Morning View:

Good Morning Traders.

We had a fair bit going on across markets late Friday night and into the weekend with story lines coming out of the UK, Europe and the US so take a seat, get out your coffee and ease back into the trading week with us here at Vantage FX.

You Emailed it to Who?!:

“Bank of England accidentally emails Brexit taskforce plans to newspaper”

“Central bank has set up a taskforce, led by Sir John Cunliffe, to look at the effect a UK exit from the European Union would have on our economy”

This one is almost too hard to believe. The incompetence it must have taken for someone inside the Bank of England to forward a sensitive document featuring ‘guided responses to media questions’ and all to one of the biggest newspapers in the country is just mind boggling.

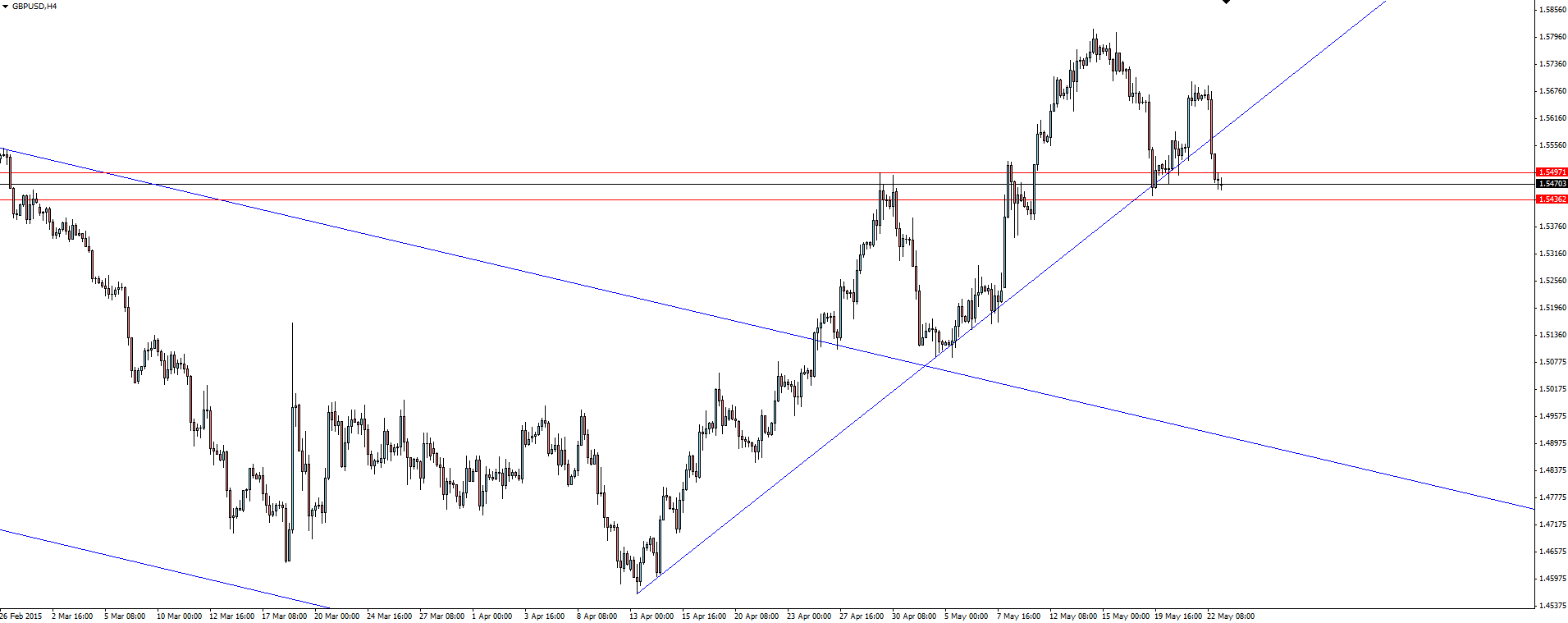

GBP/USD Daily:

Click on chart to see a larger view.

GBP/USD Hourly:

Click on chart to see a larger view.

This just added to cable’s pain: the news of the UK’s uncertainty in the EU combining with Yellen’s ‘on track’ comments to wipe out gains on the back of the good UK retail figures earlier in the week.

Price has broken through that short term trend line but stalled nicely in the marked zone. I’m expecting some sort of consolidation and a creep back along the underside of it, but new highs could well be out of the question in the near term.

