Within the next few weeks, we should know whether the trade truce between the US and China will give way to renewed conflict, peace or drawn out simmering tension. The result will determine in large part what happens to currencies in the Asia region.

Last month we spelt out our Asian FX scenario, which we paraphrase below.

The FX view superimposes a dynamic trade story on top of a similarly directional story for the US Fed, resulting in three distinct periods for Asian FX:

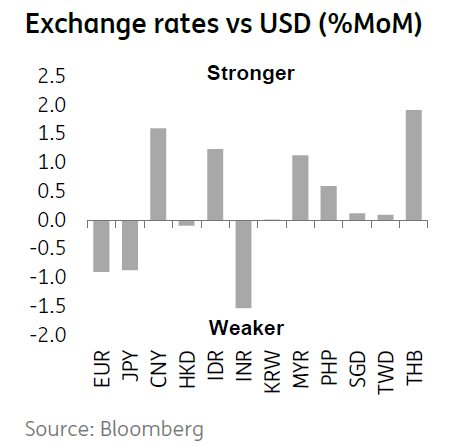

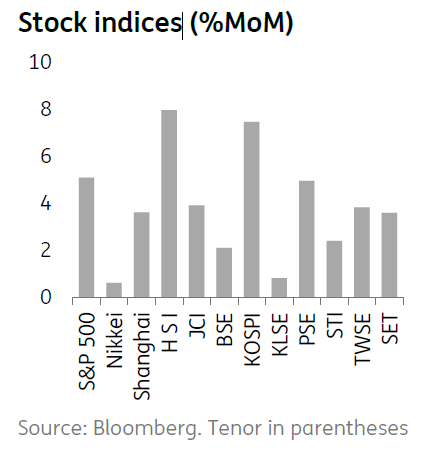

1) An initial period of USD softness (Asian FX strength) in which markets were relatively calm and optimistic, arguably where we are now and have been since 1 January this year. This could be punctuated by a brief spell of even greater euphoria on a positively spun trade announcement before March.

2) This would then be followed by revision of both the trade and Fed views as lack of trade substance and labor market heat led to a rethink on both issues and Asian FX weakness.

3) A return to a softer USD view as fiscal stimulus ebbs, cumulative US financial tightening begins to bite and Chinese stimulus measures begin to bear fruit.

The view seems in reasonable shape a month on, though there are of course wobbles and the transition between phases one and phase two might yet see a no trade deal announcement, in which case, the reversion to Asian FX weakness may be more brutal and miss out the ‘last hurrah’ which would require us to do some forecast trimming.

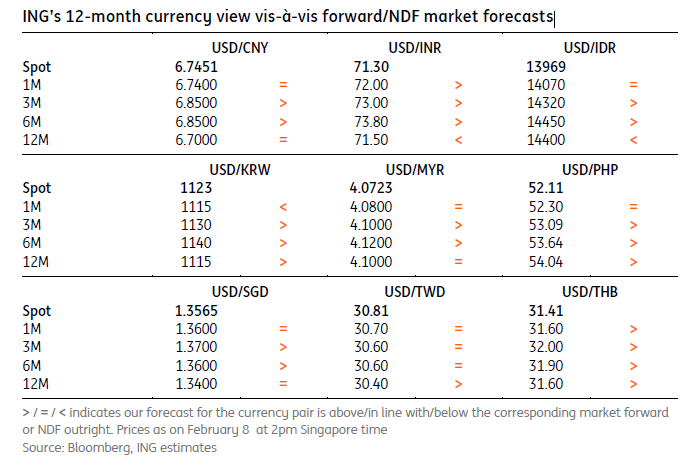

That said, at this stage, there has been no need to perform any radical surgery on the forecasts, with the notable exception of the Chinese yuan, which despite ongoing macro disappointment, no longer looks as if it will break the 7.0 hurdle, and we have shifted the profile for the CNY lower.

We have revised our yuan forecasts to reflect the CNY’s appreciation since the beginning of the year and an apparent change in direction from the People’s Bank of China. For now, it appears that they will take their steer for the CNY from the dollar index and will be keeping the yuan roughly stable against a basket of currencies.

One side effect of the stronger yuan is that it will help support imports from the US in the near-term, which will provide a helpful backdrop to trade negotiations.

However, some renewed CNY weakness during the middle of the year will support the weakening economy and Chinese export markets. We anticipate some recovery by the year end, though, with USD/CNY ending the year at 6.75.

