Asian markets skidded on Friday, as Europe’s debt troubles remained in focus. The Nikkei fell 1.2% to 8375, the Kospi sank 2%, and the ASX 200 slumped 1.9%. China’s Shanghai Composite dropped 1.9%, and Hong Kong’s Hang Seng, declined 1.7%.

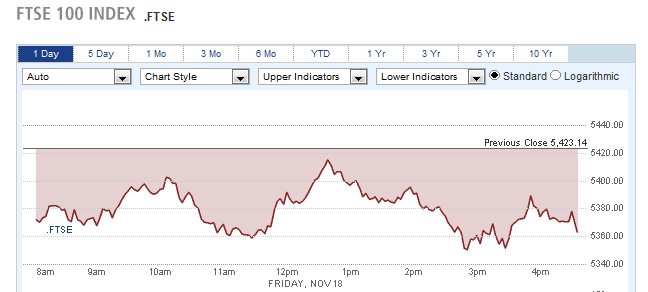

European markets continued to drop. Comments by German’s chancellor Merkel, that the ECB “cannot pretend to have powers they don’t have” cast doubt on plans for the ECB to lend money to the IMF to purchase sovereign bonds. The ECB cannot buy bonds directly. The FTSE fell 1.1%, the CAC40 dropped .4%, and the DAX closed down .9%.

FTSE slumps more than 1%

In the US, the Dow gained 26 points to 11796, while the Nasdaq fell .6% and the S&P 500 closed flat.

Currencies

The Dollar traded modestly lower against the major currencies. The Euro rose .4% to 1.3524, the Pound advanced .3%, and the Australian Dollar ticked up .1% to 1.0010. The Swiss Franc gained .5% to 1.0908.

Economic Outlook

Leading indicators gained by .9% last month, beating analyst forecasts.

Short Term Spanish Bond Yields Soar

Equities

Asian markets ended mixed as investors responded to the latest failure by US lawmakers to address the nation’s deficit troubles. The Nikkei fell .4% to 8315, but was well of its intraday low of 8261. The Korean Kospi rose .3%, erasing early losses, and the ASX 200 sank .7%, weighed down by a 4.3% drop in Qantas Airways. In greater China, the Shanghai Composite closed flat and the Hang Seng inched up .1% to 18252.

European markets extended their losing streak to 4, as a weak debt auction in Spain pressured financials. An government auction of 3-month bonds had a yield of 5.11%, more than double the rate from a month ago. The DAX slumped 1.2%, the CAC40 dropped .8%, and the FTSE fell .3%. European banks fell more than 3%, as the value of their bond holdings continues to erode.

European Markets Continue to Fall

In the US, the major indexes closed moderately lower. The Dow shed 54 points to 11494, the S&P 500 dropped .4%, and the Nasdaq slipped .1%.

Currencies

The Dollar closed mixed against world currencies. The Euro rose .2% to 1.3514, and the Swiss Franc gained .4% to 1.0943. The British Pound, Japanese Yen, and Australian Dollar all eased fractionally.

Economic Outlook

US GDP data showed the economy grew at a rate of 2% in the third quarter, less than the 2.5% previously estimated. On a better note, the Richmond Manufacturing Index was flat, better than last month’s -6 reading.

Weak Chinese PMI Data Hits Equities

Equities

Negative PMI data from China pressured Asian shares, as factory growth fell to its lowest level in nearly 3 years. In China, the Shanghai Composite fell .7%, and the Hang Seng slumped 2.1%. Australia’s ASX 200 declined 1.7%, as materials stocks sank on the Chinese news, and the Kospi dropped 2.4%. Japanese markets were closed for a holiday.

European markets continued to drop, and a weak German bond auction spooked investors. The auction had an incredibly low bid-to-cover ratio of .65, as the government failed to sell the entire amount planned. The DAX fell 1.4%, the CAC40 lost 1.7%, and the FTSE shed 1.3%.

Selling pressure mounted in the US, with the Dow closing down 236 points to 11258. The Nasdaq fell 2.4% and the S&P 500 lost 2.2%. Financials fell after the Federal Reserve said it would conduct stress tests on the 6 largest US financial companies to weigh the risk of a worsening European debt crisis. The 6 banks all fell more than 3% on the news.

US Markets Continue to Fall

Deere rallied 2.9% after raising its guidance for 2012 and reporting strong earnings. Pandora Media shares tumbled 11.3% after issuing a weaker than expected outlook.

Currencies

The Dollar rallied strongly against the major currencies, as the Euro closed down 1.3% to 1.3335, and the Australian Dollar tumbled 1.6% to .9687. The Pound fell .8% to 1.5515, and the Canadian Dollar lost .9% to 1.0478. The Yen fell .5% to 77.35, and the Swiss Franc dropped .7% to 1.0867.

Economic Outlook

The reality that even Germany is having trouble raising money is a strong warning sign for the markets, although Germany’s bond yields are close to record lows.

Nikkei Drops to 2 1/2 Year Low

Equities

Asian markets ended mixed following Wednesday’s sharp slide on Wall Street. The Nikkei returned from a holiday, dropping 1.8% to 8165, its lowest close since early 2009. Korea’s Kospi gained .7%, shaking off opening weakness, while the ASX 200 eased .2%. The Hang Seng rose .4% and the Shanghai Composite inched up .1% amid rumors of monetary easing in China.

Nikkei Falls Below March's Quake Low

In Europe, the major indexes closed lower, surrendering early gains. The DAX fell .5%, the FTSE slipped .2%, and the CAC40 ended flat, following remarks by German Chancellor Merkel which reiterated her opposition to changes in the ECB.

Currencies

The currency market experience very narrow trading ranges thanks to the closure of US banks. The Euro, Swiss Franc and Canadian Dollar all ended within a few pips of their opening prices. The Pound slipped .2% to 1.5494, while the Australian Dollar gained .4% to .9726.

Economic Outlook

US markets close early on Friday, and volume is expected to be light.

European Equities Rally Despite Soaring Yields

Equities

Stocks closed lower in Asia, as a deadlock in Euro zone negotiations raised investor fear. The Nikkei eased .1% to 8160, the Kospi slumped 1%, and the ASX 200 dropped 1.5%. Hong Kong’s, Hang Seng, declined 1.4%, weighed down by HSBC’s 1.7% loss, and the Shanghai Composite shed .7%.

European markets rallied, as the DAX and CAC40 gained 1.2%, and the FTSE rose .7%. Nonetheless, the DAX fell 5% for the week, and the CAC40 shed 4.5%. S&P downgraded Belgium’s debt one notch to AA. An auction for 6-month debt in Italy had an astonishing yield of 6.5%, up from 3.5% last month.

DAX Bounces Feebly Following Recent Slide

US markets closed lower on light volume. The Dow eased 26 points to 11232, the Nasdaq slumped .8%, and the S&P 500 fell .3%.

Currencies

The Dollar climbed against most currencies, as growing uncertainty fueled a return to safety. The Euro dropped .9% to 1.3230, and the Yen sank .8% to 77.75. Rumors that the Swiss National Bank would raise the exchange floor for the EURCHF hurt the Swiss Franc, which closed down 1.1% to 1.0750. The British Pound slipped .3% and the Australian Dollar edged down .2% to .9714.

Economic Outlook

Monday’s reports will include new home sales and the Dallas Fed manufacturing survey.