America may have the world’s largest stock market...

But it’s not the world’s only stock market.

Successful investors know that diversification is key to a healthy portfolio. Making the right investments overseas is a smart way to hedge your bets during market uncertainty back home.

This is especially true of Asian stocks.

The continent is home to many up-and-coming names in the tech space.

However, many Asian stocks don’t have an American equivalent. For that reason, you can’t directly trade them from this side of the Pacific.

Fortunately, a variety of Asian tech ETFs are available in the U.S.

They provide Americans with easy and fairly low-risk access to many exciting Asian equities. Let’s look at three such funds.

One is Korean, the second is Taiwanese and the third is from the Chinese mainland.

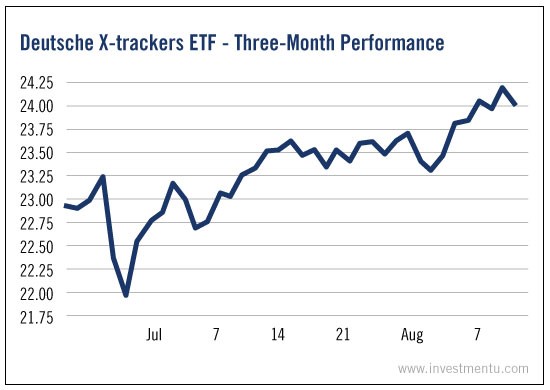

Deutsche X-trackers MSCI South Korea Hedged Equity (NYSE:DBKO)

This ETF of South Korean stocks is a classic contrarian play. It’s fairly new and trades in lower volumes than similar funds.

It focuses on strong Korean exporters like Samsung (KS:005930) and Hyundai Motor Co (DE:05380). It also adjusts for currency risk by hedging exposure to the South Korean won.

This could be a wise response to recent fears about Japanese yen devaluation.

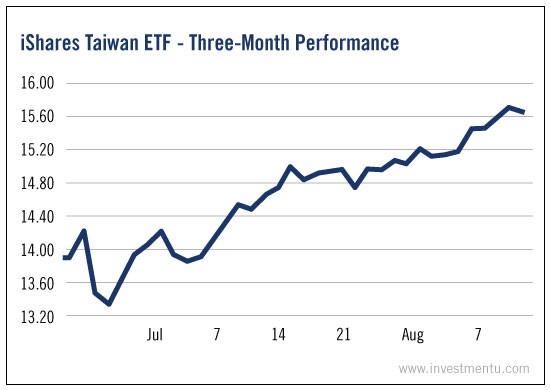

iShares MSCI Taiwan (NYSE:EWT)

iShares Taiwan is a nice sampler of large and mid-cap stocks. The companies included are responsible for making Taiwan such an economic powerhouse.

It’s largely weighted toward Taiwan Semiconductor Manufacturing (NYSE:TSM), the world’s largest integrated circuit foundry. (Taiwan Semiconductor is also a rare example of a Taiwanese company that trades freely on a U.S. exchange.)

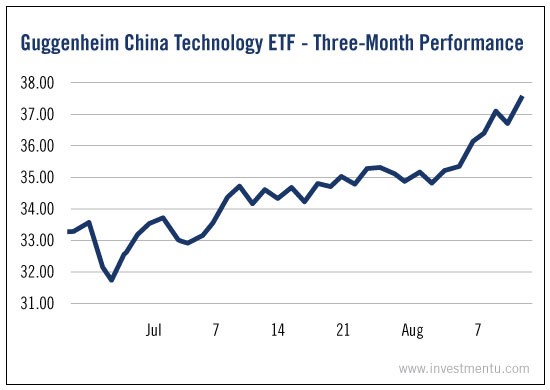

Guggenheim Invest China Technology (NYSE:CQQQ)

This fund presents an excellent selection of China’s fast-growing tech giants. It is especially heavy on AAC Technologies Holdings Inc (HK:2018), Sunny Optical Technology Group Co Ltd (HK:2382) and Lenovo Group (HK:0992).

It’s a great pick for investors who don’t want to miss out on the growth of China’s Silicon Valley challengers.

These are just three examples of a range of Asian ETFs available to American investors. Funds like these provide some of the safest and easiest ways to access the fast-growing stocks of the Far East.