A packed schedule across the region that should reflect the uncertain business environment.

PMI releases across the region

This coming week, Indonesia and the Philippines will report their PMI manufacturing figures for March, with both readings expected to improve from the previous month. Indonesia will likely see an improvement as COVID-19 daily infections drop, helping bolster the economic outlook and new orders. Meanwhile, the Philippines will enjoy another month of expansion as the country saw its lowest level of restrictions since the start of the pandemic, thanks to the large drop in COVID cases.

We should see a slightly different picture in China, as PMI data will reflect that both manufacturing and non-manufacturing activity could be moderately affected by stricter COVID-related social distancing measures. However, even if that is the case, factories have not been affected enough to push the manufacturing PMI to below 50 (and dip into contractionary territory).

The same goes for the non-manufacturing PMI. This is because this round of lockdowns has been very brief in Shenzhen, the tech hub of China. There have been no lockdowns in Shanghai thus far, and employees have become used to working from home. Consequently, operations of the financial sector should not have been affected. Jilin has the most COVID cases so far, but its contribution to GDP is small compared to other cities in China.

Korea expected to outperform Japan, but underlying risks cloud the medium-term outlook

In South Korea, we expect February industrial production and retail sales to rise firmly on the back of the solid export performance and relaxation of mobility restrictions. Digging deeper, however, the Consumer Survey Index, Business Survey Index, and PMI may yet reveal a decline, revealing cautious sentiment on the outlook. Additionally, March trade data will be released, for which we will probably see exports recording another month of double-digit growth, albeit at a slower pace than the previous month.

In Japan, February industrial production and retail sales are likely to slide as local surveys and other activity data have suggested. The Tankan index is also expected to decline due to the highly uncertain geopolitical situation, but the labor market is expected to make some gradual progress after the Omicron peak.

Prices expected to climb in Indonesia

Indonesia also reports CPI inflation next week, with the headline inflation number possibly exceeding 2.5%. March inflation will be nudged higher by improving domestic demand, at a time of surging global commodity prices for staples and energy. We are also closely watching developments in core inflation as Bank Indonesia Governor Perry Warjiyo has indicated that any adjustments to monetary policy will likely be carried out should core inflation accelerate sharply.

Rising prices should drive Australian retail sales higher in February

Australian retail sales should accelerate at a similar pace to January, although this will be a greater reflection of the rising price environment than the volume of sales made. This will be particularly pronounced in sales of food, as agricultural disruption owing to severe flooding in parts of Australia, on top of the surge in global commodity prices, is likely to feed through.

These price induced effects could be partially offset by relatively stagnant growth in monthly spending on other products such as clothing and footwear, as rising prices, such as fuel/petrol, should dampen other consumer spending.

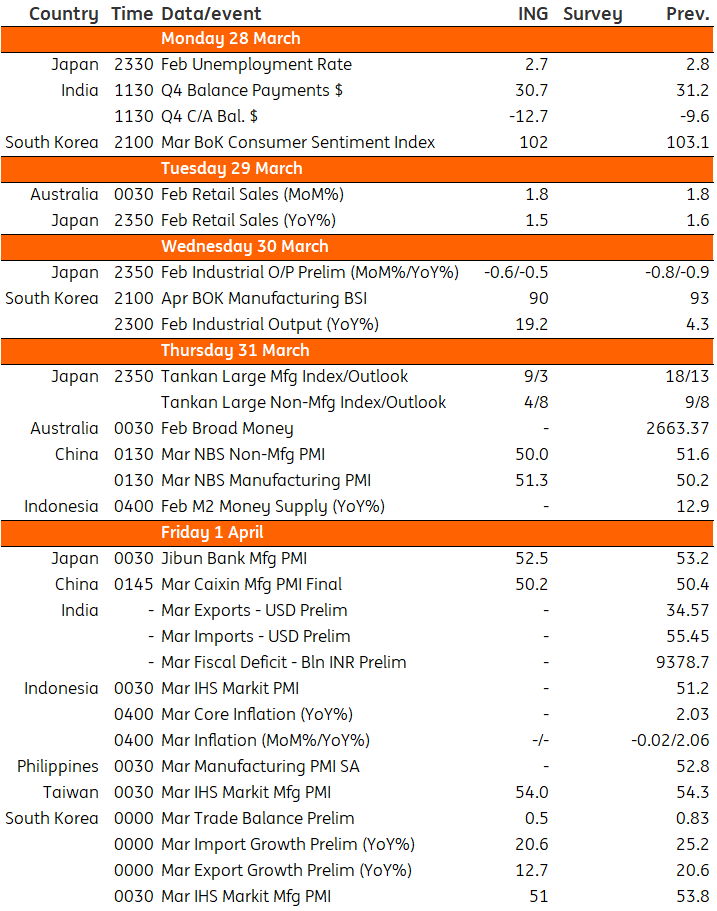

Key events the coming week

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more