Given the recent wobbles experienced by the Indonesia rupiah, we expect the central bank to stay put next week, but China's central bank might cut its revamped loan prime rate

People's Bank of China could go more accomodative

The People's Bank of China will announce the revamped loan prime rate (LPR) on Sunday, 20 October. Though the medium-term lending facility interest rate remains unchanged, there is still a chance that the central bank will cut the one-year lending facility by 5 basis points to 4.15% to support the flagging economy.

Bank Indonesia to stay put... for now

Indonesia's central bank will meet on 24 October against a backdrop of slowing growth. The central bank governor forecasts growth to dip to 5.1%, citing the headwinds from the trade war for this expectation.

With inflation within target and decelerating, the central bank has some room to trim borrowing costs further. Governor Warjiyo has slashed borrowing costs for three straight meetings in a bid to provide a boost to sagging GDP growth momentum, but the central bank may opt to keep its powder dry given the recent wobble experienced by the IDR. That being said, we expect BI to stay on hold with the possibility for a rate cut at the November meeting if inflation resumes its downward trend and growth numbers warrant further stimulus.

Barrage of data

China’s industrial profit growth should shrink less than previous months as infrastructure projects have created businesses to manufacturers.

Orders and deliveries of smartphones will provide some support to Taiwan export orders and industrial production as well as Hong Kong exports and imports, but the support should not be enough to change a yearly negative growth trend to positive growth.

The Philippines will report the budget balance for the month of September with spending figures and the budget balance now increasingly of importance given the recent slowdown in GDP growth due to the budget delay. Government officials have vowed a swift catch-up in spending with a substantial budget deficit seen to rekindle hopes for a rebound in growth for the 3Q.

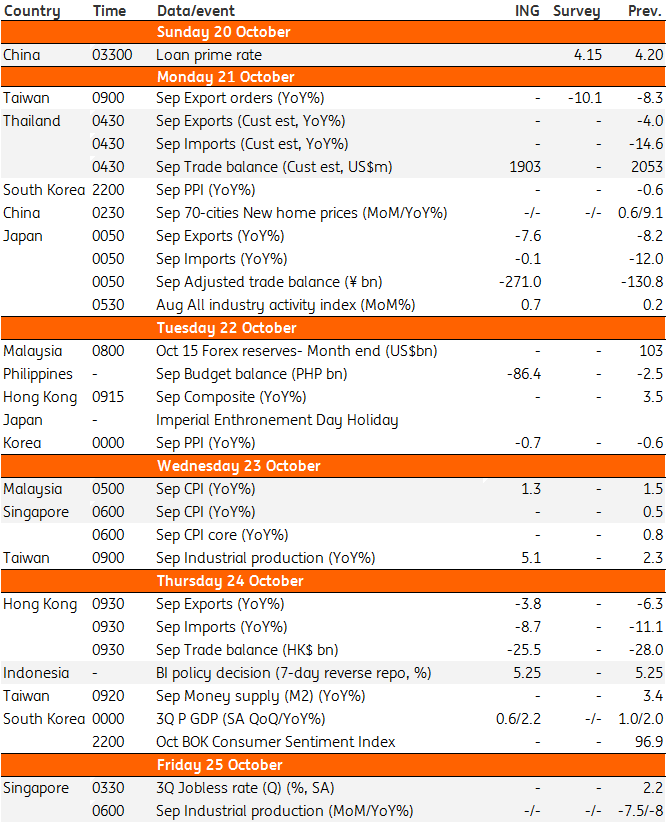

Asia Economic Calendar

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more