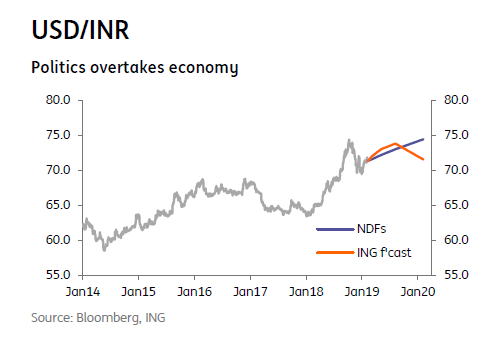

Politics has clearly overtaken the economy ahead of the general elections in May 2019. In a last-ditch attempt to lure voters, the incumbent government has not only put up a populist budget for FY2020 but has also pushed the central bank to ease policy.

The authorities appear to be ignoring what’s good for the economy over the longer term, namely fiscal sustainability and sustained low inflation. This isn’t good for investor sentiment. Moreover, skepticism about populist policies helping PM Narendra Modi’s administration to remain in power prevails.

We continue to see Indian financial assets, including the INR, remaining under weakening pressure until the political dust settles.

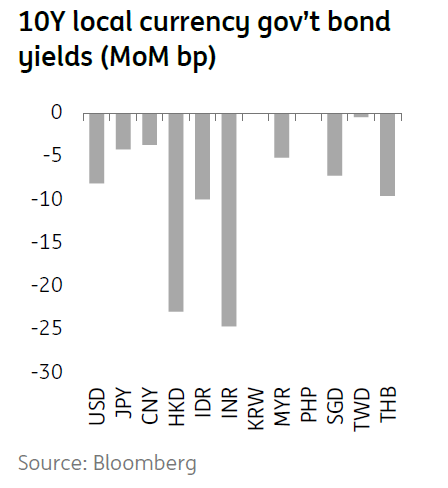

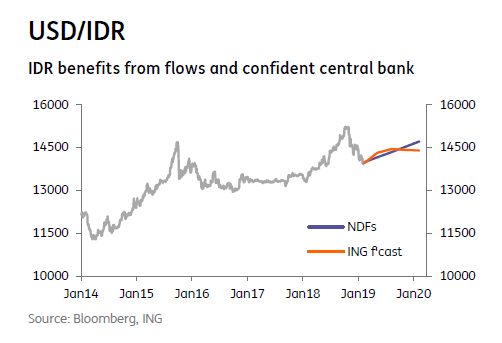

The IDR continues to outperform other currencies in the region with foreign flows propping up the currency and like other Asian FX, helped by the market pricing in a less aggressive rate hike cycle by the US Federal Reserve.

Limiting the upside to some extent have been comments from Indonesia’s central bank governor, Perry Warjiyo, indicating that the recent tightening cycle may be ‘close to peak’ while concerns about China’s economic health (Indonesia’s top trade partner), have also capped the IDR rally.

Bank Indonesia has forecast a narrowing of the current account deficit in 2019 as the government implements measures to curb imports and bolster exports to help stabilize the IRD. Meanwhile, the governor has reiterated the IDR is ‘undervalued’ given Indonesia’s fundamentals, also helping lend additional strength to the currency.

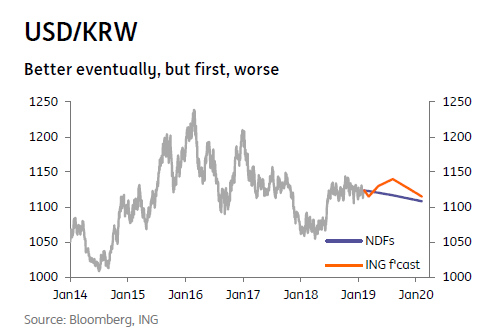

The Korea story is one of a currency that isn’t performing well, ranking worse than all Asian peers except the INR so far this year.

That’s not really the FX company the KRW should be keeping. Macro flows do not support any further tightening by the central bank, but likewise, the prospect that they could reverse their illtimed November hike seems remote.

Meanwhile, the news flow on exports, domestic activity, business confidence and inflation continues to get worse. Something has to give, and it might well be the currency. Expect it to get worse, before it eventually gets better.

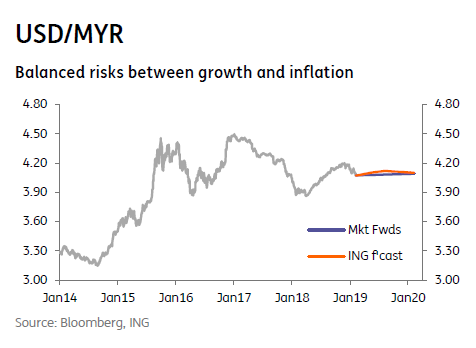

Malaysia’s GDP growth accelerated in the final quarter of 2018 as firmer global oil prices supported exports and widened the trade surplus. Manufacturing performance also improved. We estimate 4Q18 GDP growth of 4.6% YoY, up from 4.4% in 3Q and yielding full-year growth of 4.7%.

