China’s foreign exchange reserves data for June should give an idea about the extent of capital flight as the Chinese yuan turned from Asia's outperformer to an underperformer with 3% depreciation.

Downside risk to consensus on China reserve data

It’s no longer a question if the US will go ahead with tariffs on Chinese imports tomorrow (6 July) - instead, it's now more a question about the aftermath – the impact on the world’s second-biggest economy and then on the rest of the world. As a result, China’s economic data for June will be under close scrutiny.

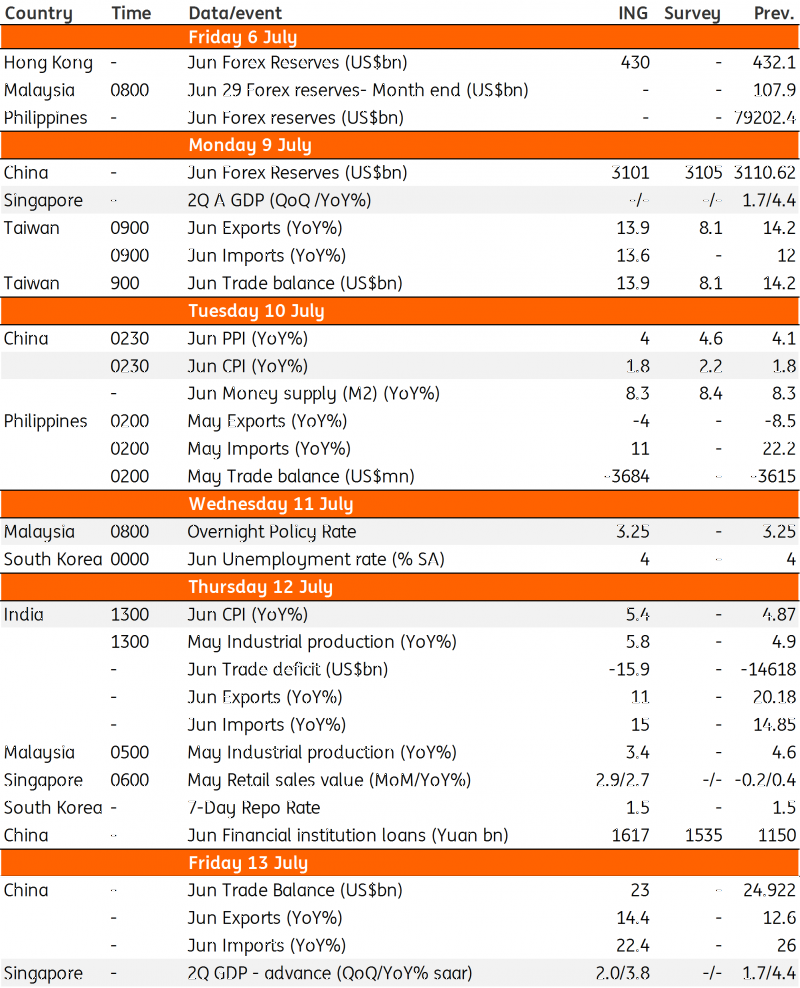

The data dump starts with foreign exchange reserves data this weekend (7 July), followed by inflation, bank lending, and trade over the course of the coming week, and then culminates in second quarter GDP release the following week.

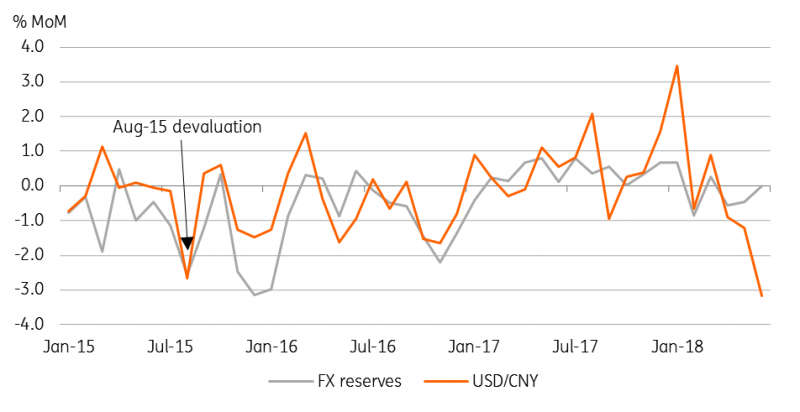

Of all, the foreign exchange reserves will be key given what's been happening to the Chinese yuan (CNY) following the US tariff announcement in mid-June – a shift from being Asia’s outperformer until the announcement to underperformer with over 3% depreciation since. The latest depreciation reminds us of the 2.7% devaluation in August 2015 and judging from a $93bn fall in reserves in August 2015, the consensus of only $8bn reserves fall may appear to be understating the capital flight from China.

Other data releases include exports, which are expected to have held up well in June ahead of the tariff kick-off, possibly led by front-loading of shipments before the tariffs take effect. The consensus on exports is 10.6% year on year growth in comparison to 12.6% in May, and for new yuan lending, it is CNY 1.535tr (CNY 1.150tr in May).

A surprise easing from the People's Bank of China with a cut in banks’ reserve requirement should have supported the bank lending, while inflation continues to grind higher.

Korea and Malaysia central bank to stay on hold

Elsewhere in Asia, central banks in Korea and Malaysia will hold their monetary policy meetings, and the consensus is looking for no change in the rate policy by either. Hence all the attention will be on their policy statements, which, in all likelihood, will express caution on growth as the trade heat rises.

We're constantly watching our growth forecasts for regional economies for a downgrade and apart from a few Asian central banks, especially in countries where wide trade and current account deficits have battered currencies in the sell-off this year including India, Indonesia, and the Philippines, we expect monetary policy to remain on hold in the region.

India inflation data to lead RBI for next hike in August

India’s consumer price inflation for June will condition expectations of the next Reserve Bank policy meeting in early August. On our forecast, inflation accelerated to 5.4% YoY in June from 4.9% in May on higher food and transport components.

The RBI forecasts inflation in a 4.8-4.9% range in the first half of FY19 (Apr-Sep 2018). Latest hike in the minimum support prices for agriculture produce and rising oil prices will sustain high inflation in the period ahead. We have been forecasting a 25bp RBI policy rate hike in August, and have now added one more 25bp rate hike at the October meeting.

Asia Economic Calendar

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. For our full disclaimer please click here.