Asian markets are trading on a mixed note today on the back of favorable economic data from Japanese economy acting as a positive factor. While on the other hand, unrest in Iraq along with expectations of another round of QE tapering of $10 billion by the US Federal Reserve in its meeting which started yesterday acted as a negative factor. The US Dollar Index traded on a positive note and gained around 0.3 percent yesterday on the back of rise in risk aversion in market sentiments in early part of the trade which led to increase in demand for the low yielding currency. Further, estimates of another round of QE tapering by the US Federal Reserve in its meeting which started yesterday and unrest in Iraq supported an upside in the currency. However, mixed economic data from the country capped sharp gains in the DX. The currency touched an intraday high of 80.76 and closed at 80.72 on Tuesday. The US dollar is flat in the Asian session.

US Building Permits was at 0.99 million in May as against a rise of 1.06 million in April. Core Consumer Price Index (CPI) was at 0.3 percent in last month from 0.2 percent in April. CPI grew by 0.4 percent in May with respect to 0.3 percent a month ago. Housing Starts was at 1.0 million in May when compared to 1.07 million in April.

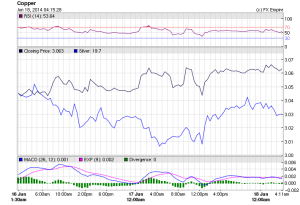

Gold continued to ease this morning to trade at 1267.40 down by $4.60. Gold prices are trading on a weak note on account of profit booking which continues from yesterday’s trading session. Since gold prices have gained more than 4 percent in past few sessions it was right opportunity for traders to lock in profits in an uncertain situation where violence in Iraq is escalating while geo-political tensions in Ukraine. Silver prices on the international markets is trading on a flat note at 19.682 after trading volatile in the previous trading session as markets remain uncertain with host of events ranging from violence in Iraq to uncertain situation in Ukraine with regards to the gas payment issue.

Strength in the dollar index by around 0.07 is also pressurizing the industrial metal. The Base metals pack on the LME is trading higher with most metals gaining around half a percent on positive global market sentiments Copper continued to gain adding 2 points to trade at 3.062, while palladium gained $1.20 and platinum eased taking its from precious metal to trade at 1440.15 down by $2.45. Copper climbed amid speculation that demand will stabilize in China as policy makers try to support growth in the world’s largest consumer of industrial metals. China’s central bank extended a reserve-requirement cut to some national lenders including China Merchants Bank Co. And Industrial Bank Co., as officials are trying to shore up an economy set for the weakest growth since 1990. Today’s gain for copper, the longest rally in three weeks, pared the metal’s drop this year to 8.7 percent. China last week announced new steps aimed at bolstering slowing growth by cutting taxes, spending more on developing the Yangtze River region. Demand to use copper as collateral to get loans will continue in China despite a probe into metal stockpiled at Qingdao Port because of “relatively high borrowing costs.