Draghi’s Jawboning:

“In a monetary union you can’t afford to have large and increasing structural divergences between countries. They tend to become explosive.”

“Therefore, they are going to threaten the existence of the union, the monetary union.”

Stating the obvious really, but with Greece looking like exiting the euro with every headline that passes, things aren’t being sugar coated anymore. The difference between the rich and poor within the Eurozone has always been the biggest issue.

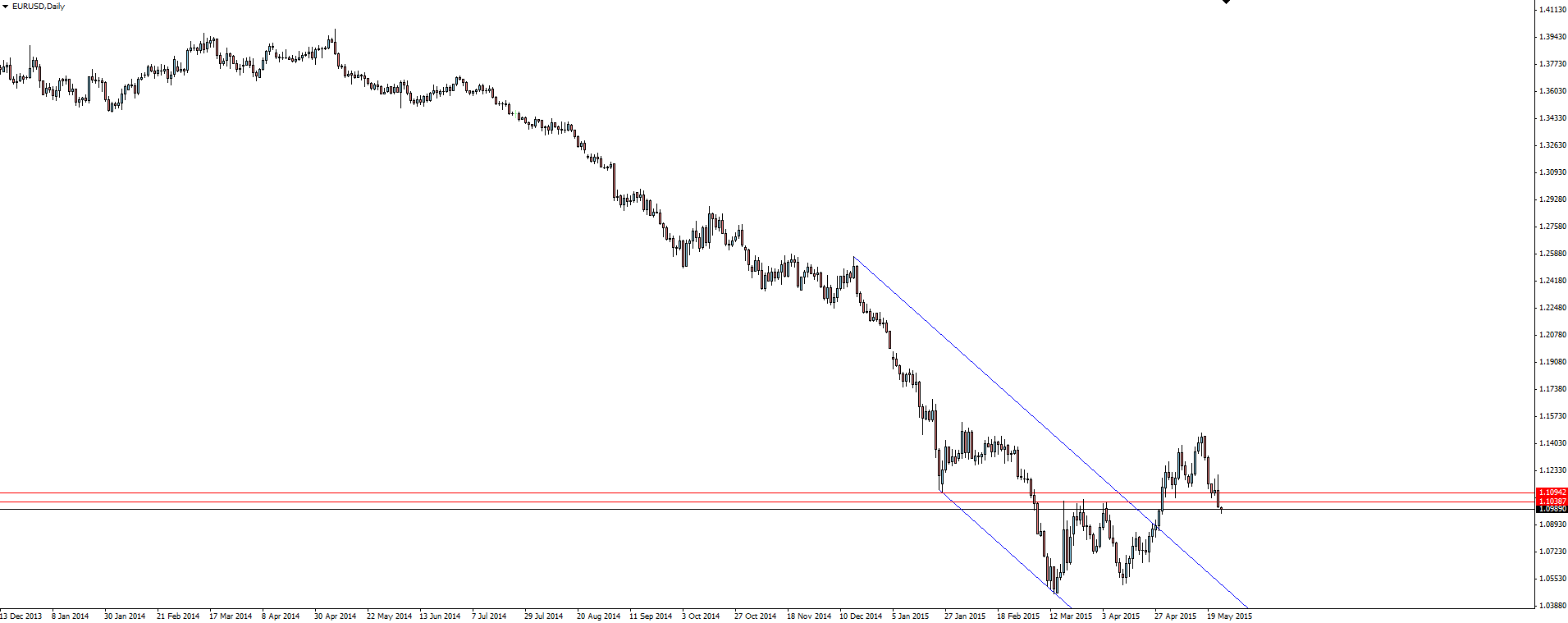

EUR/USD Daily:

Click on chart to see a larger view.

EUR/USD Hourly:

Click on chart to see a larger view.

A pretty good jawboning effort from Mr. Draghi, sending the euro lower through its similar short term demand zone. Definitely leading the race to new lows now.

Fed Still on Track:

“If the economy continues to improve as I expect, I think it will be appropriate at some point this year to take the initial step to raise the federal funds rate target”

Janet Yellen Friday told the market that the Fed is still on track to raise interest rates this year. The Fed’s strategy of consistent, small statements on how they will go about raising rates has been a model of how to go about a change in cycle in my opinion.

