Asian markets jumped in response to Monday’s Wall Street rally, inspired by Bernanke’s suggestion of another round of government stimulus. The Nikkei surged 2.4% to 10255 its highest close in more than a year. The Hang Seng rallied 1.8% to 21047, the ASX 200 climbed .9%, and the Kospi advanced 1% to 2040. The Shanghai Composite bucked the trend, easing .2% to 2347.

In Europe, markets declined, surrendering some of Tuesday’s gains after US consumer confidence data came in below forecasts. The CAC40 slumped .9%, the FTSE slid .6%, while the DAX closed flat. The Royal Bank of Scotland advanced 3.3% on rumors of a possible investment by Abu Dhabi’s ruling family.

US stocks closed lower after hovering near break even for most of the session. The Dow declined 44 points to 13198, the S&P 500 lost .3% to 1413, and the Nasdaq settled down .1% at 3120.

Dow Slips 44 Points

Bank of America skidded 3.3% after Baird downgraded the stock.

Currencies

The dollar traded modestly higher on Tuesday, as currency markets traded in a narrow range. The Australian dollar shed .5% to 1.0482, the Canadian dollar lost .3% to .9944, and the pound traded flat. The euro and Swiss franc both declined .2%, and the yen dropped .3% to 83.10.

Economic Outlook

The Case Shiller home price index showed prices remained flat in January. Consumer confidence fell to 70.2 from 71.6 last month, slightly below expectations.

Global Stocks Slide On Mounting Economic Concerns

EquitiesAsian markets closed mostly lower on Wednesday, led by heavy losses in China. The Shanghai Composite tumbled 2.7% to 2285, a 2-month low as disappointing earnings weight on the index. The Hang Seng fell .8%, the Kospi slid .4%, and the Nikkei dropped .7% to 10183. Australia’s ASX 200 escaped the losses, rallying 1%, after the country’s central bank reported that the nation’s banking sector is in good shape.

European markets skidded, weighed down by weak economic data. The CAC40 and DAX slid 1.1%, and the FTSE dropped 1% to 5809. Data suggested that Spain is now in another recession, and the UK’s GDP shrank more than forecast.

US stocks opened sharply lower but recovered much of their losses throughout the day. The Dow shed 72 points to 13126, while the S&P 500 and Nasdaq both fell .5%. Caterpillar shares sank 3.5% to 104.26, pressured by a disappointing durable goods report.

Currencies

The currency markets traded mixed on Wednesday. The pound fell .3% to 1.5894, the Australian dollar declined .6% to 1.0393, and the Canadian dollar slipped .3% to .9980. The yen advanced .5% to 82.78, while the euro and Swiss franc closed flat.

Economic Outlook

Durable goods orders rose 2.2% last month, less than the 3% hoped for by analysts. Weekly mortgage applications rose while refinancing applications fell, a positive sign for the housing industry.

Asian And European Stocks Skid, Energy Sinks

EquitiesAsian markets fell on Thursday as mounting fears of a global slowdown weighed on investors’ nerves. The Nikkei slid .7% to 10115, the Kospi slumped .9%, and the ASX 200 eased .1%. The Shanghai Composite tumbled for a second day, skidding 1.4% to 2252, and the Hang Seng sank 1.3% to 20609.

Selling pressure intensified in Europe, as the DAX tanked 1.8% to 6875, the CAC40 fell 1.4%, and the FTSE dropped 1.2%. Financial shares fell nearly 3%, and Italy’s MIB index plunged 3.3%.

Germany's DAX Drops 1.8%

In contrast, US stocks continued to show their resilience, as the major indexes bounced back from a 1% slide to close mixed. The Dow rose 20 points to 13146, 113 points off its low for the day. The Nasdaq declined .3%, and the S&P 500 eased .2% to 1403.

Sprint jumped 5.3% after Deutsche Bank raised its outlook for the company.

Currencies

The currency markets traded mixed with no clear direction. The yen advanced .5% to 82.44, the pound rose .4% to 1.5952, and the Canadian dollar edged up .2% to .9965. The euro, Swiss franc, and Australian dollar all slipped .1%.

Economic Outlook

Weekly unemployment claims fell to 359K, a 4-week low, but fell short of analyst forecasts for 351K. GDP for the 4th quarter rose at 3%, as expected.

