 mark, which continues to hold the rate this morning as well. Although there is a good possibility we may get more upside movement in the near term, we would still prefer to wait for a break above the 0.7001 barrier, marked by yesterday’s high, before getting comfortable with larger advances.

A push above the 0.7001 hurdle would confirm a forthcoming higher high and may set the stage for a further move north, where the next potential resistance area could be at 0.7018, marked by the high of June 23rd. Slightly higher sits another possible resistance barrier, which may temporarily halt the acceleration, and that’s the 0.7036 barrier, marked by the high of June 16th. The pair might stall there for a bit, or even correct slightly lower. That said, if the rate remains above the psychological 0.7000 zone, the bulls could take advantage of the lower rate and lift it up again. If this time the previously-discussed 0.7036 obstacle fails to provide resistance and breaks, the next possible target might be an intraday swing high of June 10th, at 0.7058.

Alternatively, if the rate falls back below the 0.6982 hurdle, which is the high of July 3rd, that could lead to some further correction lower. That’s when we will aim for the high of July 13th, at 0.6958, a break of which could open the door for a move to test the aforementioned downside line from above, which may provide support.

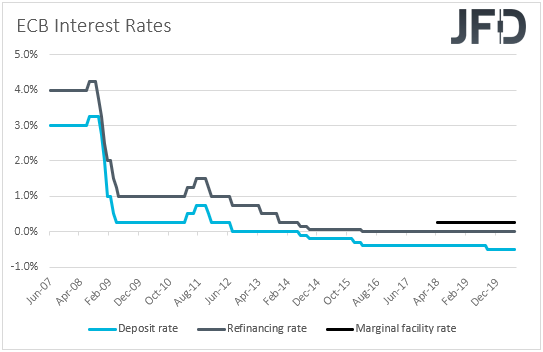

ECB TAKES THE CENTRAL BANK TORCH

As for today, the central bank torch will be passed to the ECB. At its latest meeting, this Bank decided to increase its pandemic emergency purchase program (PEPP) by EUR 600bn to a total of EUR 1350bn, extending the horizon of the purchases to “at least the end of June 2021.” Officials also repeated that they remain ready to adjust all of their instruments as appropriate, to ensure that inflation moves towards their aim in a sustained manner.

With the headline CPI rate at +0.1% yoy, the core one at +0.9% yoy, and the Composite PMI still pointing to contraction, although coming in better than expected, the door for further easing remains wide open. However, with officials expanding their stimulative efforts just at the prior gathering, we don’t expect any new action at this meeting. We believe that they may prefer to wait and see how and whether their latest decision is affecting the broader economic recovery. That said, we expect President Lagarde to urge EU governments to take action as soon as possible, especially after failing to find common ground on a EUR 750bn rescue fund. Investors may decide not to shake the boat after this meeting, as they may prefer to focus on a special EU summit, scheduled for tomorrow and Saturday, where leaders will discuss once again the rescue plan. If they indeed find common ground, the euro is likely to get benefited. The opposite may be true if they once again fail to agree.