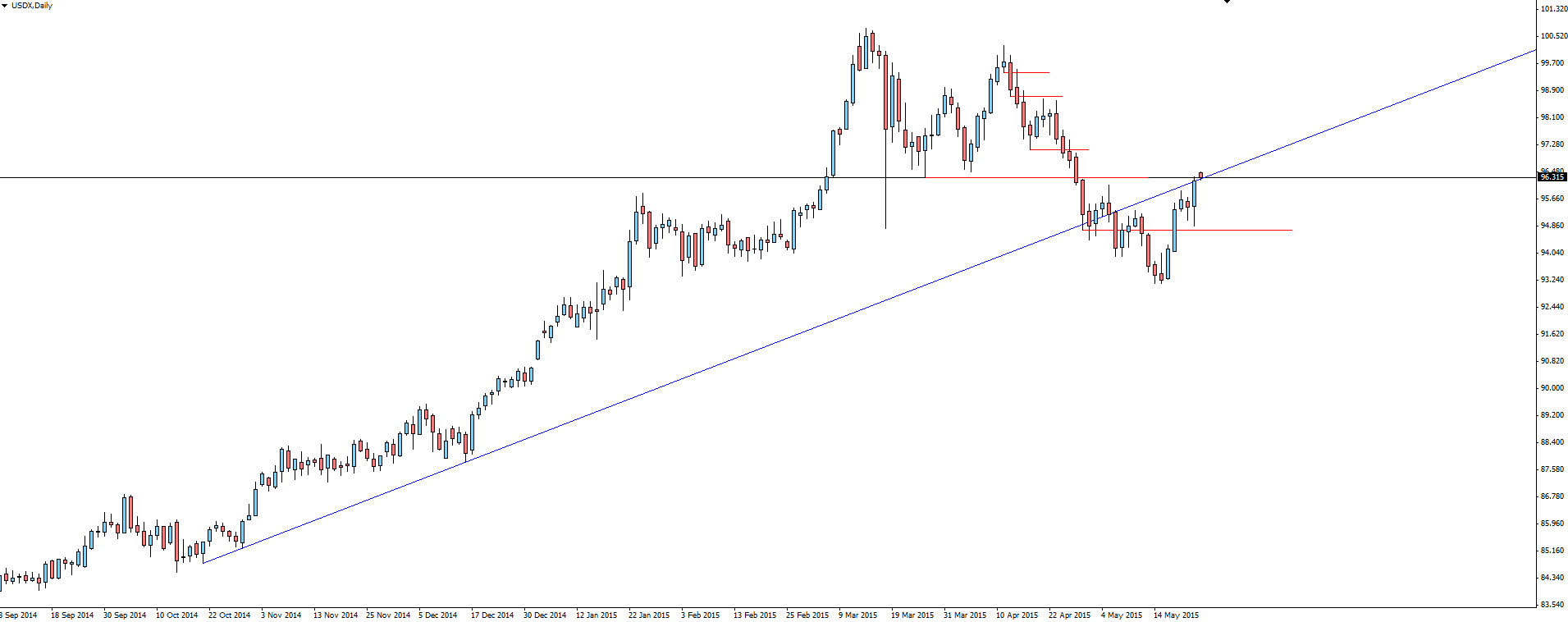

USDX Daily:

Click on chart to see a larger view.

A couple of previous levels of support have now been re-gained, but most importantly, price has tucked back in above the broken daily trend line. So often you see trend line breaks behave this way, consolidating and then re-validating the line again even after it has been broken.

Strength!

———-

On the Calendar Today:

The light Asian session calendar followed by a whole host of Bank holidays across both Europe and the US lets us ease into the trading week this fine Monday morning.

FOMC Member Fischer delivers a speech titled “The Federal Reserve and the World Economy” in Israel later in the evening, but not something that is expected to deliver any new, market moving soundbites.

Monday:

CHF Bank Holiday

EUR French Bank Holiday

EUR German Bank Holiday

GBP Bank Holiday

USD Bank Holiday

USD FOMC Member Fischer Speaks

Sometimes finding myself in the Australian bubble, a little sheltered from the rest of the world, I like discovering some background on some of these holidays:

“Whit Monday or Pentecost Monday (also known as Monday of the Holy Spirit) is the holiday celebrated the day after Pentecost, a movable feast in the Christian calendar.”

“Memorial Day is a federal holiday in the United States for remembering the people who died while serving in the country’s armed forces.”

You learn something new every day!

———-

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Asian Session Morning: You Emailed It To Who?!

Published 05/24/2015, 08:43 PM

Updated 01/13/2022, 05:55 AM

Asian Session Morning: You Emailed It To Who?!

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.