US Stocks Complete Best Quarter Since The 90s

Equities

Asian markets closed mixed on Friday, while ending the quarter with strong gains. The Nikkei eased 31 points to 10084, up 19.3 for the first quarter, and the Kospi settled flat, cementing a gain of 10% for the first quarter. The Hang Seng slipped .3% to 20556, climbing 11.8% in the first quarter, and the Shanghai Composite rose .5%, inching up a mere 2.9% in the first 3 months of the year. Finally, the ASX 200 edged down .1%, up 7% for the quarter.

In Europe, stocks rallied as finance ministers agreed to expand the region’s rescue fund., as concerns over Spain’s debt troubled escalated. The CAC40 advanced 1.3%, the DAX climbed 1%, while the FTSE rose a more modest .5%. Gains in Europe were more muted than elsewhere, as the FTSE rose just 3.5% for the quarter.

US stocks closed mixed. The Dow rose .5% to 13212, the S&P 500 gained .4% to 1408, while the Nasdaq eased .1% to 3092. For the quarter the Dow gained 8%, the S&P climbed 12%, and the Nasdaq surged 18.7%. All three indexes had their best showing since the 1990s.

Nasdaq Climbs 18.7% in First Quarter, Largest Gain Since 1991

Research in Motion shares jumped 7.1% even though the company posted a loss, after suggesting the company will launch an internal review which may involve a sale of the company.

Currencies

European currencies advanced, encouraged by the expansion of the rescue fund to 700 billion euros. The euro rose .3% to 1.3340, the pound gained .4 to 1.6012, and the Swiss franc climbed .5% to 1.1086. The yen slid .5% to 82.86, the Australian dollar declined .3 to 1.0342, and the Canadian dollar eased .2 to .9987.

Economic Outlook

Personal income rose .2%, less than forecast, while personal income jumped .8%, exceeding forecasts. Chicago PMI declined slightly to 62.2 from 64, while consumer sentiment jumped to 76.2, its highest level in more than a year.

Solid PMI Data From China And US Energizes Stocks

EquitiesPMI data from China exceeded analyst forecasts, rising to an 11-month high of 53.1, lifting some Asian markets. The Nikkei rose .3% to 10110, led by car makers, and the Kospi climbed .8% to 2029. Moody’s raised its credit rating on South Korea’s sovereign debt, boosting financial stocks. The Hang Seng slipped .2% to 20522, and the ASX 200 eased .1%, while the Shanghai Composite was closed for a holiday which will extend through Wednesday.

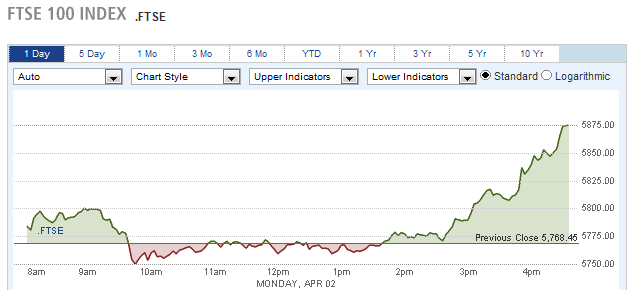

European markets traded sharply higher, as the upbeat news from China, and solid US data lifted investor optimism. The FTSE rallied 1.9%, the DAX climbed 1.6%, and the CAC40 gained 1.1%. The gains came despite a disappointing manufacturing report from the eurozone, indicating the region is in the midst of another recession.

Afternoon Rally Boosts FTSE 1.9%

US stocks gained, with the Dow ticking up 52 points to 13264, the Nasdaq jumping .9% to 3120, and the S&P 500 climbing .7% to 1419.

Currencies

The yen climbed 1% to 82.03 in a steady day-long rally, and the commodity currencies gained, with both the Australian dollar and the Canadian dollar up .8%. The euro eased .1% to 1.3326, the Swiss franc declined .2% to 1.1067, while the pound edged up .1% to 1.6032.

Economic Outlook

Monday’s economic data was mixed. ISM manufacturing PMI rose to 53.4 from last month’s 52.4 reading, slightly above forecasts. However, construction spending unexpectedly fell 1.1%, extending last month’s decline.