MARKETS

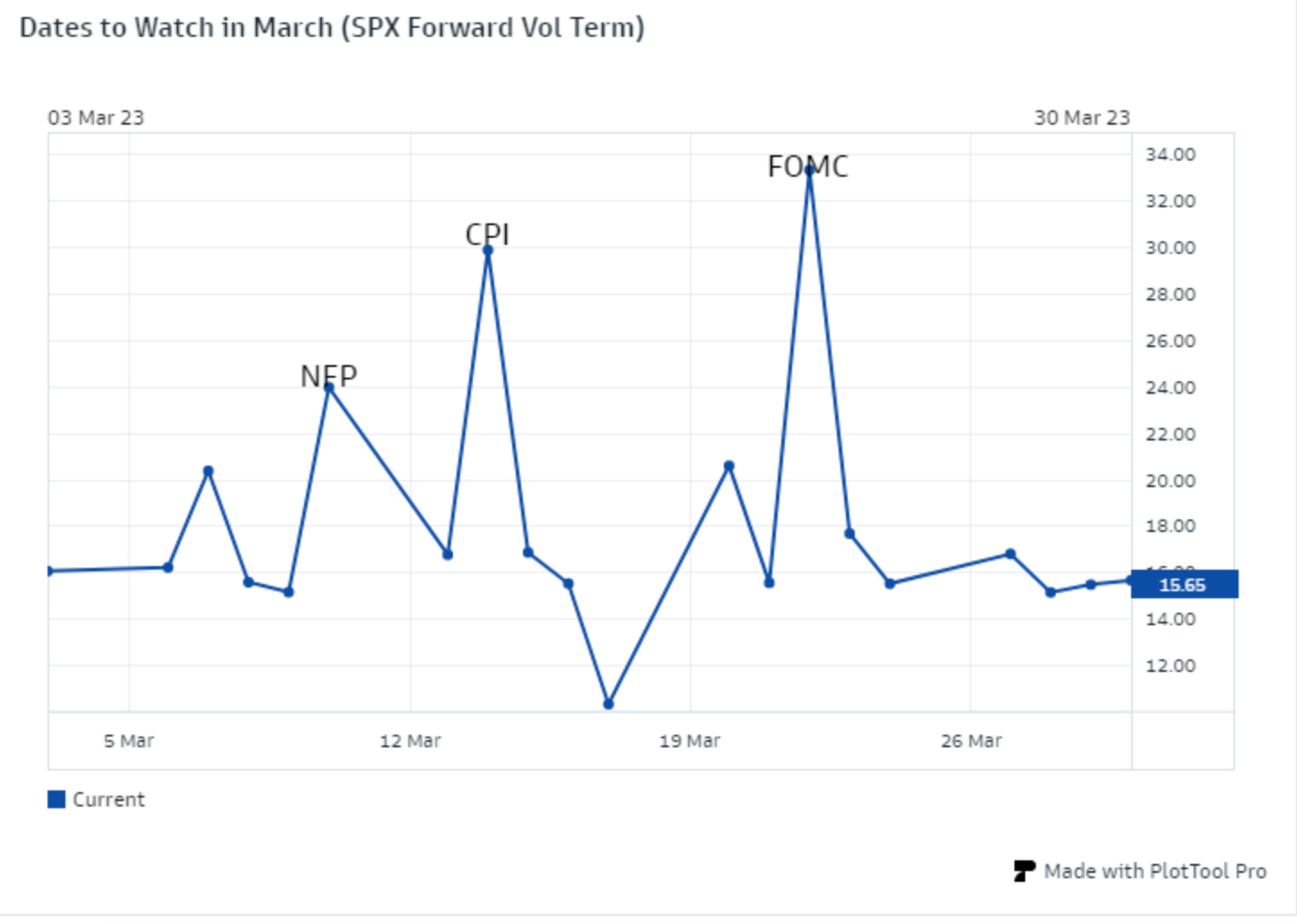

New week, same narrative: most market participants will again start fretting about the Fed's hiking path and are marking their calendars for 2 key data events—NFPs and a CPI—between now and March FOMC.

Monetary policy transmission has become a key topic for policymakers and markets as financing conditions have tightened, but the inflation run rate remains very high. Currently, markets are pricing 30 bp of hikes for the March FOMC, leaving investors facing an unstable equilibrium and an extremely high-risk event. The lags inherent in monetary policy create risks of policy error in both directions, leaving both central banks and investors walking on a razor's edge.

The US jobs report will be front and center for markets this week, along with Fed Chair Powell's congressional testimony before House and Senate committees.

Powell will importantly have the opportunity to define the Committee's reaction function to upcoming prints. Most important will be whether the Chair takes the opportunity to express a preference for sticking with a 25bp hike in March or if he leaves the door ajar for returning to a faster pace this month. If Powell does not slam the door shut on the potential for a larger hike, markets could put substantially more weight on a 50bp hike at the March meeting in response to last month's hotter data.

Ultimately, the heavy data calendar over the next few weeks, particularly CPI and NFP, will be critical for determining how that settles.

ASIA

The 2023 National People's Congress started on March 5th. Premier Li Keqiang delivered the Government Work Report (his last), which outlined key economic targets for this year. Policymakers aim to achieve "around 5%" GDP growth target in 2023, which was slightly less ambitious than the "above 5%" or "5%-5.5%" discussed by some investors with more bulled-up expectations.

Over the next few days, the fiscal budget report and discussions on the Party and government institutional reforms could offer a more market-friendly interlude. Still, investors are already setting sights on a press conference to be held by new government leaders on March 13th, which may convey more forward-looking policy clues.

With the government appearing to maintain the status quo, i.e. a marginal increase in fiscal stimuli, the market would likely remain cautious about China's recovery. As a result, the RMB has opened up a bit weaker and could underperform and remain at the mercy of the USD outlook until investors can gauge the expected bounce in critical monthly activity indicators such as industrial production, retail sales, fixed asset investment, and trade data, have not yet shown a robust recovery.

In equities, the sell-off from overbought levels, I think, is essentially over. Mainland investors remain cashed up and long-onlies underweight, especially outside the internet space. This sets the market up to rally even in a mildly favorable policy scenario after the initial knee-jerk lower at the open.

After a brief hiatus, several data releases out of China this week are likely to end growing skepticism over the strength of its post-reopening recovery.

FOREX

The Bank of Japan will hold its Monetary Policy Meeting on March 9-10. The meeting will be the last under Governor Haruhiko Kuroda's decade-long stewardship. And while traders had positioned short Yen, thinking that the BOJ likely wanted to avoid making yield curve control (YCC) adjustments that could have a wide-ranging impact on bonds and the forex and equity markets, they are now turning more cautious, knowing that Kuroda can be full of surprises.