Asian equities are mildly higher as the week starts on hope of Chinese stimulus, but so far gains are limited. The forex markets are steady in general with mild weakness seen in the Australian dollar ahead of tomorrow's RBA rate decision. Other commodity currencies, Kiwi and Loonie, are firm. The dollar and yen are the weakest currency next to Australian dollar. While more consolidation would likely be seen ahead of the key event risks later in the week, some important economic data today could trigger volatility, in particular in Euro and the Loonie.

Chinese Premier Li Keqiang indicated last Friday that the government would push ahead with infrastructure investment to stimulate the country’s growth. According to Li, the government has "gathered experience from successfully battling the economic downturn last year and we have policies in store to counter economic volatility for this year" and it would "launch relevant and forceful measures” according to the plans in the government work report. Despite recent weakness in the economic data, Li indicated that "the overall performance in the economy so far this year is relatively stable and we saw some positive changes, but we cannot neglect the increasing downward pressure and difficulties".

Economic data released today so far saw new Zealand building permits dropped -1.7% mom in February while NBNZ business confidence dropped to 67.3 in March. Japan manufacturing PMI dropped to 53.9 in market and industrial production dropped -2.3% mom in February Japanese housing starts rose 1.0% yoy in February. Key focus for the rest of the day would be Eurozone CPI flash which is expected to slow to 0.6% yoy in March. Canada GDP will also be closely watched and is expected to show 0.4% mom growth in January. Other data to be featured include Swiss KOF, UK mortgage approval and M4, U Chicago PMI.

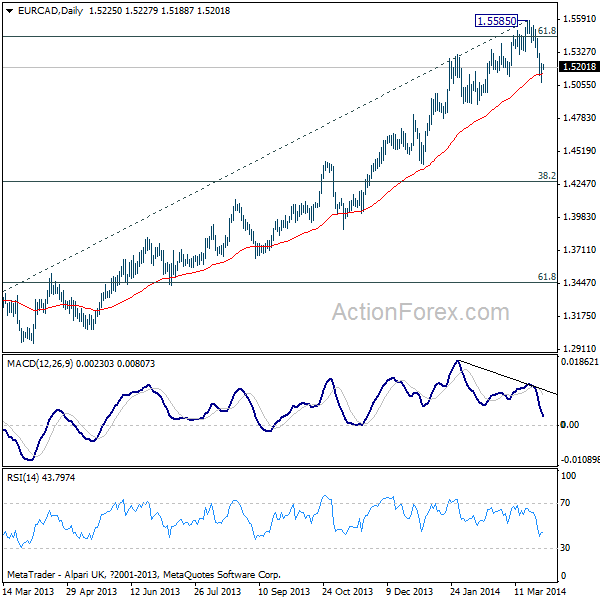

EUR/CAD has likely made a medium term top at 1.5585 after hitting 61.8% retracement of 1.7511 to 1.2126 at 1.5454, on bearish divergence condition in daily MACD. Near term outlook in the cross is mildly bearish and sustained trading below 55 days EMA (now at 1.5150) will pave the way to 38.2% retracement of 1.2126 to 1.5585 at 1.4264. On the upside, even in case of recovery, risk will stay heavily on the downside before break of 1.5585 and deeper decline is still expected to extend the correction.