Asian Session Morning:

Good morning traders. A fairly quiet one overnight, with no major market moving data releases seeing forex markets chopping about for the day and basically ending where they began.

“It’s only just beginning.”

The big news yesterday, while not being market related, was the raids on Football’s governing body, FIFA. If you’re a global citizen, then you should be able to at least see the potential political power for good that FIFA has, and if you’re a football fan, then you understand how fundamentally wrong the organisation conducts itself.

This is just the start, but 9 FIFA officials were arrested on suspicion of receiving bribes totalling $100m (£65m). President Sepp Blatter was not among the accused, but he has overseen this whole shambles, so surely it can only be a matter of time. Change is coming.

———-

On the Calendar Today:

Fairly straight forward on the calendar today, with only the 1 major data release coming from each of the 3 major sessions.

Thursday:

AUD Private Capital Expenditure

USD G7 Meetings

GBP Second Estimate GDP

USD Unemployment Claims

———-

Chart of the Day:

It feels like an eternity ago that we were talking about AUD/NZD below parity. Let’s have a look at where we sit now.

AUD/NZD Weekly:

Click on chart to see a larger view.

On the Weekly, as you can see, price put in big bullish candles 4 weeks in a row but stalled at trend line resistance. We got a nice little rejection off this level and have now come back down to the horizontal zone that has been tested a few times over the last few years and could now be re-activated.

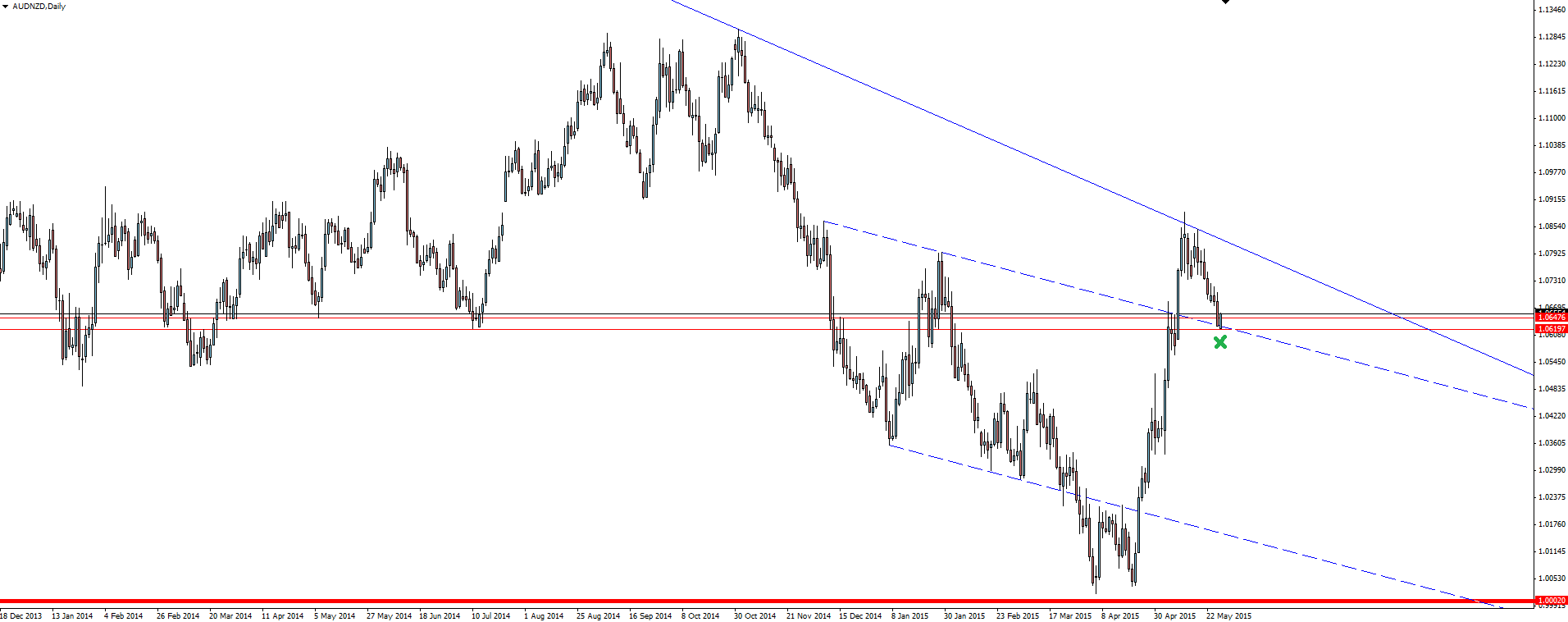

AUD/NZD Daily:

Click on chart to see a larger view.

This horizontal zone lines up perfectly with previously broken daily channel resistance that could now also be acting as support. Anywhere that you get a confluence of levels such as this is worth taking note of.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Asian Session Morning: Market Chop And FIFA Sting

ByVantage

AuthorDane Williams

Published 05/27/2015, 08:26 PM

Updated 01/13/2022, 05:55 AM

Asian Session Morning: Market Chop And FIFA Sting

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.