Meanwhile, inflation remains subdued, ending 2018 at 0.2%. Finance Minister Lim sees it rising to 1.6-2.0% this year. The risk to this forecast is tilted downward, more so in an environment of on-hold US Fed policy and softer USD.

We think the central bank assesses economic risks as fairly balanced between growth and inflation. We maintain our on-hold policy view for 2019.

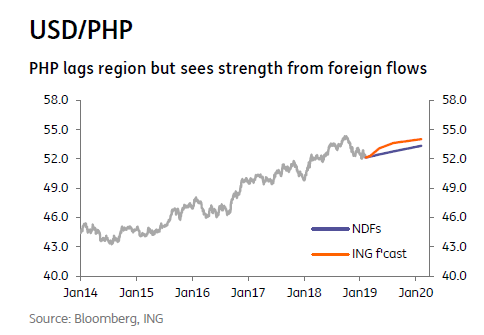

The Philippine’s peso has seen bouts of appreciation but generally underperformed the region, which rallied on the back of expectations that the Fed would be less aggressive in hiking policy rates in 2019.

Foreign flows have returned to the Philippines with both the local bond and equity market registering weeks of positive inflow given the risk-on tone, providing brief episodes of appreciation.

Offsetting the inflow of foreign funds was substantial corporate demand given still elevated import demands as well as softer 4Q GDP numbers which increase the likelihood that the central bank’s next move will be in an accommodative direction.

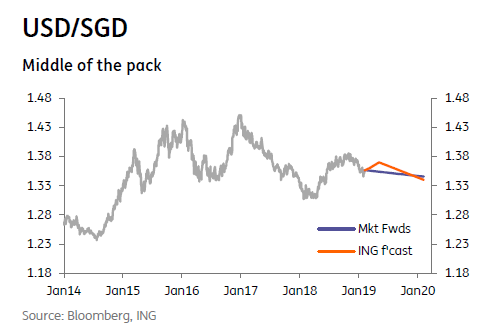

As you would expect from a nominal exchange rate targeting regime, the SGD is a solid middle of the pack performer so far this year, with a very slight appreciation vs the USD.

That performance will likely continue over the rest of the year, though with inevitable patches of fluctuation.

Making up for some fairly obviously weakening economic indicators, the main policy levers are likely to be fiscal, with support likely in the forthcoming budget, allowing monetary policy to remain steady, rather than backtracking. A return to a neutral monetary setting is only likely in the event of a much more negative trade scenario. Though those risks are substantial.

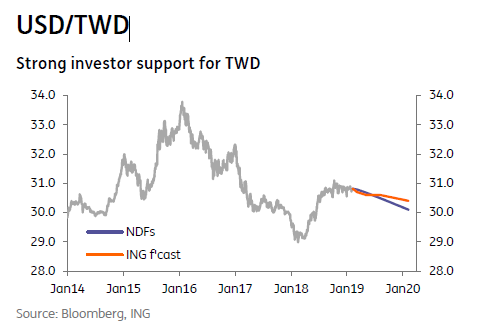

Taiwan’s manufacturers continue to face a downward cycle of orders placed by smartphone sellers. This is a key factor that has weakened Taiwan’s export and import activities.

Progress in the China-US trade talks is difficult to guess as China has not issued any statements after recent meetings, and the hints form the US trade side have been inconsistent.

Inflows from foreign investors have provided some stabilization to the TWD.

With the policy interest rate low at 1.375%, there is little further room for the central bank to move, and any easing will likely be done as a last resort.

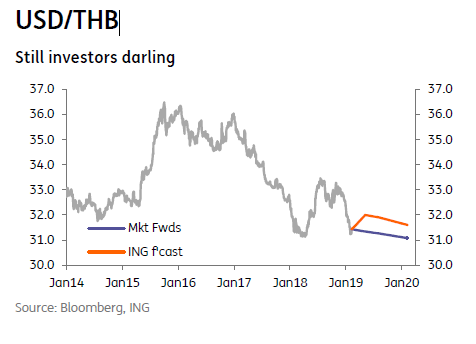

The Thai baht’s 4% year-to-date appreciation against the USD puts it at the top spot among Asian currencies. This is despite lingering political risks before general elections scheduled for 24 March. Even so, we have revised our USD/THB forecast lower.

Aside from the large current account surplus, a major source of confidence in the currency probably lies in the fact that the military Junta will likely maintain its grip on the government after elections, sustaining political and economic stability.

The 2018 current account surplus came in at 7% of GDP, a sharp narrowing from 11% in the previous two years. We expect 5% in 2019 as exports falter with slower global growth. We think the authorities have more reason to be worried about a strong currency.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more