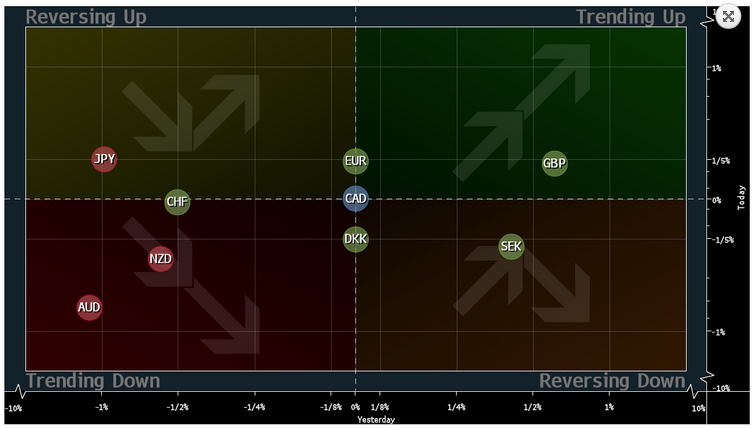

Currencies

Indices

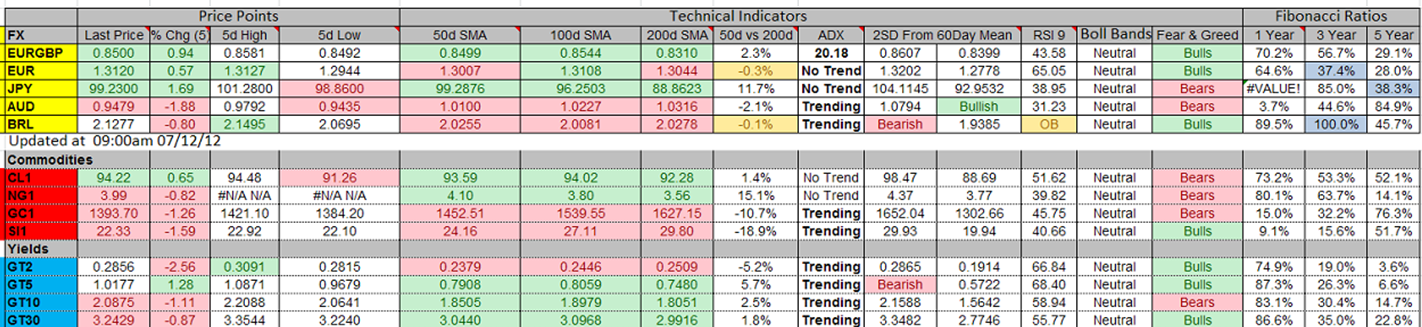

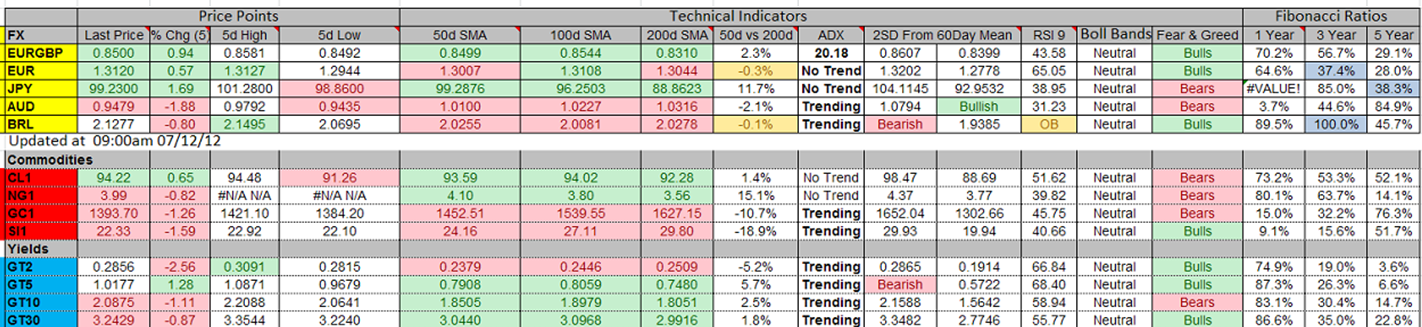

- EUR/USD - the pair is moving in an upward channel on a 30 minute time frame. The price is trading above the 50 and 100 day moving averages.

- USD/JPY - the price has broken the descending triangle on a 30 minute time frame. The downward trend is becoming stronger as the price is below the 50 and 100 day moving averages.

- GBP/USD - the price is trading in a resistance zone on a 30 minute time frame. The price could see a pause or change of trend, as the pair has pierced the Bollinger band® at this level too.

Indices

- Asian Markets closed with deep losses on Thursday. The Shanghai index plunged by -1.27%, and was the worst performing index during the Asian session.

- European stocks are trading mixed during the early hours of trading. The IBEX 35 is best performing index and is up by almost 0.59%.

- U.S. Indices closed lower yesterday. The S&P 500 was the worst performer, closing with a loss of -1.37%

- European commission has backed up Latvia in joining the euro in 2014. However, the final decision will be made by finance ministers on July 9.

- Most economists are predicting that the European Central bank will leave their bench mark interest rate unchanged at their policy meeting today.

- The Bank of England is also expected to keep its asset purchase program unchanged in their policy meeting today, a Bloomberg survey revealed.

- Never Move stops down in a losing position, this state of emotion destroys trading discipline.

- Gold is firmly below the $1400, and the price action is struggling for direction. hHowever, the technical shows that the bias could be to the downside.

- Oil - The black gold has recovered from its earlier losses and it is trading up during the early hours of trading. The price is moving in a sideways pattern on a 4 hour time frame.

- VIX - Volatility index increased by 7.56% on Friday.

News Agenda For Today

07.15 GMT

CHF - CPI m/m

11.00 GMT

GBP - Asset Purchase Facility

GBP - Official Bank Rate

11.45 GMT

EUR - Minimum Bid Rate

12.30 GMT

EUR - ECB Press Conference

USD - Unemployment Claims

12.45 GMT

CAD - BOC Gov Poloz Speaks

14.00 GMT

CAD - Ivey PMI

Trend

DISCLOSURE & DISCLAIMER:

The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.

by Naeem Aslam