Currencies

Indices

14.00 GMT

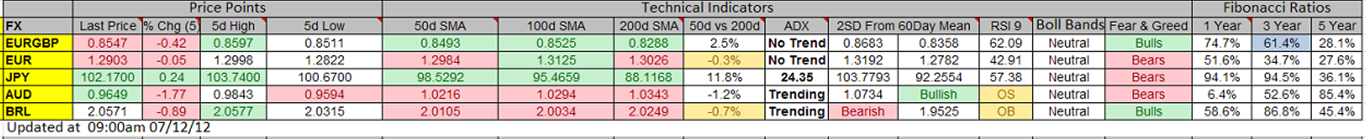

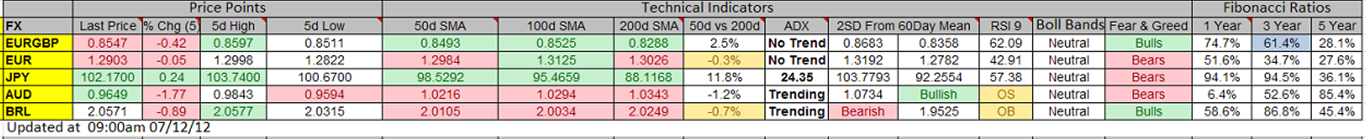

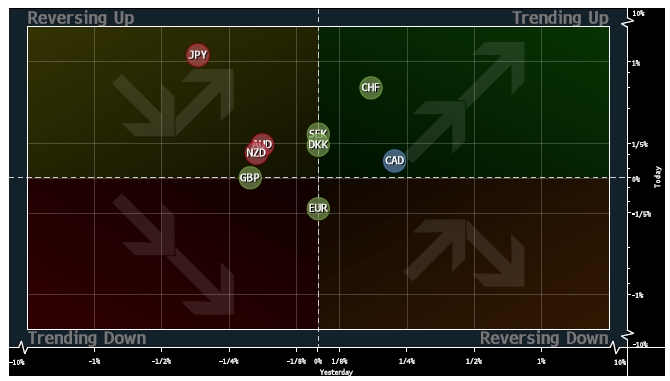

- EUR/USD- the pair has bounced briefly from its minor support on a 30 minute time frame. This support zone was provided in our analysis yesterday. The RSI is showing that bias could be towards the upside.

- USD/JPY- the price action bounced back from a support zone on a 30 minute time frame. This support level was given in our analysis on the May 24. The RSI is in over bought territory.

- GBP/USD- the price has broken its upward channel to the downside on a 30 minute time frame. The pair is trading below the 50 and 100 day moving averages.

Indices

- Asian Markets closed strongly up today. The Nikkei 225 was the best performer, closing with a gain of 1.20%

- European stocks are also trading higher on Tuesday. The FTSE MIB is leading the gains and is up by almost 1.55%.

- U.S. Indices closed with some mild losses yesterday. The S&P500 was the worst performer, closing with a loss of -0.12%

- The two biggest economies in the euro zone will today present a blue print to tackle youth employment.

- Taiwan has confirmed that it will be announcing a stimulus package to boost its economy by May 31. The growth forecast was reduced by the Central Bank for 2013.

- Never Move stops down in a losing position, it is a state of emotion which destroys trading discipline.

- Gold is trading is trading in a bullish pattern on a 30 minute time frame. Price action for the precious metal does look weak.

- Oil - The black gold bounced back up from its support zone on a 4 hour time frame. This was provided in our daily video analysis.

- VIX - The volatility index dropped by -0.57% yesterday.

14.00 GMT

USD – CB Consumer Confidence

DISCLOSURE & DISCLAIMER:

The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.

by Naeem Aslam