Positive Kick Start to December

An optimistic start to December as equity indices gain, government bond futures drop and no news appears to be good news on the trade talk front. As well, risk sentiment stabilized on the back of robust official and Caixin Manufacturing PMI prints for China. “Big data” indicators suggest that growth in November was like October across multiple channels for China, including industrial production and consumption metrics amid trade talk optimism.

The PMI estimate beats was a much-welcomed surprise for regional risk markets and might very well kick off a much-needed big data positive surprise for December.

Besides, the CNY PMI data provides more evidence that China continues to insulate itself from external economic growth issues while looking at both inwards and regionally for growth and trade while providing liquidity to enterprises that need it the most. Still, more easing may be needed to sustain the tentative stabilization.

HK Bill response?

In response to the U.S. law on HK, China has reportedly suspended U.S. vessel requests to visit HK. It will likely ruffle a few U.S. feathers but is unlikely a trade deal breaker. A precedent for similar actions goes back to August when the Chinese government denied requests for two U.S. Navy ships to make port visits to Hong Kong amid civil unrest.

Currency Markets

ASEAN currency markets

G-10 currency markets

G-10 FX volatility sold off dramatically the final week of November as the ECB and Fed have sucked the life out of currency markets after both central banks indicated monetary policy had run its course. Still, with neither bank even remotely inclined to raise interest rates for the foreseeable future, it’s back to the geopolitical see-saw ride for direction.

The only currency that might wake up G-10 traders from their week-long slumber is the Pound. GBP/USD opened a bit weaker today after polling data from Survation over the weekend showed that Labour had narrowed the gap to the Conservatives. The pair continues to consolidate between 1.2820 and 1.2970. Look for further intraday poll-driven volatility.

EUR/USD remains range-bound, and the pair keeps bouncing off levels below 1.10. With volatility at all-time lows last week, but hard to envision any top side explosion as trader participation remains low ahead of the holiday season.

Gold and Bonds

After the month-end bid for fixed income has cleared, the stage bonds are starting to look a little more in danger even more so as global economic data seems to be stabilizing, albeit at the low end of things. But still positive to trigger the reflationary trade bulls into action and today’s significant uptick in U.S. yields has been enough to send gold lower during today’s trading session.

Oil

Oil is holding up after the weekend report indicating Iraq’s oil minister says OPEC and its partners will consider production cuts of 400kb/d below the current level when the group meets in Vienna later this week.

The indication so far has been that there is support for an extension of existing cuts but not for deeper cuts, so if this news pans out, it could provide a decent boost to oil price sentiment. Still, the major swing factor remains the size of tariff rollback assuming, of course, a phase one trade deal will happen.

AxiTrader Gold Weekly

U.S. economic data will factor large in this week's narrative.U.S. economic data will likely factor into the gold trader's decision-making process as this week's data calendar could very well impact the tone of the December 11 FOMC meeting. And of course, the market will continue to react to U.S.-China trade development.

However, in the absence of fresh catalysts price action may continue to consolidate within the current price range $1450-1475

Friday's drop in global equity markets stoked gold prices triggering a soft and cautious bid under the yellow metal. However, with U.S. bond yields confined to narrow trading ranges, in the absence of a decline in the U.S. 10-year U.S.T yields, gains were limited to the $ 1465 region.

Also, lending support to the gold market on Friday, Gold is the new obsession in Eastern Europe, Bloomberg reports. Poland's government touted the economic might of gold after completing the repatriation of 100 tons of the yellow metal this week. In Hungary, meanwhile, PM Orban has been ramping up holdings of the safe-haven asset to boost the security of reserves. Central Bank demand has been an unyielding narrative throughout 2019 and is expected to continue through 2020

Last week, gold prices bounced off $1450 on Tuesday, which remained the most interesting technical play of the week — suggesting that traders could be relying heavily on that support level to start accumulating speculative longs. However, it could also trigger another sharp selloff on a significant break, as was the case with $1480 earlier this month.

Although prices rose on Friday, over the short term, the overall downward pressure on the gold of the last few weeks looks likely to remain in place, especially if there is a trade breakthrough.

However, over the medium to longer-term, elections in Europe in December, geopolitical risks, and the gradual retreat of bond yields in the U.S. could be gold-supportive. And since the Feds have all but ruled out moving interest rates higher for the foreseeable future, this also encourages gold investors even more so given the heightened level macro uncertainty that ominously looms on the horizon.

While the near-term path may be lower, the downside may be limited. Despite the improved risk-on sentiment, investors have remained generally positive toward gold as they continue buying on dips.

Trading Gold this week

When it comes to trading and important news week calendar, what is critical in the analysis is correctly calculating what you believe the market has priced in and then evaluating those expectations versus what you believe to be the actual odds of that outcome occurring. Too often, this nuance is lost. Don't ever forget that this game is not about predicting what will happen in an absolute sense, but what will happen versus what is priced into the data release expectation.

The gold market will likely pay close attention to this week's U.S. economic data, where gold best chance to rally above $ 1475 will probably come from the devil in the data's details.

However, trade twists and turns may yet turn supportive for gold. While the current level of price action neutrality suggests that peak tariffs have been reached and the markets are assigning a 25 % probability that the Phase one deal rolls back on the last tariff increase from September 1 of 15% on $ 111 bn will occur.

So, on confirmation of the September tariff rollback, S, we could see the short-lived move below $ 1450 trigger a more lasting impression, especially if the recent low of $ 1445 gives way.

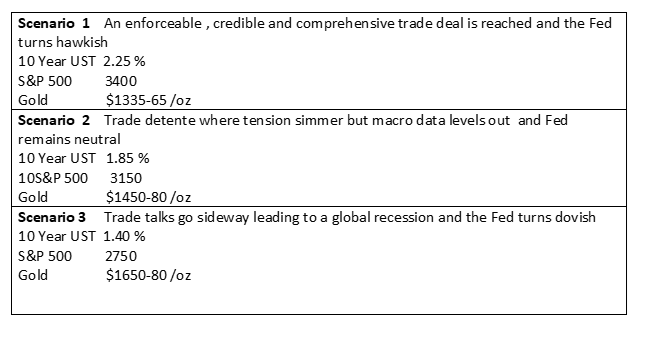

Trade talk outcome scenarios