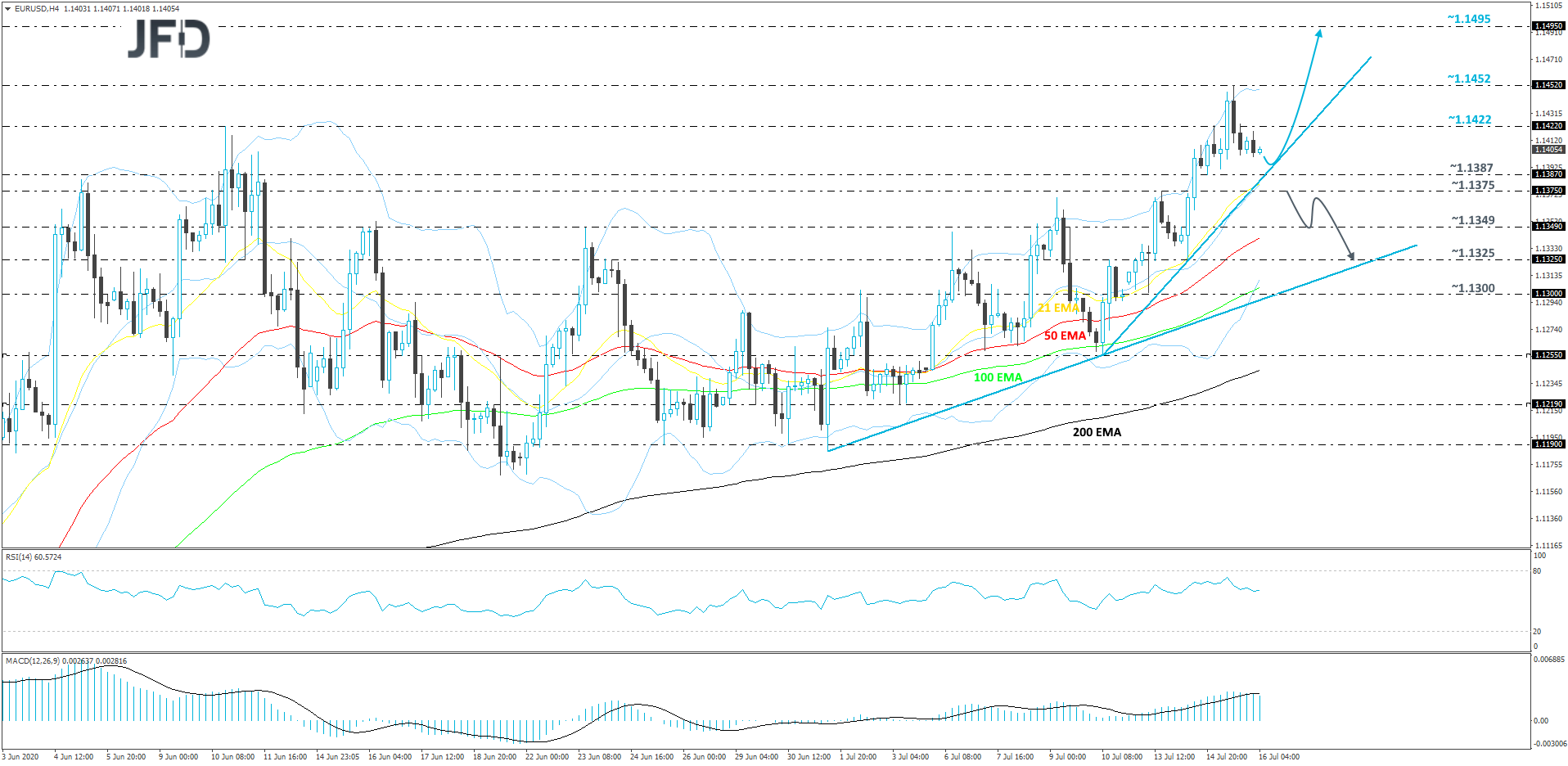

EUR/USD – TECHNICAL OUTLOOK

After a successful run to the upside in the first half of this week, EUR/USD eventually found resistance near the 1.1452 barrier and is now seen correcting lower. However, the pair remains above a short-term upside support line taken from the low of July 10th. If that line continues to provide support for the rate, the bulls might take charge and drive EUR/USD up again, hence why we will stay somewhat bullish.

A further decline could bring the pair closer to the aforementioned upside line, which if stays intact, could help the bulls to push EUR/USD back to the 1.1422 obstacle, or even the 1.1452 barrier, which is the current highest point of this week. The rate may get a temporary hold-up there, but if that barrier eventually surrenders, its break would confirm a forthcoming higher high and the next potential target could be at 1.1495, which is the highest point of March and the current highest point of this year.

On the other hand, if the previously-mentioned upside line breaks and the rate falls below the 1.1375 hurdle, marked by the high of July 13th, that may cause the bulls to step away temporarily, allowing the bears to grab the steering wheel. EUR/USD might then drift to the 1.1349 obstacle, a break of which could force the pair to slide to the 1.1325 level, marked by the low of July 14th. Slightly below it runs another short-term tentative upside line, drawn from the low of July 1st, which may provide additional support.

AS FOR THE REST OF TODAY’S EVENTS

During the early European morning, we already got the UK employment report for May. The unemployment rate stayed unchanged at 3.9% instead of rising to 4.2% as the forecast suggested, while the employment change showed that the economy lost less than anticipated jobs. As for wages, both the including and excluding bonuses rates declined by less than expected.

Later, we have the US retail sales for June and the initial jobless claims for last week. Expectations are for both headline and core sales to have slowed to +5.0% mom from 17.7% and 12.4% respectively, while initial jobless claims are forecast to have slowed to 1.250mn from 1.314mn.

As for the speakers, besides ECB President Christine Lagarde, who will hold a press conference after the ECB decision, we have four more officials stepping up to the rostrum today: BoE Governor Andrew Bailey, BoE Chief Economist Andy Haldane, New York Fed President John Williams (NYSE:WMB) and Chicago Fed President Charles Evans.